Key Takeaways

- Sustainability initiatives and product innovation are rapidly expanding margins and market share, positioning the company ahead of peers in growth and profitability improvement.

- Operational efficiencies and financial discipline are boosting free cash flow, enabling either higher shareholder returns or accelerated future investment opportunities.

- Heavy reliance on legacy cement and petrochemical businesses, limited innovation in sustainability, and intensifying competition threaten Siam Cement's long-term profitability amid global industry transformation.

Catalysts

About Siam Cement- Operates in the cement and building materials, chemicals, and packaging businesses in Thailand and internationally.

- While analyst consensus highlights steady regional infrastructure demand, the current recovery in Thailand and rapid GDP growth in Vietnam and Indonesia, coupled with the absence of past budget delays, suggests volume growth and revenue for Siam Cement could surpass expectations in the short and long term.

- Analysts broadly agree sustainability investments will improve profitability, but the pace and scale of Siam Cement's shift-87% of cement mix now low-carbon, strong global market acceptance, and green products already making up over half of revenue-point toward faster margin expansion and market share gain than the market currently assumes.

- The imminent commissioning of the LSP ethane retrofit and advanced supply chain logistics (with long-term U.S. contracts and technology upgrades) will bring a structural cost advantage for the chemicals division, materially lifting gross margins and group-level EBITDA once industry spreads recover.

- Ongoing aggressive deleveraging, working capital release, and lower CapEx are driving much stronger free cash flow than peers, positioning Siam Cement for either elevated dividends or opportunistic investments that can accelerate future earnings growth.

- Material advances in smart building materials, digitalization, and international distribution expansion (particularly through retail networks and Smart Living solutions) are creating high-margin, defensible growth segments likely to enhance earnings quality and resilience across cycles.

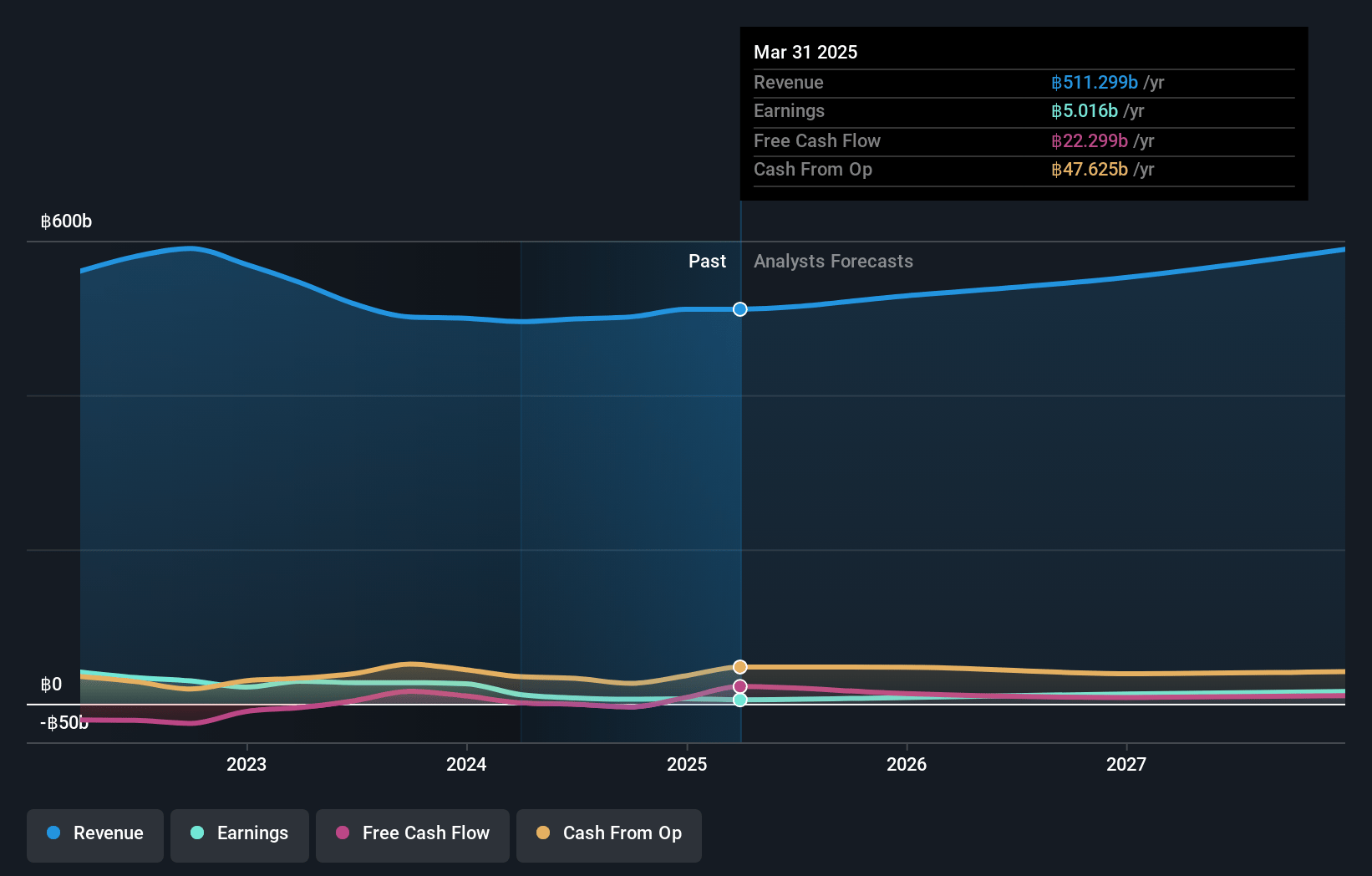

Siam Cement Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Siam Cement compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Siam Cement's revenue will grow by 12.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.0% today to 4.4% in 3 years time.

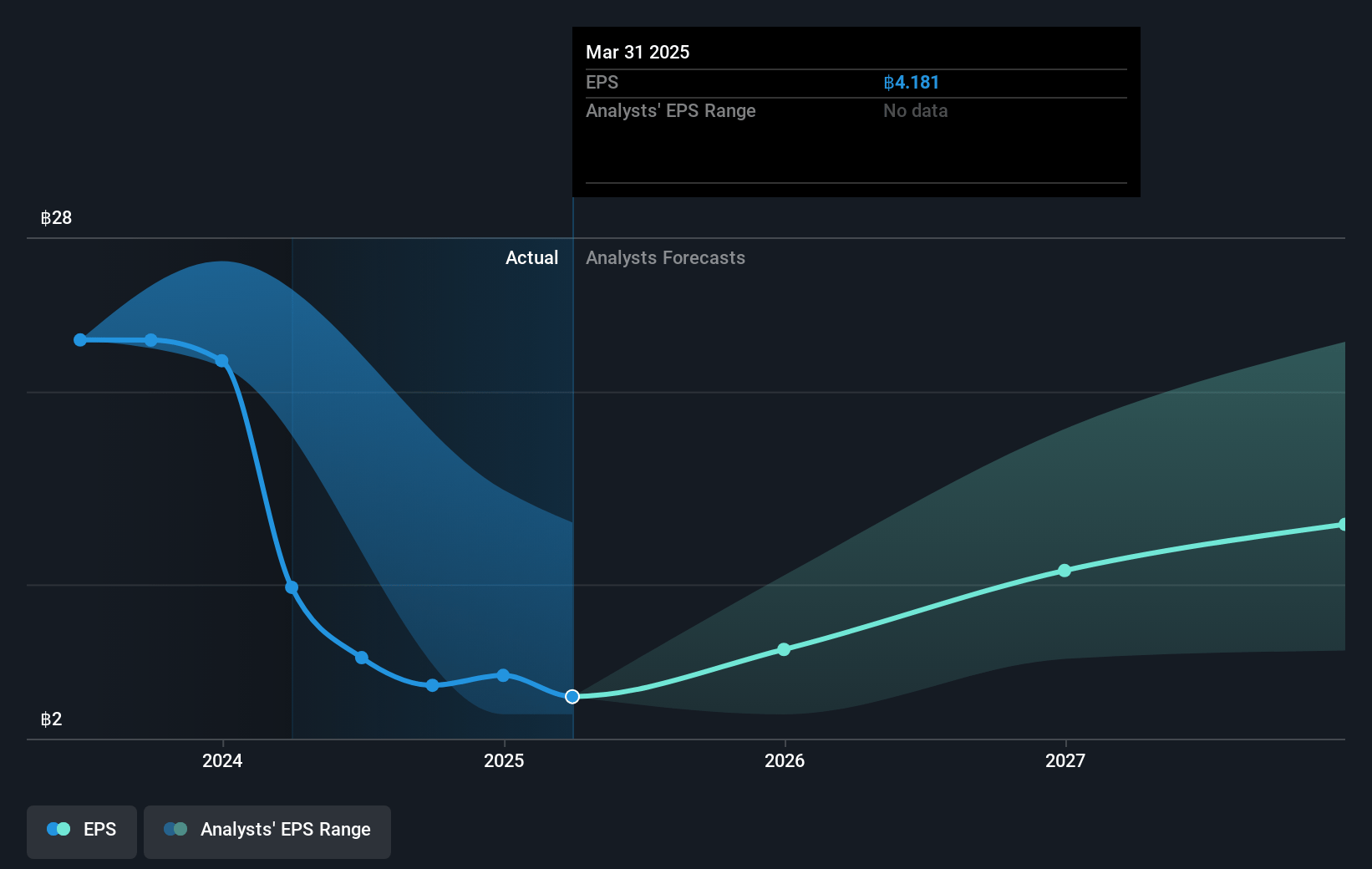

- The bullish analysts expect earnings to reach THB 31.9 billion (and earnings per share of THB 26.61) by about July 2028, up from THB 5.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, down from 42.1x today. This future PE is greater than the current PE for the TH Basic Materials industry at 8.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.74%, as per the Simply Wall St company report.

Siam Cement Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Siam Cement's large exposure to traditional cement and petrochemical businesses leaves it vulnerable to the accelerating global shift towards green construction materials and decarbonization, which could reduce long-term demand and pressure future revenues.

- The company's current stability in EBITDA and cash flow is heavily reliant on cost-cutting, asset sales, and ongoing restructuring, and not underpinned by significant revenue growth or product diversification, raising concerns over the sustainability of net income as industry headwinds intensify.

- Despite investments in low-carbon cement and recycling businesses, Siam Cement's innovation in sustainable materials remains modest compared to the pace of industry transformation, increasing the risk of technological obsolescence and potential asset write-downs that could reduce future earnings.

- Net margins and overall profitability are under long-term threat due to rising energy costs, stricter carbon regulations, and the prospect of carbon pricing, which will steadily drive up operating and compliance expenses for Siam Cement's emissions-intensive core business.

- Competitive pressures are intensifying, as low-cost producers in China and India continue expanding, while volatile energy and raw material prices-exacerbated by global macroeconomic and geopolitical risks-create additional uncertainty and may erode future margin stability for the company.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Siam Cement is THB333.51, which represents two standard deviations above the consensus price target of THB187.72. This valuation is based on what can be assumed as the expectations of Siam Cement's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of THB462.5, and the most bearish reporting a price target of just THB110.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be THB718.4 billion, earnings will come to THB31.9 billion, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 12.7%.

- Given the current share price of THB176.0, the bullish analyst price target of THB333.51 is 47.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.