Narratives are currently in beta

Key Takeaways

- Stable interest income, strong credit performance, and fee income growth will bolster BOK Financial's revenue and earnings.

- Strategic growth and loan expansion in key sectors will support margin and earnings growth.

- Decreases in loans, trading fees, and refinancing activity present risks to BOK Financial's revenue growth, earnings stability, and future net margins.

Catalysts

About BOK Financial- Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

- BOK Financial is seeing stabilization and upward trends in net interest income and net interest margin, which are expected to improve further as they capture down rate deposit betas, leading to increased revenue and earnings.

- The company's credit performance remains strong, with net recoveries and low criticized asset levels, which should keep net margins healthy and support future earnings stability.

- The increase in fee income contributions, particularly from surpassing $110 billion in assets under management, will likely continue to bolster revenue and earnings as these segments grow.

- The normalization of the yield curve and anticipated loan growth, following the recent Federal Reserve rate cut, should support further margin and earnings growth.

- Strategic growth in commercial real estate and the energy sector, along with managing concentration limits and gathering new commitments, is expected to drive loan growth and enhance revenue going forward.

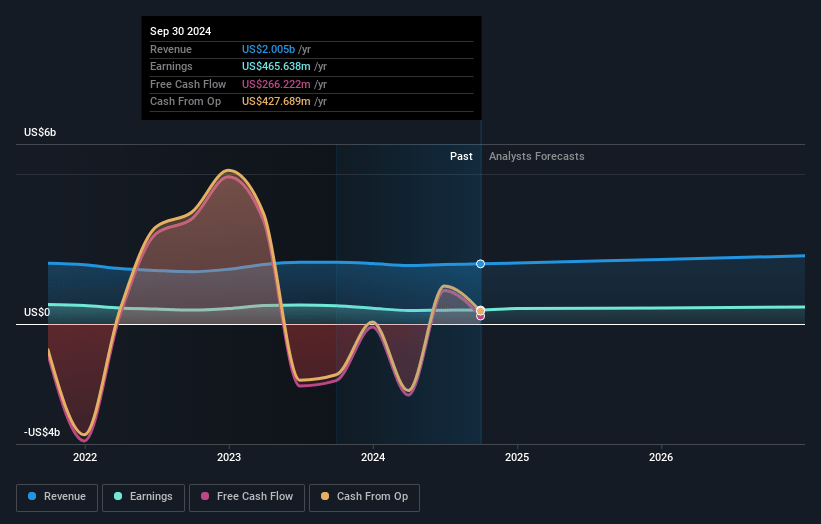

BOK Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BOK Financial's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.2% today to 25.4% in 3 years time.

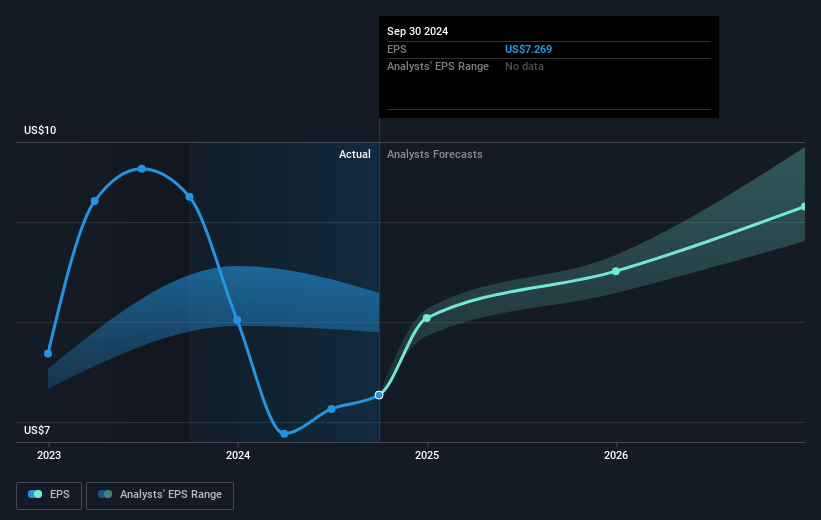

- Analysts expect earnings to reach $603.6 million (and earnings per share of $9.86) by about January 2028, up from $465.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $542 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, which is the same as it is today today. This future PE is greater than the current PE for the US Banks industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 1.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.49%, as per the Simply Wall St company report.

BOK Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The third quarter saw a decrease in period-end loans by 2.3%, influenced notably by a 9.4% decrease in energy balances and a 4.3% decline in general business and service loans, which may negatively impact future revenue growth.

- Trading fees decreased significantly by 14.6% due to reduced mortgage-backed securities volumes, reflecting potential volatility and adverse conditions in the mortgage origination market, which could suppress revenue.

- Healthcare business loans decreased by 1.9% due to increased payoffs as borrowers refinanced at attractive fixed rates, posing a risk to net interest margins and future earnings stability.

- The decline in the loan balance for specialized segments is attributed to the impact of rates, M&A activity, and bond market dynamics, suggesting a risk of unstable loan growth and subsequent earnings fluctuations.

- The fee income and net interest margin improvement were bolstered by a one-off increase in loan fees and early payoff fees, which is not expected to recur, potentially affecting future net margins unfavorably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $123.0 for BOK Financial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $137.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $603.6 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of $108.69, the analyst's price target of $123.0 is 11.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives