Key Takeaways

- Strong industry win rate and demand for large turbos suggest potential future revenue growth amid industry consolidation.

- Strategic investments in zero-emission technologies and flexible cost structures enhance margin growth and earnings potential.

- Exposure to softening automotive industry demand, competitive pressures, and volatile commodity prices risks Garrett's revenue growth, margin stability, and earnings.

Catalysts

About Garrett Motion- Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors worldwide.

- Garrett Motion's strong new business win rate in a consolidating industry ensures continued demand, which is expected to positively impact future revenue growth.

- The company is witnessing growth in demand for large turbos, especially driven by booming data centers requiring advanced backup power solutions, which could increase future revenues.

- Garrett's investment in zero-emission vehicle technologies and partnerships, such as with SinoTruk for next-generation electric powertrains, positions the company for future growth in earnings once production begins around 2027.

- The implementation of sustainable fixed cost actions and a highly flexible variable cost structure has provided Garrett with a significant year-over-year margin increase, suggesting that net margins could continue to improve.

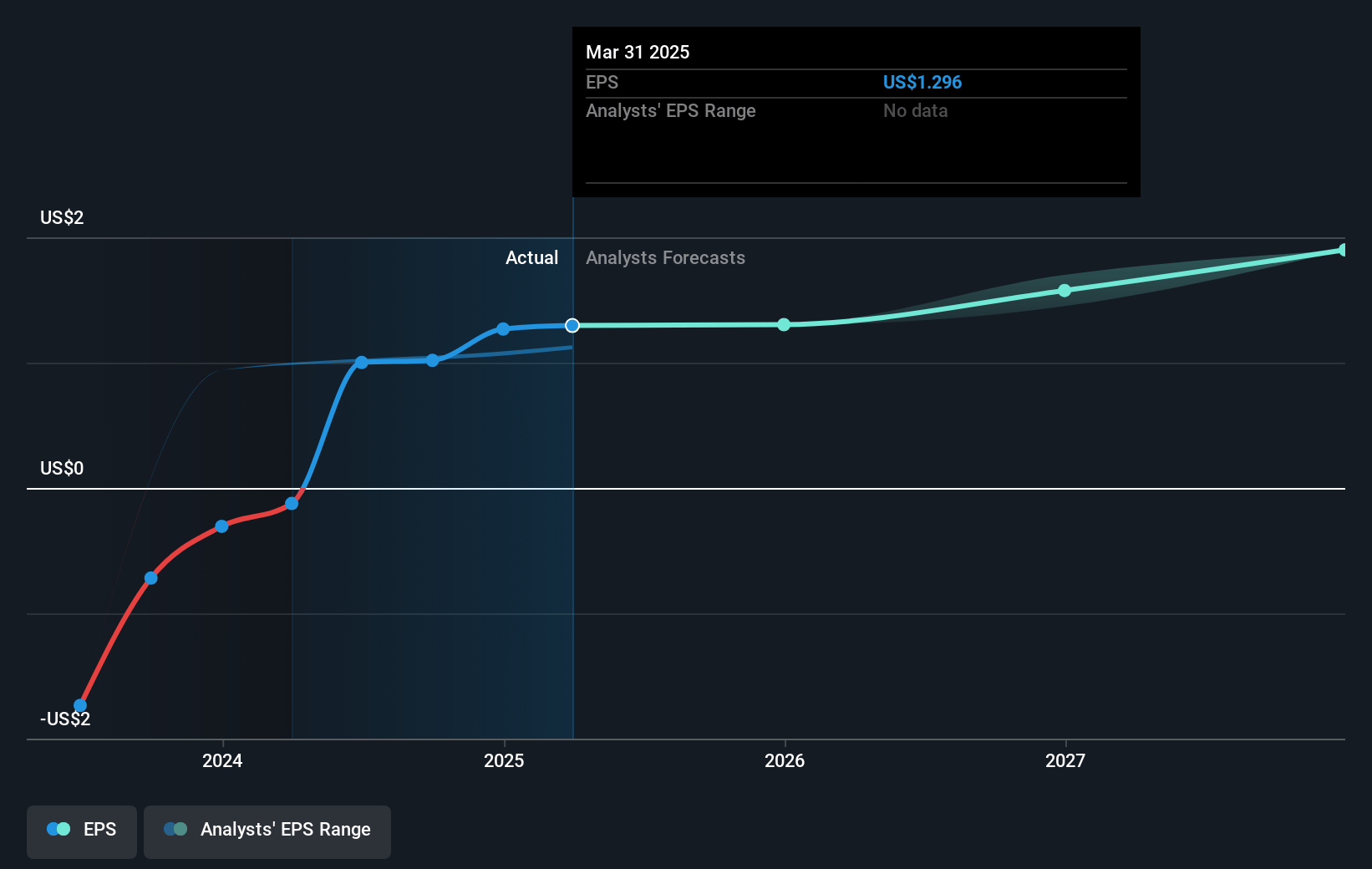

- Continuous share repurchases under the stock buyback program are expected to positively affect earnings per share (EPS) as share count decreases.

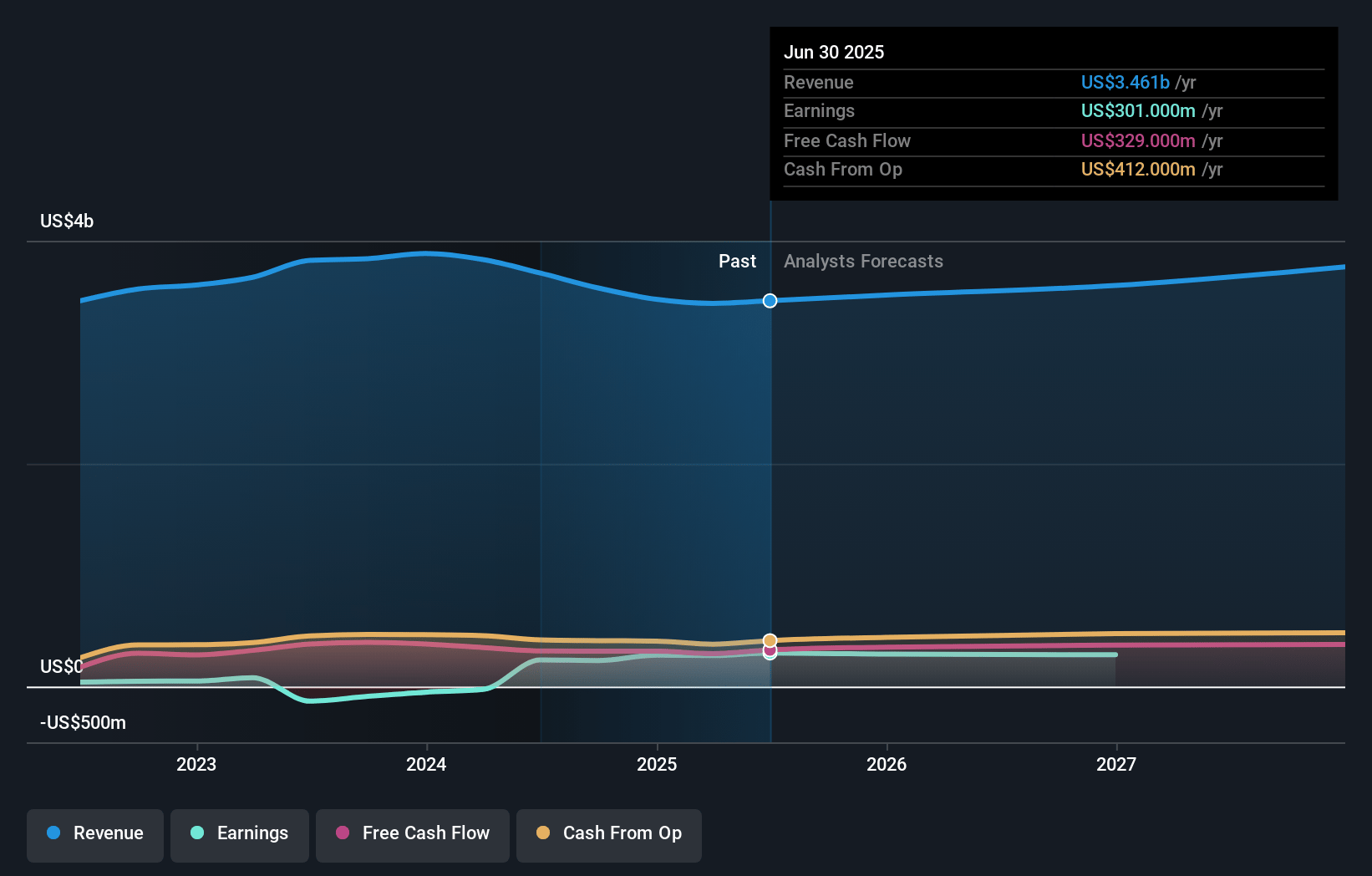

Garrett Motion Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Garrett Motion's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 9.5% in 3 years time.

- Analysts expect earnings to reach $347.6 million (and earnings per share of $1.79) by about January 2028, up from $234.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 8.6x today. This future PE is lower than the current PE for the US Auto Components industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 3.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

Garrett Motion Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exposure to softness in the light vehicle industry in Europe and China, along with competitive pressures, poses a risk to Garrett's future revenue growth and could impact net margins due to decreased sales volume.

- The company's reliance on segments that are experiencing declining demand, such as on-highway commercial vehicles in Europe and certain verticals like agriculture, could negatively affect revenue stability and earnings.

- Garrett's ongoing price pressures from automakers, who are facing their own financial challenges, may compress future net margins if Garrett is unable to maintain or increase pricing.

- The industry's general softening macro environment, specifically in light vehicle production, presents a risk to Garrett's revenue projections and could result in underperformance against their own financial outlook.

- The continued fluctuation and volatility in commodity prices, even though they have been margin accretive currently, could unpredictably affect Garrett’s future net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.0 for Garrett Motion based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $347.6 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 8.5%.

- Given the current share price of $9.41, the analyst's price target of $12.0 is 21.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives