Key Takeaways

- Dependence on mature semiconductor nodes and slower R&D threatens UMC's margins as industry shifts to advanced technologies and customers seek next-generation solutions.

- Geopolitical tensions, rising protectionism, and stricter ESG regulations pose risks to UMC's revenue stability, supply chains, and long-term profitability.

- Focus on specialty technologies, capacity expansion, and strong partnerships supports revenue growth, margin resilience, and earnings stability amid industry volatility and competitive pressures.

Catalysts

About United Microelectronics- Operates as a semiconductor wafer foundry in Taiwan, China, Hong Kong, Japan, Korea, the United States, Europe, and internationally.

- Intensifying global efforts for semiconductor self-sufficiency, particularly in the US, Europe, and China, risk undermining UMC's export growth and could accelerate the build-out of domestic capacity among its customers, leading to long-term overcapacity and persistent revenue erosion.

- The company's primary reliance on mature process nodes, notably the 22

- and 28-nanometer technology that now accounts for nearly 40 percent of revenue, will expose UMC to severe pricing pressure and impending commoditization as competitors improve their capabilities and customers migrate to next-generation nodes, resulting in shrinking gross margins and declining earnings.

- Heightened geopolitical tensions and rising protectionist barriers threaten to disrupt UMC's access to critical markets and supply chains, increasing the likelihood of revenue volatility and potential loss of key customers, particularly as major regions seek domestic alternatives and restrict cross-border semiconductor trade.

- Slower pace of research and development investment compared to leading-edge foundries will likely leave UMC technologically lagging as semiconductor innovation shifts towards advanced nodes and novel architectures, diminishing its pricing power and causing long-run deterioration in net margins and competitive positioning.

- Escalating environmental regulations and the global push toward stringent ESG compliance are projected to raise capital expenditures and operating costs, pressuring free cash flow and further limiting the company's ability to sustain profitability in a capital-intensive, increasingly competitive environment.

United Microelectronics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on United Microelectronics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming United Microelectronics's revenue will grow by 1.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 16.7% today to 15.0% in 3 years time.

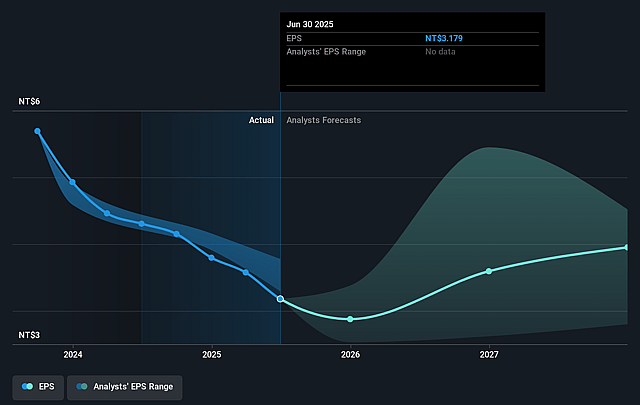

- The bearish analysts expect earnings to reach NT$37.5 billion (and earnings per share of NT$3.0) by about September 2028, down from NT$39.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, up from 13.1x today. This future PE is lower than the current PE for the US Semiconductor industry at 31.5x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.31%, as per the Simply Wall St company report.

United Microelectronics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained strong demand for 22

- and 28-nanometer specialty nodes, which account for a record 40 percent of total sales and are expected to remain the core growth engine for 2025 and beyond, could increase revenues and support margin resilience.

- Ongoing expansion of manufacturing capacity, especially with the Singapore Fab 12i Phase 3 ramping up in 2026, positions UMC to capture additional market share regionally and meet growing customer demand, likely benefiting top-line revenue growth.

- The company's strategic focus on differentiated specialty technologies in power management, RF, embedded non-volatile memory, and high-voltage solutions enhances pricing power and average selling prices, potentially improving net margins and earnings.

- Strengthened long-term partnerships, including with Intel on 12-nanometer technology and key wireless communication customers, provide higher business visibility, diversified revenue streams, and mitigate volatility in earnings.

- Healthy utilization rates, robust product pipeline, and the company's ability to maintain firm ASP despite foreign exchange fluctuations point to resilience in UMC's financial structure, underpinning stable or improving gross margins and net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for United Microelectronics is NT$34.6, which represents two standard deviations below the consensus price target of NT$45.87. This valuation is based on what can be assumed as the expectations of United Microelectronics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$60.0, and the most bearish reporting a price target of just NT$32.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be NT$250.1 billion, earnings will come to NT$37.5 billion, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 9.3%.

- Given the current share price of NT$41.25, the bearish analyst price target of NT$34.6 is 19.2% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on United Microelectronics?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.