Key Takeaways

- MediaTek's edge AI SoC and strategic alliances enhance its market position, driving potential revenue growth through high-end mobile devices and AI applications.

- Strategic focus on AI and automotive markets offers significant growth opportunities, leveraging strong partnerships to protect margins and supply chain stability.

- MediaTek faces potential revenue and margin challenges from increased operating expenses, market concentration in China, geopolitical risks, and ambitious AI investments amidst supply chain constraints.

Catalysts

About MediaTek- Engages in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) in Taiwan, rest of Asia, and internationally.

- MediaTek's introduction of the flagship Dimensity 9400 SoC, optimized for edge AI applications, indicates potential for increased adoption in high-end mobile devices, which could bolster revenue as the demand for AI-capable smartphones grows.

- The collaboration with Google and integration of large language models such as Gemini Nano and Llama 3.2 suggest potential for new AI applications, which could enhance MediaTek's market position and increase earnings through software and service opportunities.

- The commitment to the USD 45 billion custom AI accelerator market by 2028, supported by strategic partnerships and advanced ASIC developments, presents a significant revenue growth opportunity in cloud and data center sectors.

- MediaTek’s strategic focus on the automotive market, securing new projects, and targeting mid

- to long-term growth trends could provide a stable revenue stream and potentially improve operating margins as these technologies mature.

- Despite geopolitical risks, MediaTek’s strong compliance and structured partnerships with key technology suppliers like Arm should help maintain a stable supply chain and margin protection, fostering investor confidence in future earnings growth.

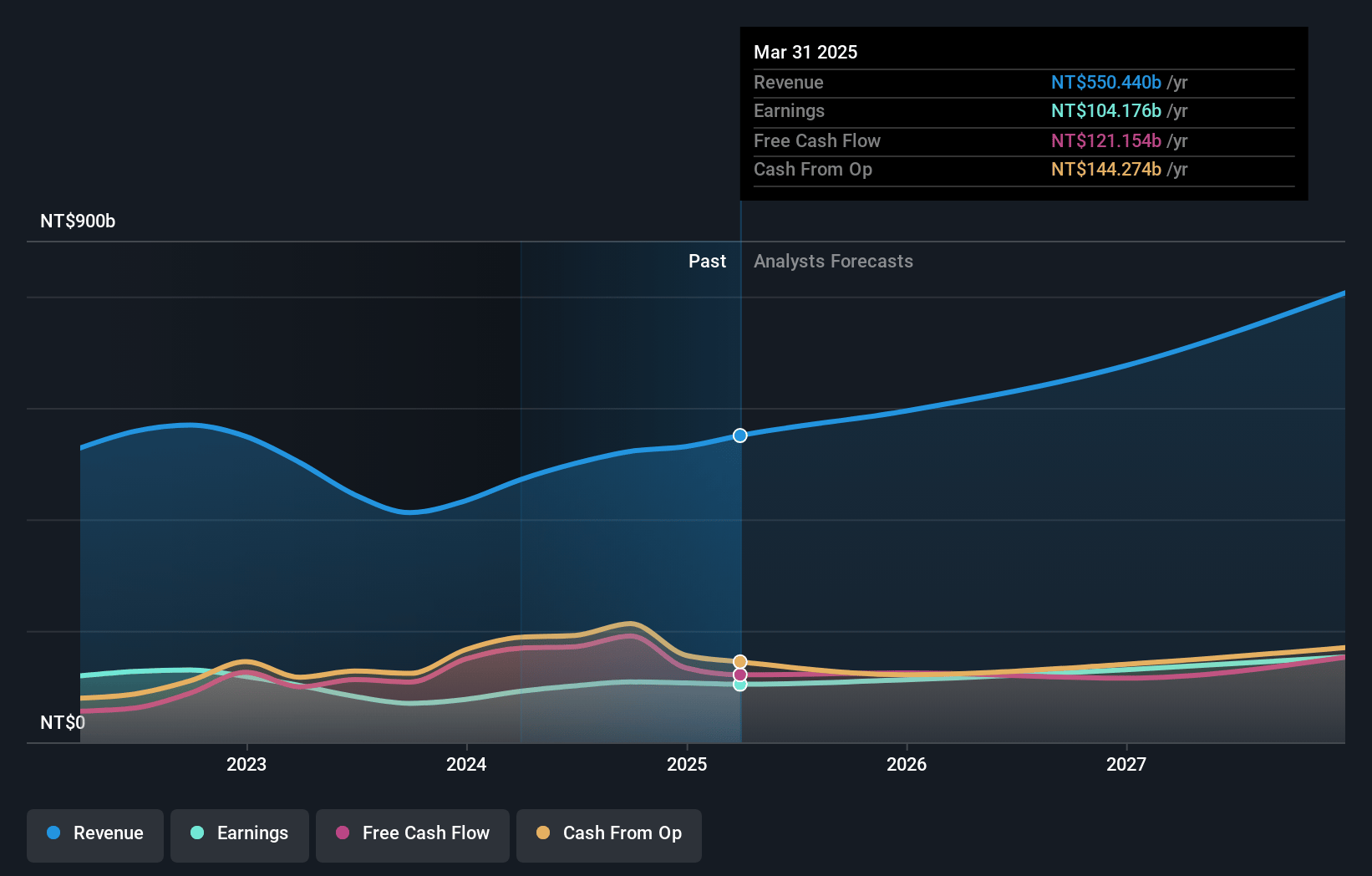

MediaTek Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MediaTek's revenue will grow by 12.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.7% today to 17.8% in 3 years time.

