Key Takeaways

- The Dowlais and GKN Automotive merger and strategic driveline investments position American Axle for increased market share and revenue growth as EV and hybrid adoption rises.

- Operational efficiencies, localized production, and strong OEM relationships enhance margin stability, customer retention, and sustained long-term earnings in a shifting automotive landscape.

- Reliance on traditional products, customer concentration, high debt, and slow EV adaptation expose the company to long-term margin and revenue risks as industry shifts accelerate.

Catalysts

About American Axle & Manufacturing Holdings- Designs, engineers, and manufactures driveline and metal forming technologies that supports electric, hybrid, and internal combustion vehicles.

- The transformational combination with Dowlais and GKN Automotive is expected to significantly increase American Axle's size and scale, enabling it to better withstand industry cycles, deliver approximately $300 million in anticipated synergies, and unlock substantial new cross-selling opportunities for e-axle and driveline content as global platforms shift toward EVs and hybrids. This should strengthen both revenue growth and margin expansion prospects.

- AAM’s strategic focus on advancing its EV, hybrid, and ICE-agnostic driveline portfolio positions the company to capture market share as original equipment manufacturers increasingly invest in electric truck, SUV, and commercial vehicle platforms, supporting higher content per vehicle and widening the company’s addressable market, which is a clear long-term driver of top-line growth.

- Persistent global supply chain localization and the onshoring trend in North America is benefiting AAM due to its already high USMCA compliance (over 90 percent of products made in North America meeting regional standards). As OEMs mitigate tariff and policy risk by regionalizing supply, AAM is well-positioned to win incremental business, improve customer stickiness, and stabilize or improve operating margins.

- Efficiency and cost control initiatives, especially in the metal forming business, are driving sequential and year-over-year improvements in EBITDA margin despite lower volumes. This operational momentum, when combined with future integration synergies and disciplined capital allocation, is likely to support sustained growth in net margins and robust free cash flow generation for the long term.

- Deepening multi-year supply agreements and close relationships with key OEMs, particularly in resilient segments like full-size trucks and heavy duty vehicles, are providing revenue stability and visibility. As these platforms remain strong and production possibly increases, AAM is set to benefit from high-volume and value-added programs that can drive consistent earnings growth even during automotive industry transitions.

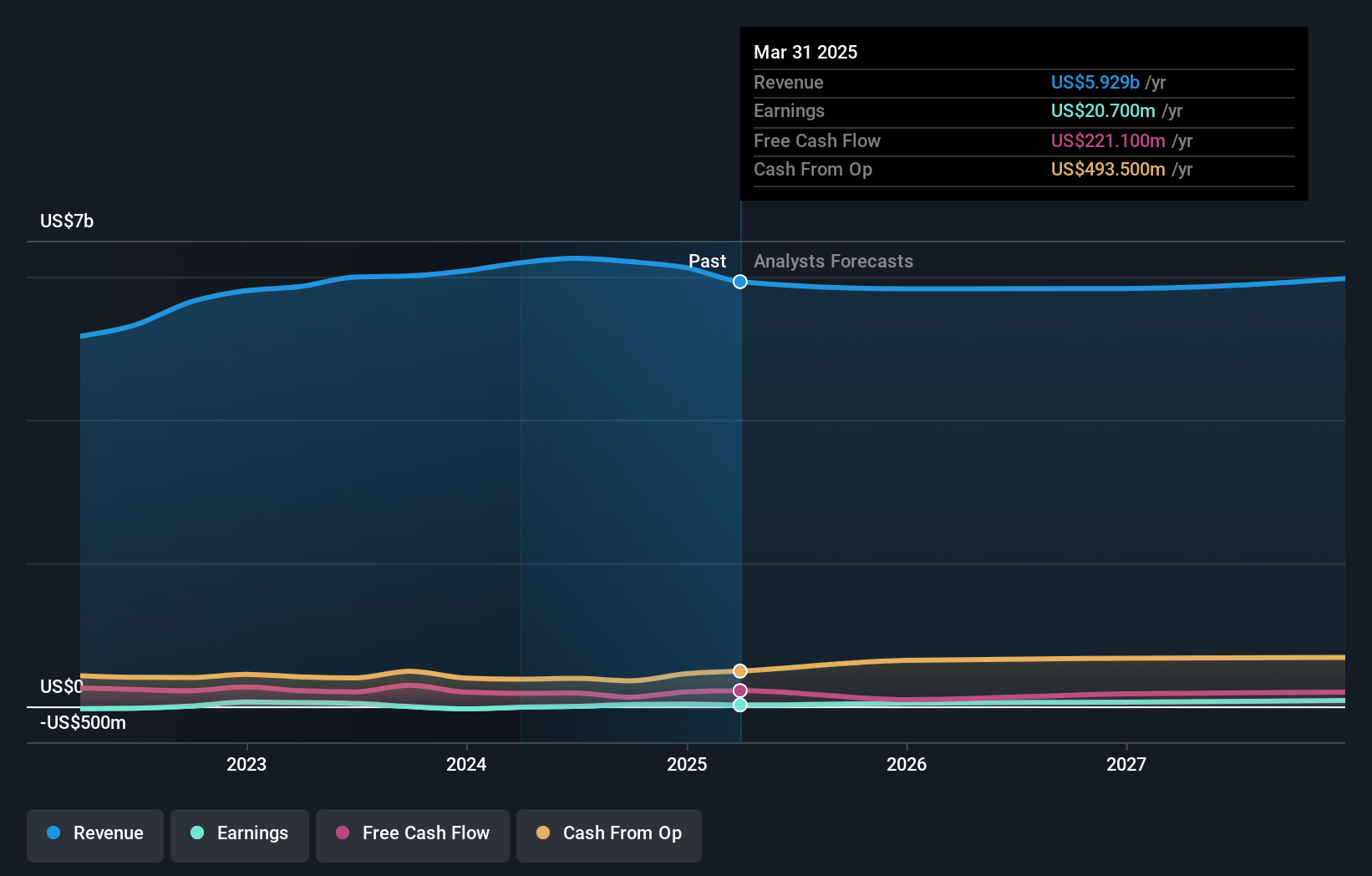

American Axle & Manufacturing Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on American Axle & Manufacturing Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming American Axle & Manufacturing Holdings's revenue will grow by 1.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.3% today to 1.7% in 3 years time.

