Narratives are currently in beta

Key Takeaways

- Strategic expansion into new markets and emphasis on Wealth Management could drive fee income growth and strengthen geographic presence.

- Investment in technology and niche lending aims to boost productivity, diversify revenue, and sustain earnings amidst competitive deposit rate pressures.

- Concerns about weak transportation sector, competitive deposit costs, and leadership transitions pose risks to earnings and revenue predictability.

Catalysts

About First Business Financial Services- Operates as the bank holding company for First Business Bank that provides commercial banking products and services for small and medium-sized businesses, business owners, executives, professionals, and high net worth individuals in Wisconsin, Kansas, and Missouri.

- The company's strategic initiatives focus on the expansion of its Private Wealth Management business into new geographic markets, which could drive fee income growth given its existing success in South Central Wisconsin.

- Positive outlook for the company's SBA team, which has hired new leaders and business development officers, suggests potential for increased gain-on-sale revenues in future quarters as the loan pipeline strengthens.

- The company's continuous focus on technology and operational efficiency through AI training and robotic process automation aims to improve productivity and client experience, potentially enhancing net margins by controlling operational costs.

- First Business Financial Services' niche C&I and Equipment Finance lending, especially its high-performing Floorplan Financing and small-ticket vendor finance business, are expected to contribute to diversified revenue streams and overall loan growth.

- Plans to further stabilize and manage the net interest margin (NIM), relying on its match funding strategy and high-quality depositor relationships, are expected to sustain earnings despite competitive pressures on deposit rates.

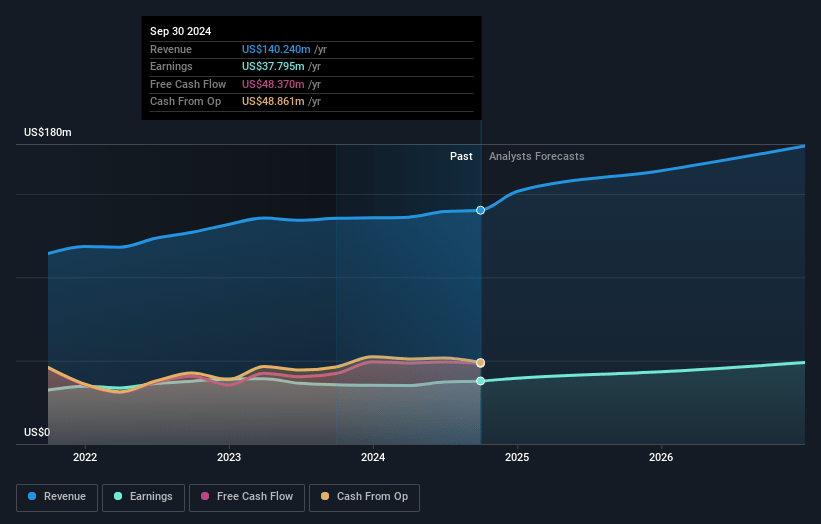

First Business Financial Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Business Financial Services's revenue will grow by 11.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 27.0% today to 27.3% in 3 years time.

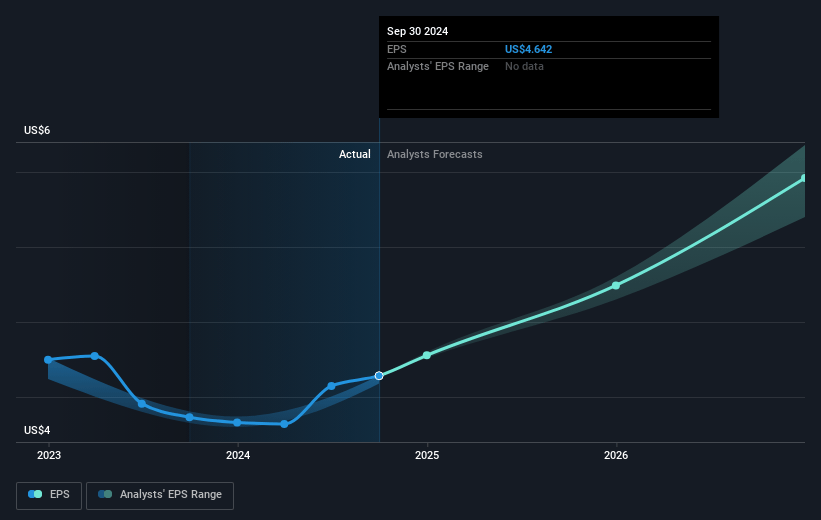

- Analysts expect earnings to reach $52.6 million (and earnings per share of $6.41) by about January 2028, up from $37.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, down from 10.7x today. This future PE is lower than the current PE for the US Banks industry at 12.3x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

First Business Financial Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company expressed concerns about the transportation sector within its Equipment Finance portfolio, highlighting weak spot rates and depressed equipment values, potentially impacting future earnings and asset quality.

- Although the bank has had strong, stable net interest margins, they hinted at potential competitive pressures on deposit costs. Any sharp increases in these costs could erode net margins if not offset by equivalent loan repricing.

- Some variability in swap fees and returns from SBIC mezzanine funds was noted, indicating that future fee income might be unpredictable, which could affect overall revenue predictability.

- The strategic plan mentions aiming to expand more into account receivable finance and other niche lending areas. While these areas can bring higher revenues, they might also represent higher credit risks, potentially affecting future net profits.

- The reliance on key personnel and recent changes in leadership like the new regional president in Kansas City implies operational risks. If leadership transitions are not managed well, it could disrupt regional market growth strategies and revenue forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.25 for First Business Financial Services based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $192.5 million, earnings will come to $52.6 million, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $48.57, the analyst's price target of $55.25 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives