Last Update 18 Oct 25

Fair value Increased 1.80%The analyst price target for Haci Ömer Sabanci Holding has increased slightly from ₺143.52 to ₺146.10. Analysts cite expectations of steady performance, supported by adjusted growth assumptions and improving industry conditions.

Analyst Commentary

Recent commentary from the analyst community has highlighted a balanced perspective on Haci Ömer Sabanci Holding, underscoring constructive developments as well as potential areas to watch. Analysts remain largely focused on factors that could impact the firm's valuation, execution capacity, and long-term growth profile.

Bullish Takeaways

- Bullish analysts point to the company's ability to maintain steady performance, benefiting from favorable industry conditions and recent improvements in growth metrics.

- Adjusted growth assumptions suggest an ongoing resilience in business operations, which has underpinned the upward adjustment in price targets.

- Cost management measures and efficiency gains are seen as supportive of margins and profitability.

- The presence of industry tailwinds, such as sectoral consolidation or increased demand in core areas, is expected to contribute positively to near-term results.

Bearish Takeaways

- Bearish analysts caution that while recent growth trends are promising, execution risk remains. Any deviation from projected performance could temper valuation upside.

- Persistent market volatility and exposure to broader economic swings may pose challenges to sustaining current growth rates.

- There is a watchful tone on margins, with some seeing room for pressure if cost control initiatives are not maintained going forward.

What's in the News

- Sabanci Holding may consider divesting businesses with low net profit margins and returns on equity, following discussions between top executives and analysts (Reuters).

- Potential divestitures could include technology retailer Teknosa and food retailer Carrefoursa, as indicated by market observers (Reuters). Other subsidiaries may also be considered.

Valuation Changes

- Fair Value: The estimated fair value has risen slightly from TRY 143.52 to TRY 146.10.

- Discount Rate: The discount rate has edged up marginally, moving from 32.05% to 32.08%.

- Revenue Growth: Projected revenue growth has fallen significantly, decreasing from 269.77% to 156.09%.

- Net Profit Margin: The net profit margin forecast has decreased from 3.74% to 2.47%.

- Future P/E: The expected future price-to-earnings ratio has increased sharply from 2.07x to 9.63x.

Key Takeaways

- Focus on renewable energy investments and digital transformation is likely to drive revenue growth and enhance margins through market demand and high-margin services.

- Strong cash reserves and strategic project funding indicate potential for future growth through high-return investments and diversification in energy production.

- Operational challenges, revenue contractions, and cost pressures threaten earnings and profitability across Haci Ömer Sabanci Holding's business segments.

Catalysts

About Haci Ömer Sabanci Holding- Operates primarily in the finance, manufacturing, and trading sectors worldwide.

- The company's focus on investing in net zero transition and expanding its energy generation capacity, particularly with the $1 billion funding secured for a 750 megawatt expansion, is likely to drive future revenue growth and enhance EBITDA margins by capitalizing on increasing demand for renewable energy.

- The acquisition of digital businesses such as Bulutistan, expected to be a unicorn, indicates a strategic push towards digital transformation, which could enhance revenue growth and higher-margin digital services, positively impacting earnings.

- The completion of the funding package for the Oriana project in the U.S. could contribute to significant future revenue growth once operational, thereby positively influencing net margins via energy production diversification.

- Akbank's effective balance sheet management and customer acquisition strategy provide a foundation for sustainable growth, potentially leading to improved recurring revenues and net income margin stabilization, as financial conditions normalize.

- Strong operational cash flow and a significant cash reserve at the holding level suggest potential future investments, which could drive revenue growth and improve earnings, particularly as these resources are redirected into high-return projects.

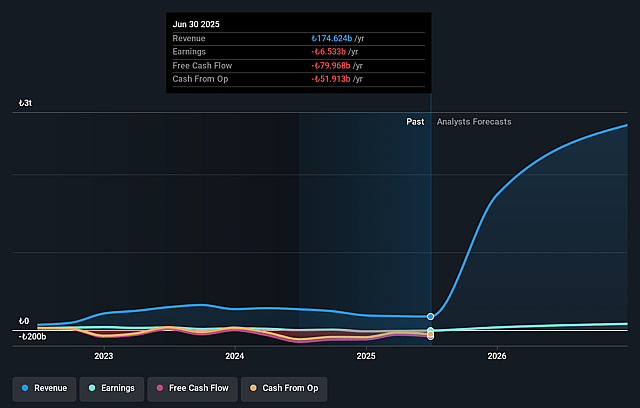

Haci Ömer Sabanci Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Haci Ömer Sabanci Holding's revenue will grow by 219.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.1% today to 3.2% in 3 years time.

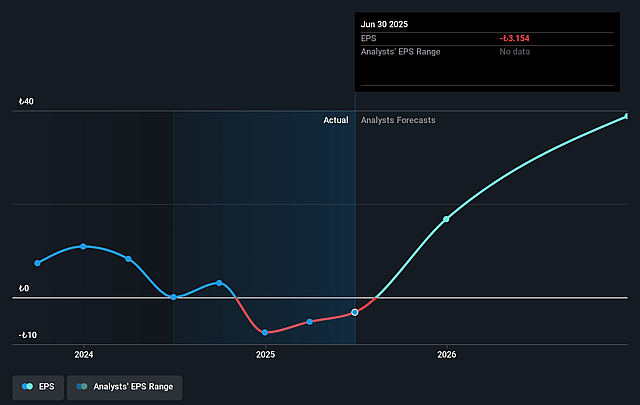

- Analysts expect earnings to reach TRY 139.1 billion (and earnings per share of TRY 70.61) by about January 2028, up from TRY 1.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.0x on those 2028 earnings, down from 138.6x today. This future PE is lower than the current PE for the TR Banks industry at 6.6x.

- Analysts expect the number of shares outstanding to decline by 2.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 32.2%, as per the Simply Wall St company report.

Haci Ömer Sabanci Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's initial reporting of no net profit and a contraction in EBITDA by 46% signals ongoing operational challenges, which can negatively impact earnings and financial stability.

- The non-bank business saw a revenue contraction of 15% and EBITDA by 19%, with a net loss reported, suggesting continued pressure on revenue and profit margins.

- Significant payroll increases (71%) and high interest rates raise concerns about increasing cost pressures that could further compress net margins.

- Inflationary pressures, particularly impacting export-oriented businesses, continue to underperform due to mismatched inflation and devaluation effects, potentially affecting revenue and bottom-line performance.

- The energy business faces challenges with low electricity prices and reduced trading activity in a less liquid market, potentially undermining revenue growth and profitability targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of TRY153.08 for Haci Ömer Sabanci Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of TRY175.0, and the most bearish reporting a price target of just TRY130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be TRY4405.7 billion, earnings will come to TRY139.1 billion, and it would be trading on a PE ratio of 5.0x, assuming you use a discount rate of 32.2%.

- Given the current share price of TRY102.4, the analyst's price target of TRY153.08 is 33.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Haci Ömer Sabanci Holding?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.