Key Takeaways

- Shifting focus to advanced electronic security products and expanding the customer base supports stronger long-term growth and improved margins.

- Operational modernization and technology-driven investments are set to enhance productivity, cost efficiency, and future earnings capacity.

- Heavy reliance on North American auto OEMs, industry headwinds, slow diversification, and technology shifts pose significant challenges to Strattec's revenue growth and long-term competitiveness.

Catalysts

About Strattec Security- Designs, develops, manufactures, and markets automotive security, access control, and user interface controls products in North America and internationally.

- Strattec is actively shifting engineering resources toward advanced power access and digital key products, positioning itself to capitalize on the rising demand for integrated electronic vehicle security and connected car access systems, supporting future revenue growth and higher net margins as product mix improves.

- The company is leveraging strategic pricing initiatives and new model year launches, along with efforts to broaden its automotive customer base beyond the traditional North American OEMs, which should mitigate revenue volatility and drive more sustained long-term sales growth.

- Ongoing modernization of manufacturing operations-supported by recent operational streamlining, headcount reduction, and targeted talent additions-sets the stage for further cost reductions and productivity enhancements, supporting gross and EBITDA margin expansion.

- Investments in new product development, with a focus on technology-driven solutions like digital keyfobs, align with increasing regulatory focus and automaker requirements for advanced safety and security features, reinforcing Strattec's relevance and long-term revenue opportunities.

- Strattec's strong balance sheet and robust cash generation provide ample resources for continued investment in growth initiatives and operational improvements, which, as scale increases, are poised to drive normalized free cash flow and improved earnings power.

Strattec Security Future Earnings and Revenue Growth

Assumptions

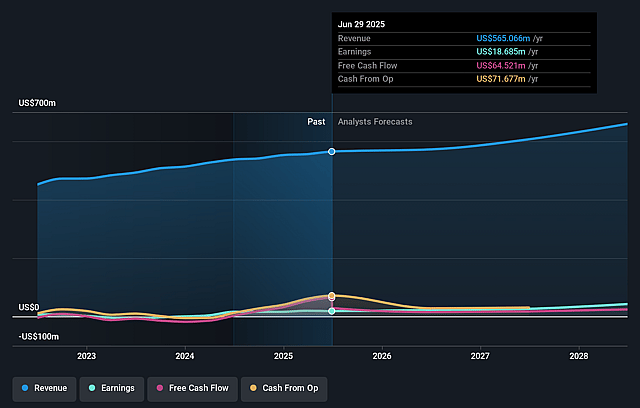

How have these above catalysts been quantified?- Analysts are assuming Strattec Security's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 6.5% in 3 years time.

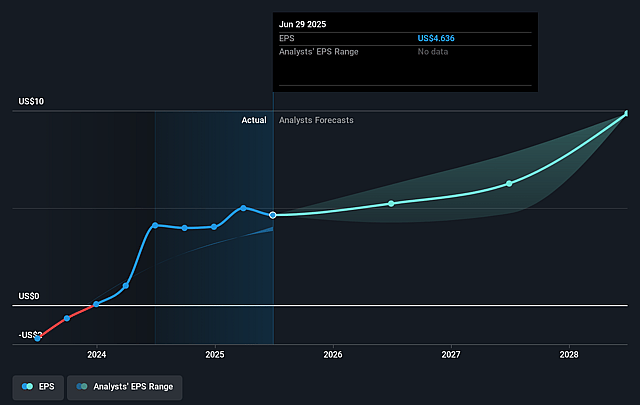

- Analysts expect earnings to reach $42.6 million (and earnings per share of $9.85) by about September 2028, up from $18.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, down from 15.0x today. This future PE is lower than the current PE for the US Auto Components industry at 17.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.83%, as per the Simply Wall St company report.

Strattec Security Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strattec remains heavily dependent on North American automotive OEM production volumes, facing near-term headwinds as third-party projections indicate a 5-6% decline in North American auto production for fiscal 2026 and ongoing end market uncertainty, posing risks to sustained revenue growth and earnings.

- The company's growth outlook is tempered by being "between significant launch cycles" with existing customers and slow progress on penetrating new customer sets, which heightens the risk of flattish or declining revenue in the medium-term, especially if new model years or market expansion are delayed.

- Strattec continues to face significant cost pressures from elevated tariffs, rising Mexican labor costs, and inflation-all of which could erode gross and net margins, particularly since tariff recoveries from customers lag associated expenses, and cost mitigation efforts may not fully offset external headwinds.

- While investments are being made in digital keyfobs and power access products, management acknowledges that the transition away from traditional hardware (such as switches and mechanical keys) is ongoing but slow; this exposes Strattec to long-term risks from automotive industry trends towards full electrification, increased digital authentication, and potential disintermediation from OEMs prioritizing software-based security solutions-threatening both long-term relevance and margin expansion.

- Strattec's customer concentration remains high, especially among the North American Big 3 OEMs, and diversification efforts are still nascent, making the company acutely vulnerable to loss of major contracts, OEM supplier consolidation trends, or shifts in procurement strategy, which would have a disproportionate negative impact on future revenues and earnings predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $80.0 for Strattec Security based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $659.5 million, earnings will come to $42.6 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of $67.38, the analyst price target of $80.0 is 15.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.