Key Takeaways

- Capacity expansion, product innovation, and geographic diversification position UMC for superior pricing power, margin gains, and outperformance versus industry expectations.

- Strong specialty technology adoption and deep customer partnerships drive stable, higher-margin revenue streams with enhanced financial resilience.

- Heavy reliance on mature chip technologies, rising global competition, and geopolitical risks threaten UMC's market share, revenue stability, and long-term profitability.

Catalysts

About United Microelectronics- Operates as a semiconductor wafer foundry in Taiwan, China, Hong Kong, Japan, Korea, the United States, Europe, and internationally.

- While analyst consensus expects strong growth in 22

- and 28-nanometer products, the sustained outperformance in market share, record-high contributions to revenue, and superior adoption rates in communications indicate UMC could significantly outgrow current targets, supporting a rapid acceleration in revenue and gross margin over the next several years.

- Analysts broadly agree that the Singapore Phase 3 fab and geographic diversification will improve supply resilience and revenue, but the high utilization rates and above-corporate-average loading at both Singapore and China fabs suggest UMC may operate closer to full capacity for longer, allowing for pricing power and margin expansion well above consensus expectations.

- UMC's advanced packaging roadmap, including 2.5D/3D integration and wafer-to-wafer stacking for RFICs and AI/Edge applications, strategically positions the company to capture a disproportionate share of the rapidly expanding edge computing market, which should open new high-value revenue streams and elevate average selling prices.

- Ongoing expansion in specialty technologies such as embedded non-volatile memory, high voltage, and RF solutions enables UMC to capitalize on demand from automotive, IoT, and industrial customers, resulting in higher-margin, less-cyclical revenue and increased financial resilience.

- Deepening long-term customer partnerships across diverse sectors, combined with persistent global growth in connected devices and digital transformation, locks in multi-year order pipelines and stabilizes utilization rates, supporting consistent growth in revenue, earnings, and free cash flow well into the next decade.

United Microelectronics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on United Microelectronics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming United Microelectronics's revenue will grow by 9.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.7% today to 19.4% in 3 years time.

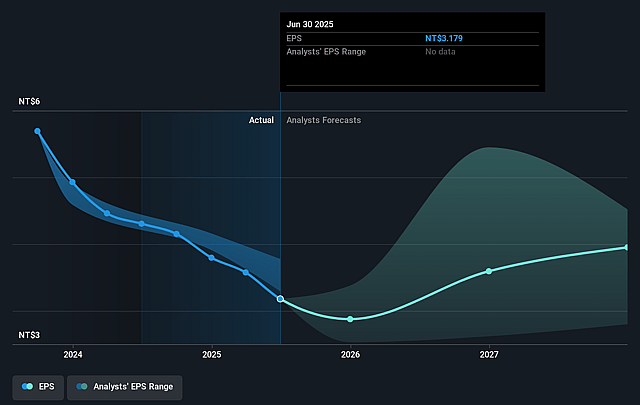

- The bullish analysts expect earnings to reach NT$61.0 billion (and earnings per share of NT$4.84) by about September 2028, up from NT$39.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.5x on those 2028 earnings, up from 13.1x today. This future PE is lower than the current PE for the US Semiconductor industry at 31.5x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.31%, as per the Simply Wall St company report.

United Microelectronics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UMC's high dependence on mature process nodes such as 22 and 28-nanometers exposes it to the risk of pricing pressure and slower market growth as customers increasingly shift to more advanced nodes, which could dampen revenue growth and long-term earnings.

- The company faces intensifying global competition and "winner-take-most" dynamics in the semiconductor foundry sector, with larger players like TSMC and Samsung able to outspend UMC in capital expenditures and technology, threatening UMC's market share and potentially eroding both revenue and net margins.

- UMC's significant exposure to Asia, accounting for 67% of revenue, leaves it vulnerable to global shifts toward onshoring and regionalization in the U.S. and Europe, potentially leading to client loss and revenue declines as Western customers diversify their supply chains away from Asian foundries.

- Ongoing high capital expenditures, exemplified by the projected USD 1.8 billion CapEx for 2025 and major investments in new fab capacity, could compress free cash flow and net margins, especially if revenue growth fails to keep pace with these investments due to industry or macro headwinds.

- Geopolitical uncertainties, such as U.S.-China tensions and evolving tariff or export control policies, introduce substantial risk to UMC's access to technology, customers, and critical equipment, threatening revenue stability and earnings reliability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for United Microelectronics is NT$57.15, which represents two standard deviations above the consensus price target of NT$45.87. This valuation is based on what can be assumed as the expectations of United Microelectronics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$60.0, and the most bearish reporting a price target of just NT$32.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NT$313.8 billion, earnings will come to NT$61.0 billion, and it would be trading on a PE ratio of 15.5x, assuming you use a discount rate of 9.3%.

- Given the current share price of NT$41.25, the bullish analyst price target of NT$57.15 is 27.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.