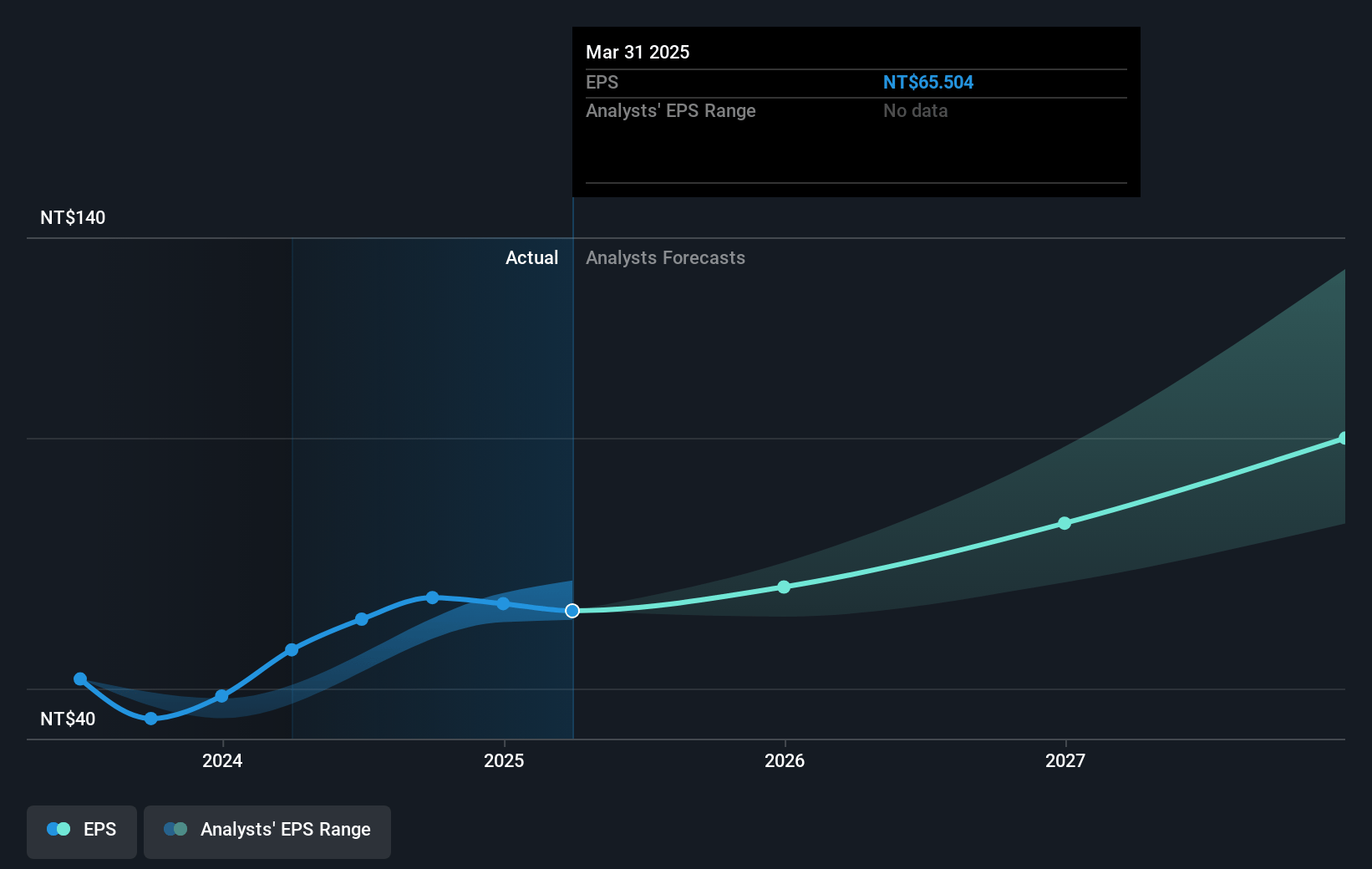

- Analysts expect earnings to reach NT$130.8 billion (and earnings per share of NT$83.18) by about January 2028, up from NT$108.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NT$152.8 billion in earnings, and the most bearish expecting NT$113.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.3x on those 2028 earnings, up from 21.6x today. This future PE is lower than the current PE for the TW Semiconductor industry at 29.1x.

- Analysts expect the number of shares outstanding to decline by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.3%, as per the Simply Wall St company report.

MediaTek Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MediaTek's operating expenses increased compared to previous quarters and the year-ago period, which could impact future net margins if not managed effectively.

- Though the Dimensity 9400 has seen strong adoption and momentum, reliance on flagship growth within the China market could expose MediaTek to risks if China’s economic recovery does not materialize as expected, potentially affecting revenue projections.

- The AI ASIC strategy targeting the USD 45 billion custom AI accelerator market by 2028 involves significant investment, and delays or underperformance could negatively impact future earnings and margin expansion efforts.

- MediaTek’s concentration in specific markets such as China and engagement in high competition segments like AI-powered mobile and edge computing devices could be risky if geopolitical tensions or market dynamics shift unfavorably, impacting future revenues and market share.

- Supply chain constraints or increased costs from foundry partnerships, licensing fees, and advanced packaging requirements could elevate cost structures, affecting future gross margins and pass-through pricing capabilities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$1498.48 for MediaTek based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$1700.0, and the most bearish reporting a price target of just NT$1180.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$733.9 billion, earnings will come to NT$130.8 billion, and it would be trading on a PE ratio of 22.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of NT$1465.0, the analyst's price target of NT$1498.48 is 2.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives