Key Takeaways

- Long-term demand and profitability face structural threats from the global shift to low-carbon materials, strict environmental rules, and inability to out-innovate leading competitors.

- Regional concentration increases exposure to economic and political risks, while aggressive global consolidation and digital disruption threaten market share and earnings stability.

- Strategic cost reductions, sustainability initiatives, and expansion into high-growth ASEAN markets are driving long-term profitability, revenue growth, and reduced earnings volatility.

Catalysts

About Siam Cement- Operates in the cement and building materials, chemicals, and packaging businesses in Thailand and internationally.

- The accelerating global shift towards alternative, low-carbon construction materials and heightened decarbonization pressures are expected to structurally erode long-term demand for Siam Cement's traditional cement, building products, and chemicals, leading to sustained revenue headwinds despite recent investments in green solutions.

- Persistently high capital intensity required to retrofit legacy operations for compliance with increasingly strict environmental regulations is likely to strain cash flow, drive up fixed costs, and suppress net margins, as any near-term cost efficiencies are outweighed by accelerating future requirements for compliance spending.

- Regional overexposure, especially in Thailand and Southeast Asia, leaves Siam Cement acutely vulnerable to macroeconomic shocks, demographic stagnation, and political instability, which could undermine construction demand growth and generate volatile, cyclical swings in both earnings and cash generation.

- Difficulty achieving innovation leadership in advanced, specialty chemicals and recycled materials risks long-term margin compression, as competitors-especially from China and multinational industry leaders-bring more cost-effective and technologically advanced low-carbon products to market, further eroding Siam Cement's pricing power and profitability.

- Intensifying industry consolidation and digital disruption threaten Siam Cement's market position, as larger and more agile global peers increasingly absorb market share, implement superior supply chain technologies, and drive chronic pressure on both volumes and net earnings potential over the next decade.

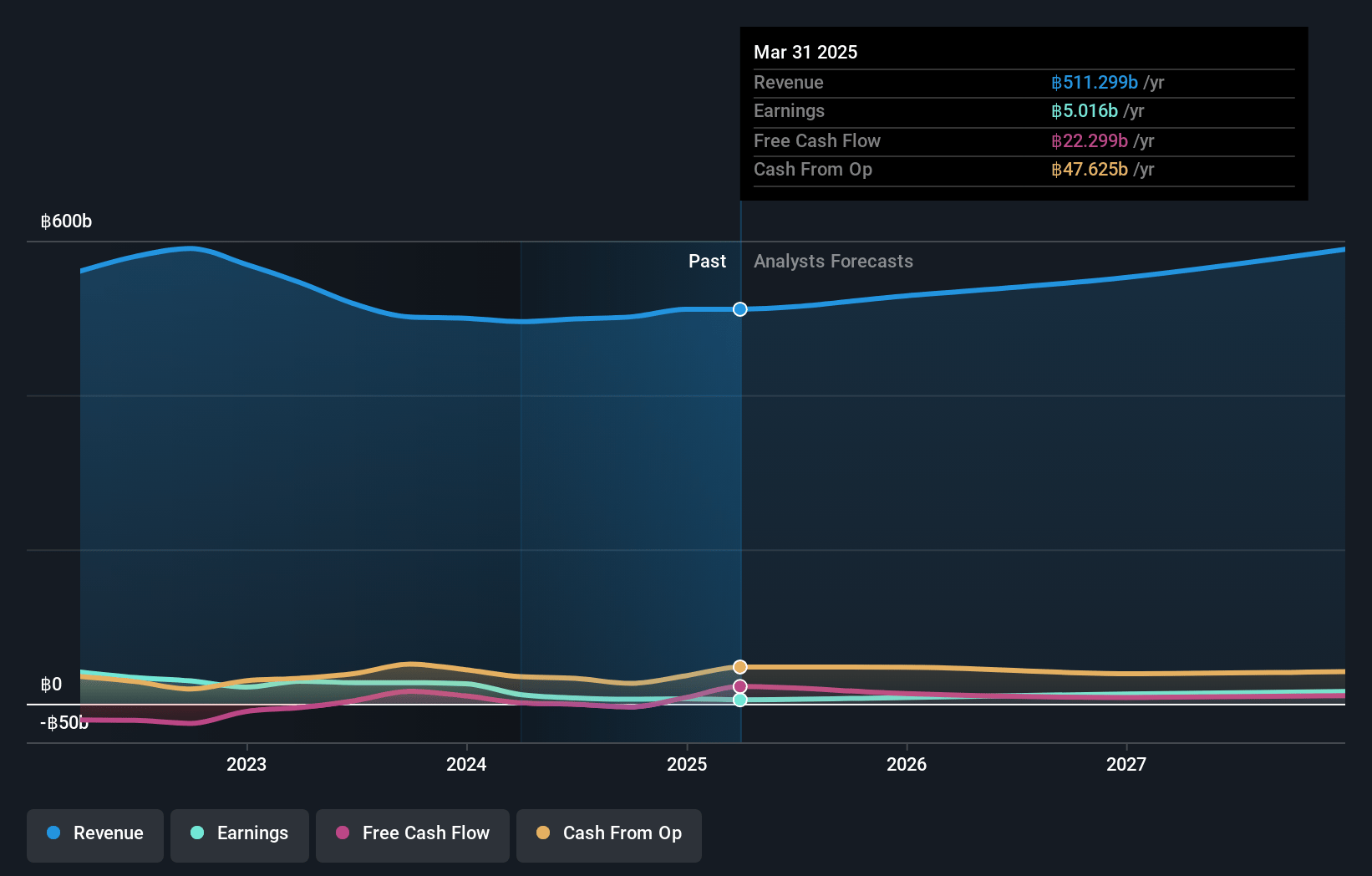

Siam Cement Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Siam Cement compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Siam Cement's revenue will decrease by 0.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.0% today to 1.8% in 3 years time.

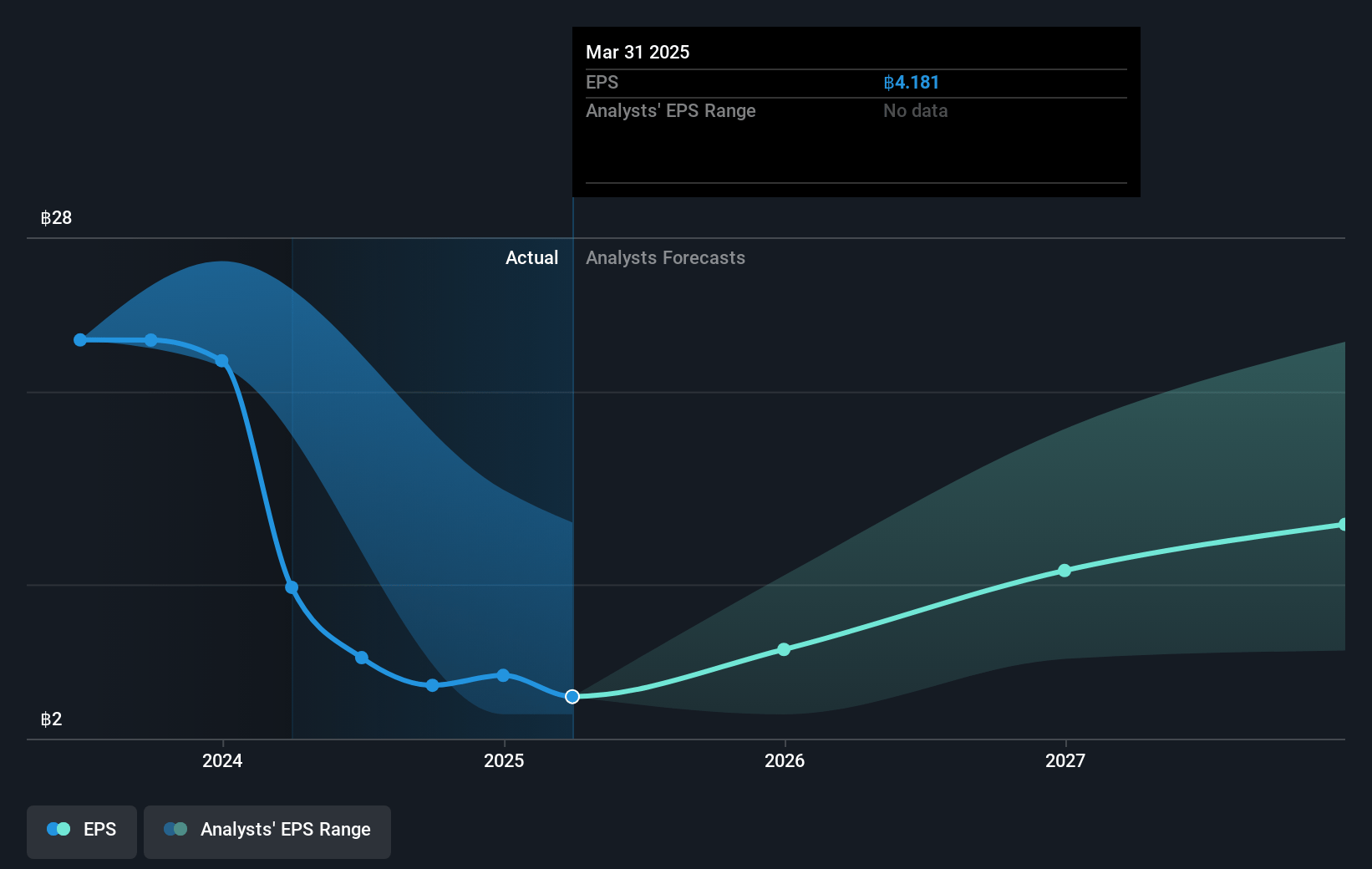

- The bearish analysts expect earnings to reach THB 9.3 billion (and earnings per share of THB 7.77) by about July 2028, up from THB 5.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.2x on those 2028 earnings, down from 42.9x today. This future PE is greater than the current PE for the TH Basic Materials industry at 8.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.63%, as per the Simply Wall St company report.

Siam Cement Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing cost reductions, restructuring, and operational efficiency programs have generated annual savings of over 1.35 billion THB, improving the company's cost structure and supporting higher net margins and earnings resilience even during challenging operating environments.

- The company's proactive deleveraging strategy, strong cash flow generation, and stable EBITDA have enabled a reduction in net debt and maintenance of a conservative net debt to equity ratio of 0.7 times, lowering financial risk and supporting dividend payouts, which improves overall earnings stability.

- Siam Cement's rapid growth in low-carbon and sustainable products, with revenue from Green Choice products accounting for 54% of total revenue and significant ramp-up in green cement exports to markets like the US and Australia, positions the company to capitalize on long-term global trends in decarbonization, supporting revenue and profitability growth.

- Strategic expansion in high-growth ASEAN markets such as Vietnam and Indonesia-markets with projected GDP growth rates of up to 8 percent-adds multiple growth engines and diversifies revenue streams, which is likely to fuel long-term revenue expansion and reduce earnings volatility.

- Investments in green energy, alternative fuels, and digital transformation have improved production efficiency, reduced costs, and created competitive advantages in sectors facing heightened regulatory and sustainability standards, supporting long-term improvements in net margins, earnings, and overall return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Siam Cement is THB115.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Siam Cement's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of THB462.5, and the most bearish reporting a price target of just THB115.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be THB505.2 billion, earnings will come to THB9.3 billion, and it would be trading on a PE ratio of 21.2x, assuming you use a discount rate of 12.6%.

- Given the current share price of THB179.5, the bearish analyst price target of THB115.0 is 56.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.