Narratives are currently in beta

Key Takeaways

- Aptiv's focus on cost-efficient product solutions and supply chain localization aims to enhance operational efficiency and improve net margins.

- Record earnings in Advanced Safety and User Experience segments underline the potential for sustained revenue growth driven by strong market demand.

- Continuous volatility in vehicle production and reliance on the China market expose Aptiv to revenue fluctuations, geopolitical risks, and margin pressures.

Catalysts

About Aptiv- Engages in design, manufacture, and sale of vehicle components in North America, Europe, Middle East, Africa, the Asia Pacific, South America, and internationally.

- Aptiv is executing on a record number of year-to-date vehicle program launches, which are expected to reaccelerate revenue growth once the industry stabilizes after current market dynamics. This positions revenue for future growth when production issues and market volatility subside.

- Aptiv is implementing additional profit improvement actions, such as prioritizing investments in cost-efficient product solutions and consolidating their manufacturing footprint. These measures are likely to improve net margins over time as they become more efficient in operations.

- The company has achieved record earnings and operating margins in their Advanced Safety and User Experience segment, driven by high-performing products and productivity initiatives. This success supports the potential for higher earnings as these segments continue to scale.

- New business bookings totaling approximately $21 billion year-to-date signal strong demand for Aptiv's solutions across various end markets, including automotive and aerospace, which should positively impact future revenue streams as these bookings convert into actual sales.

- Aptiv's initiatives to further localize its vendor base to reduce costs and enhance supply chain resiliency could lead to improved net margins and cost savings, which are vital for sustaining earnings growth amidst uncertain market conditions.

Aptiv Future Earnings and Revenue Growth

Assumptions

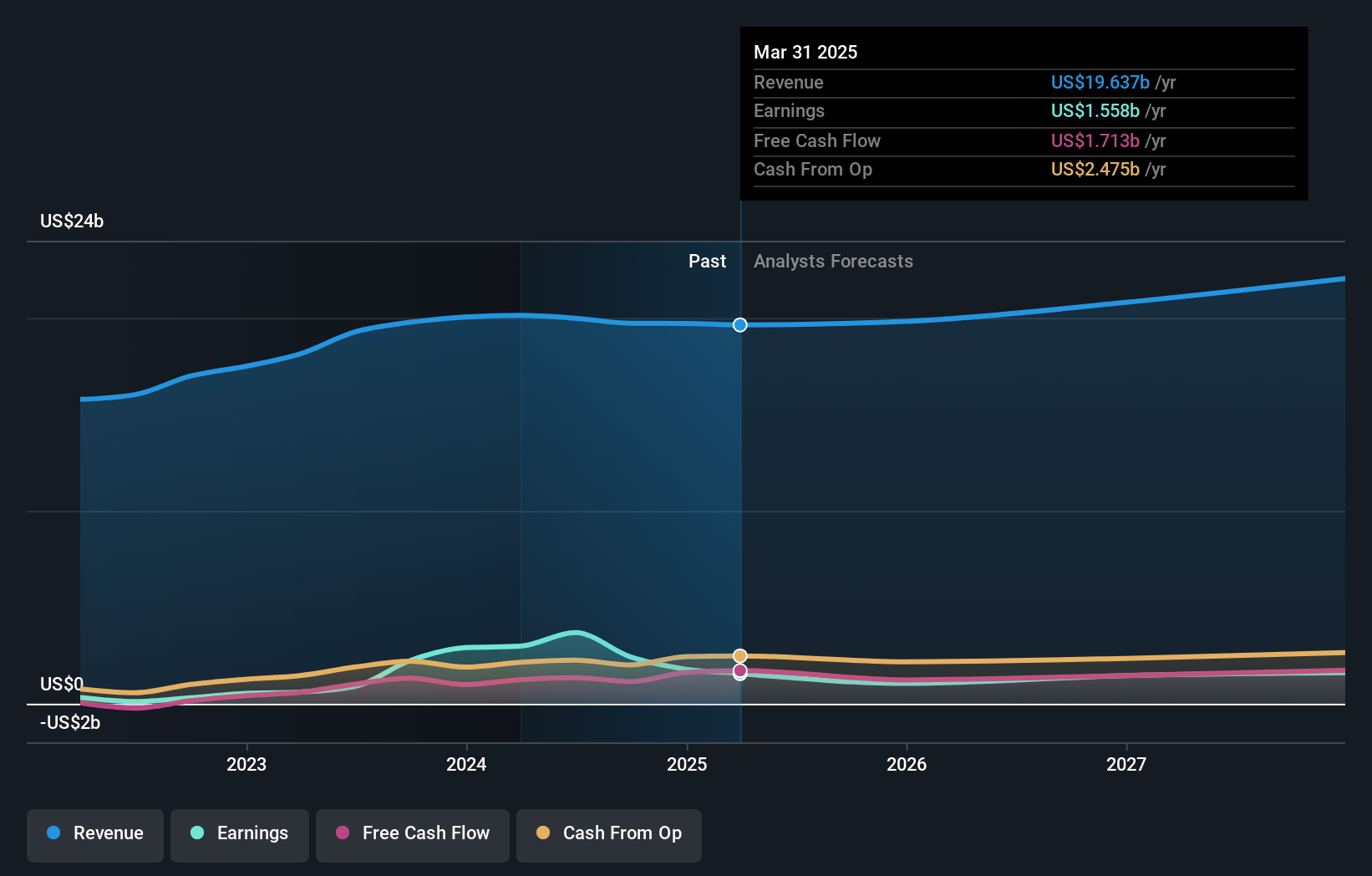

How have these above catalysts been quantified?- Analysts are assuming Aptiv's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.3% today to 6.9% in 3 years time.