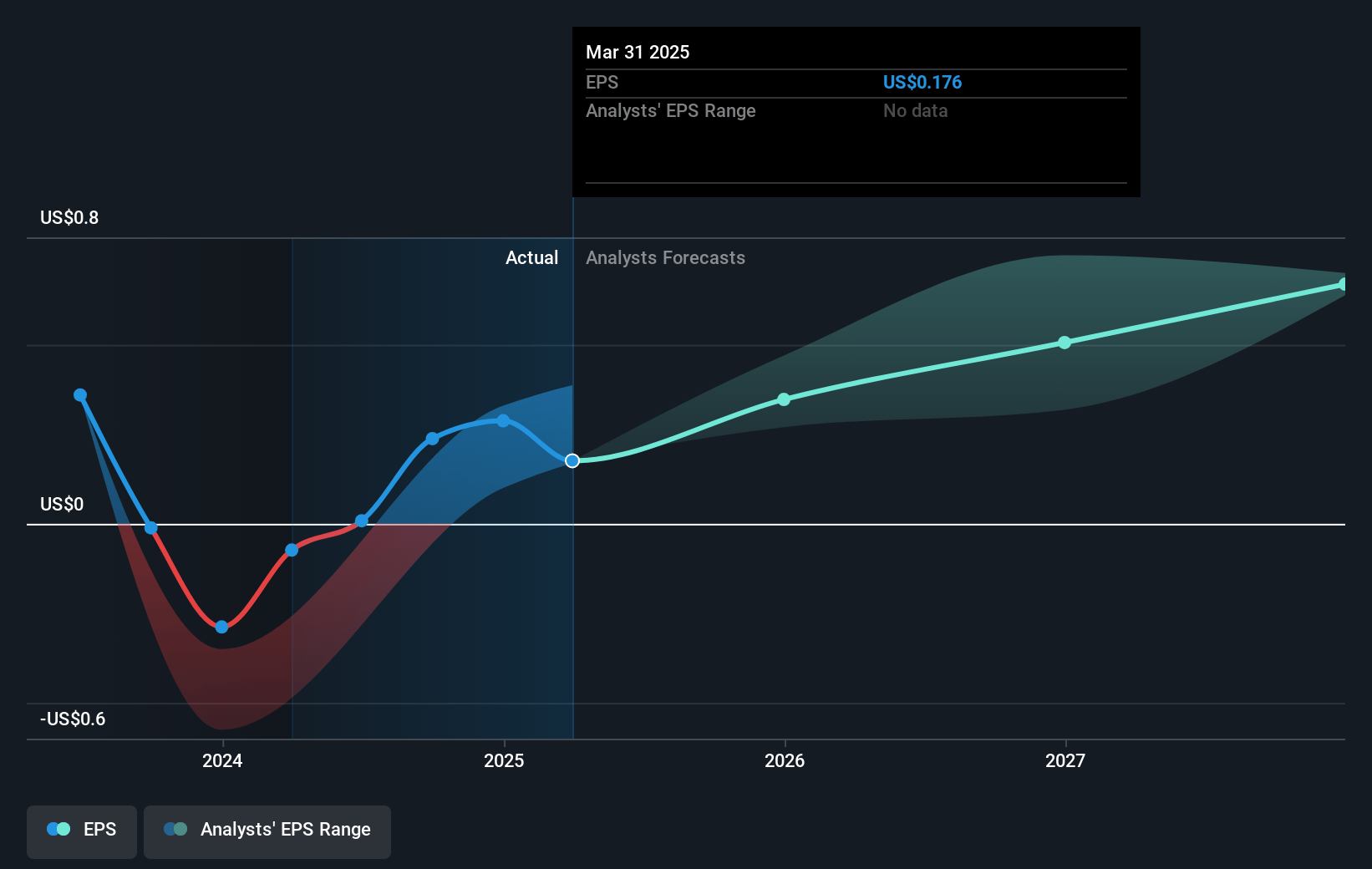

- The bullish analysts expect earnings to reach $103.2 million (and earnings per share of $0.84) by about July 2028, up from $20.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 26.8x today. This future PE is lower than the current PE for the US Auto Components industry at 14.9x.

- Analysts expect the number of shares outstanding to grow by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

American Axle & Manufacturing Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Acceleration of electric vehicle adoption poses a long-term risk, as EVs use fewer traditional driveline components than internal combustion engine vehicles, meaning American Axle’s core product lines could face structurally declining demand and lead to lower future revenues and market share.

- The company continues to rely heavily on a small number of customers, particularly General Motors, making it vulnerable to contract renegotiations, OEM insourcing, and production shifts; any adverse changes could lead to unpredictable cash flows and declining revenues.

- High debt levels and ongoing restructuring costs limit American Axle’s financial flexibility and heighten interest expenses, which could constrain net margins and erode net income if volumes decline or industry conditions worsen.

- Intense price competition from global suppliers, particularly low-cost manufacturers in Asia, could compress gross margins over time as American Axle may be forced to lower prices to maintain share, especially as the market for legacy driveline components shrinks.

- Slow progress in developing and scaling competitive electric driveline and eMobility solutions raises the risk that American Axle will miss out on EV-related contracts, which could undermine the company’s long-term earnings and lead to persistent margin pressure as the industry pivots away from ICE vehicles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for American Axle & Manufacturing Holdings is $7.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of American Axle & Manufacturing Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.5, and the most bearish reporting a price target of just $4.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.2 billion, earnings will come to $103.2 million, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 11.6%.

- Given the current share price of $4.68, the bullish analyst price target of $7.5 is 37.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.