Key Takeaways

- Pricer's strategic shift towards in-store digitalization and partnerships aims to drive revenue growth by capturing new market opportunities and expanding product offerings.

- Cost-cutting and operational optimization initiatives have enhanced profitability, enabling higher operating margins and future earnings potential.

- Despite strong order intake, revenue stability is threatened by decreased invoicing, high inventory, potential tariffs, and risks associated with new technology investments.

Catalysts

About Pricer- Provides in-store digital solutions in Europe, the Middle East and Africa, the Americas, and Asia and Pacific.

- Pricer's strategic shift to focus on being the preferred partner for in-store communication and digitalization, including the launch of its innovative Pricer Avenue product, positions the company to capture new growth opportunities in the evolving retail technology market, potentially driving increased revenue and higher gross margins as a premium product.

- The company is expanding its presence in key markets, especially the U.S., U.K., and Southern Europe, and investing in sales and R&D resources to capture market opportunities, which is expected to contribute to revenue growth and improved net margins as market share increases.

- Pricer's cost-cutting program and transformation initiatives have successfully optimized operations, reducing costs without scaling them proportionally with net sales. This supports a higher operating margin and enhanced profitability, providing potential for better earnings moving forward.

- Pricer Avenue and strategic partnerships, such as those with Google and Focal System, aim to broaden the company's solution portfolio, promoting upsells and increasing recurring revenue streams, which will enhance revenue stability and potentially higher net margins.

- The company's focus on transforming in-store environments into revenue-generating spaces through merchandising and retail media solutions, enabled by the modular Pricer Avenue system, encourages monetization opportunities that can drive revenue growth and enhance profitability through value-added services.

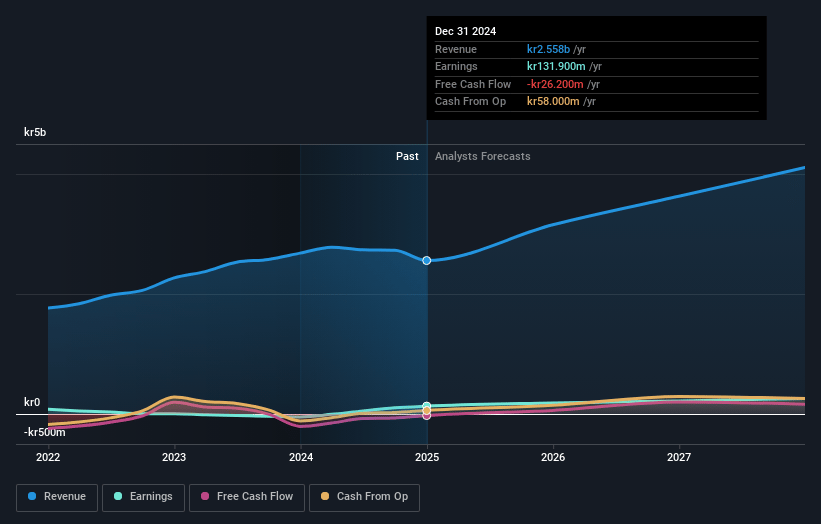

Pricer Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pricer's revenue will grow by 16.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.2% today to 6.3% in 3 years time.

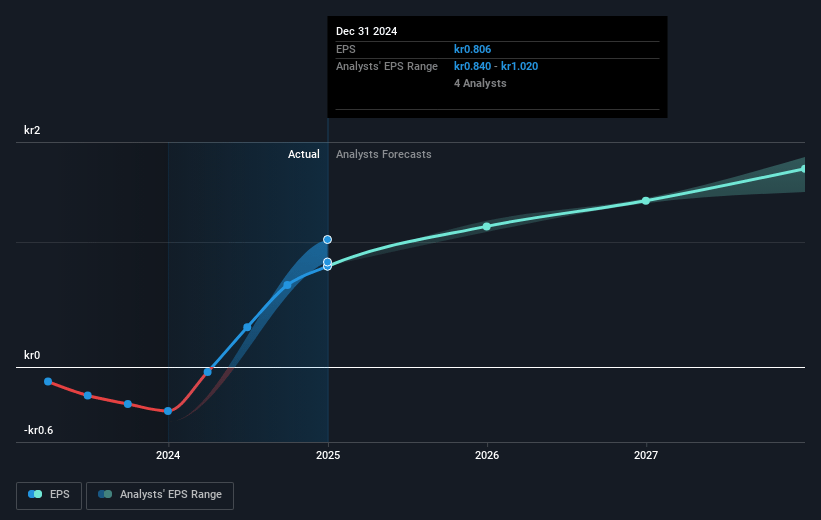

- Analysts expect earnings to reach SEK 252.0 million (and earnings per share of SEK 1.54) by about March 2028, up from SEK 131.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, up from 10.4x today. This future PE is lower than the current PE for the GB Electronic industry at 24.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.03%, as per the Simply Wall St company report.

Pricer Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite achieving strong order intake and profitability, net sales have been slightly down due to a decrease in invoicing from some major customers in 2023, which could impact revenue stability.

- The company has a higher-than-expected inventory level due to pushed sales, which may affect cash flow if not managed properly and if new sales do not materialize as anticipated.

- There is uncertainty about potential tariffs on goods imported from Europe to the U.S., which could impact pricing and profitability in a significant market for Pricer.

- Pricer is making significant investments in expanding their sales and R&D teams, which could increase operational expenses and potentially impact net margins if revenue growth does not outpace these costs.

- The reliance on new technologies and products, like Pricer Avenue, presents risks related to adoption and execution, which could affect earnings if these initiatives do not generate expected revenue or margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK17.0 for Pricer based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK4.0 billion, earnings will come to SEK252.0 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of SEK8.35, the analyst price target of SEK17.0 is 50.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.