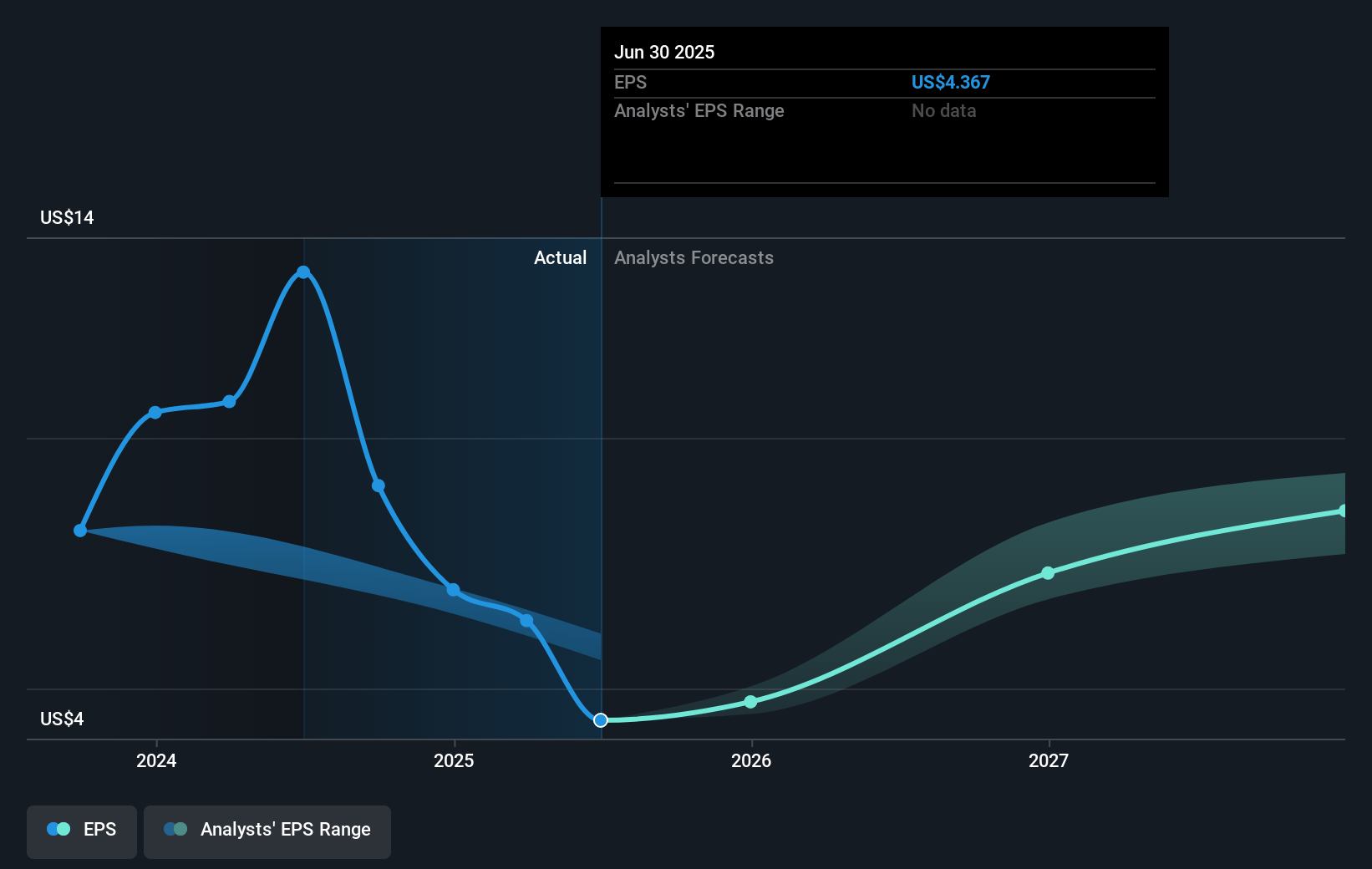

- Analysts expect earnings to reach $1.6 billion (and earnings per share of $8.26) by about January 2028, down from $2.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, up from 6.1x today. This future PE is lower than the current PE for the US Auto Components industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 6.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.28%, as per the Simply Wall St company report.

Aptiv Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continuous volatility in vehicle production schedules, especially among major OEMs, poses significant challenges for Aptiv, potentially leading to unpredictable revenues and earnings fluctuations.

- Delays in customer program awards and shifts in timelines indicate a weaker industry environment, affecting Aptiv's ability to meet its 2024 bookings target, which could impact future revenue streams and growth expectations.

- A slowdown in EV adoption and lower vehicle production have negatively impacted Aptiv's growth, particularly in the Signal and Power Solutions segment, which could result in reduced revenue and margins if the trend continues.

- Increased reliance on the China market, with 54% revenues from local OEMs, subjects the company to geopolitical risks and potential regulatory changes that might affect revenue stability and margins.

- Persistent price pressures and labor costs, especially in regions like Mexico with rising wages, could erode Aptiv's net margins if not mitigated through operational efficiencies or price adjustments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $76.88 for Aptiv based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $22.9 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of $62.8, the analyst's price target of $76.88 is 18.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives