Key Takeaways

- Limited progress in electric vehicle development and ongoing dependency on outdated models threaten market share and profitability amid global industry changes and rising competition.

- Strategic benefits from Stellantis partnership and capacity investments are offset by heavy external reliance, domestic market pressures, and uncertainty in future project execution.

- Intensifying competition, production uncertainty, currency volatility, and dependence on external partners are eroding market share, profitability, and long-term strategic positioning.

Catalysts

About Tofas Türk Otomobil Fabrikasi Anonim Sirketi- Manufactures and sells passenger cars and light commercial vehicles in Turkey.

- Although the expected regulatory approval and completion of the Stellantis Türkiye acquisition could bring meaningful scale advantages, expanded product offerings, and cost synergies across logistics, purchasing, and sales, the company faces substantial risks from the accelerating global shift toward electric vehicles, which threatens to outpace Tofas's still-limited EV pipeline, potentially resulting in lost long-term revenue and competitive erosion in key markets.

- While Tofas's recent EUR 256 million investment in new light vehicle capacity and model launches may support higher export volumes as global supply chains regionalize and Turkey grows its export hub status, lingering uncertainty on the rapid ramp-up of these projects and continued reliance on phased-out or aging production models may keep utilization rates suboptimal and constrain future margin expansion.

- Despite Turkey's ongoing urbanization and a growing middle class that should underpin steady domestic demand for automobiles, high local competition and unfavorable tax structures continue to diminish Tofas's local market advantage, risking further erosion of market share and hampering domestic shipment-driven revenue recovery.

- Although deepened cooperation with Stellantis could deliver strategic access to new technology, diversified business lines such as insurance and aftermarket, and help mitigate price and cost pressures, Tofas remains dependent on decisions from its partner regarding future model allocation and royalty structures, which could limit revenue predictability and reduce strategic autonomy over earnings growth.

- While the company is targeting a return to high capacity utilization and incremental project announcements to boost operational efficiency by 2027, this ambition is exposed to broader industry headwinds including intensified competition from global automakers-including aggressive Chinese EV entrants-and heightened regulatory compliance costs, both of which threaten to weigh on net margins and undermine the hoped-for recovery in profitability.

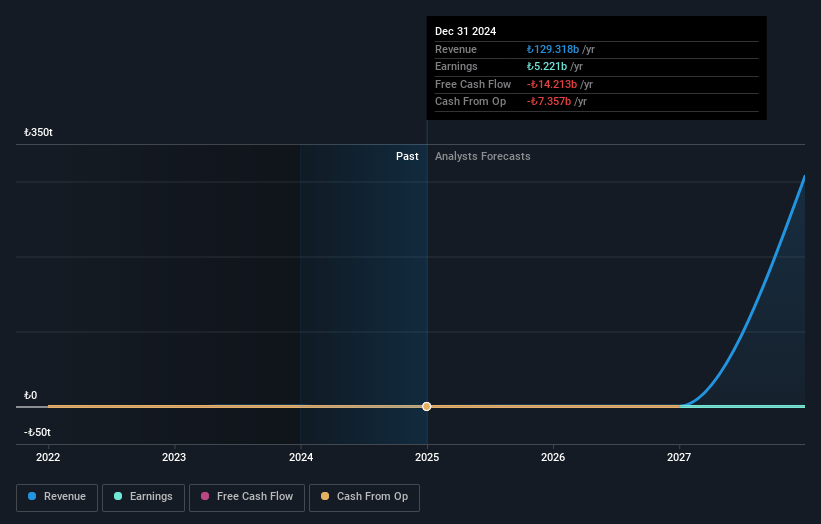

Tofas Türk Otomobil Fabrikasi Anonim Sirketi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tofas Türk Otomobil Fabrikasi Anonim Sirketi compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Tofas Türk Otomobil Fabrikasi Anonim Sirketi's revenue will grow by 50.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.1% today to 8.1% in 3 years time.

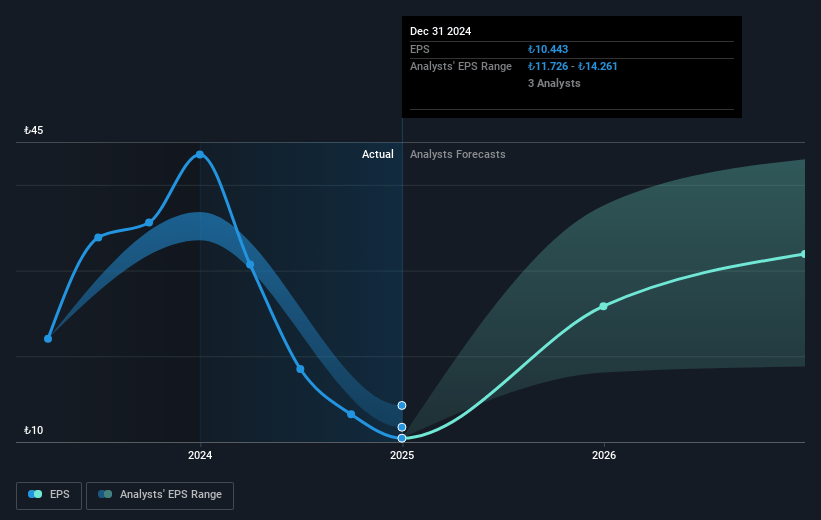

- The bearish analysts expect earnings to reach TRY 29.4 billion (and earnings per share of TRY 89.87) by about July 2028, up from TRY 1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, down from 88.5x today. This future PE is lower than the current PE for the TR Auto industry at 48.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 39.98%, as per the Simply Wall St company report.

Tofas Türk Otomobil Fabrikasi Anonim Sirketi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the Turkish automotive market, combined with a lack of local producer tax advantages and aggressive strategies from both established and new entrants (including Chinese EV manufacturers), is leading to declining market share and shipment volumes, which directly pressures both revenue and long-term earnings power.

- Delays and uncertainty associated with production transitions-including phase-outs of key models like Fiorino, unresolved production plans for the Egea line, and still-unspecified new vehicle launches-create significant gaps in utilization, keeping capacity rates low and risking under-absorption of fixed costs, which negatively impacts operating margins and net income.

- The company has experienced sharp declines in both domestic and export shipments, with first quarter export shipments down over 60 percent and total revenues falling by almost 50 percent year-over-year; if market or operational recoveries take longer than expected, sustained volume reductions will weigh on cash flow and future earnings.

- Exposure to hyperinflationary accounting adjustments and volatility in the Turkish lira is materially eroding profit before tax, as witnessed by significant net monetary losses in the quarter, which could continue to undermine reported profits and shareholder returns over the long-term.

- Heavy reliance on Stellantis for model allocation and platform decisions, combined with the company's limited visibility into its own EV and next-generation technology pipeline, creates strategic risks around long-term product relevance and market share, potentially resulting in structural declines in both revenue and competitive positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tofas Türk Otomobil Fabrikasi Anonim Sirketi is TRY220.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tofas Türk Otomobil Fabrikasi Anonim Sirketi's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of TRY546.0, and the most bearish reporting a price target of just TRY220.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be TRY365.1 billion, earnings will come to TRY29.4 billion, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 40.0%.

- Given the current share price of TRY213.4, the bearish analyst price target of TRY220.0 is 3.0% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.