Catalysts

About Fractal Gaming Group

Fractal Gaming Group designs and sells premium, design focused PC cases and gaming peripherals for enthusiast and mainstream gamers globally.

What are the underlying business or industry changes driving this perspective?

- Although the multi year PC upgrade cycle supported by Windows 11 migration and new, more affordable GPUs is driving robust demand for Fractal cases and peripherals, a reversal in component launch momentum or a weaker replacement cycle could quickly slow top line growth and leave fixed cost investments underutilized, which would pressure revenue and EBITDA margins.

- While Fractal is gaining traction in newer categories such as headsets and chairs that broaden its addressable market, intense competition and short product life cycles in these segments risk compressing pricing power and marketing efficiency, which could cap category mix benefits and weigh on net margins.

- Although the company benefits from a structurally older and more design conscious gamer base that fits its premium positioning, any shift back toward value oriented hardware or macro driven downtrading could limit volume growth in higher priced products and dilute gross margin expansion.

- While international expansion, particularly strong growth in EMEA and solid momentum in APAC, supports a larger long term revenue base, persistent tariff uncertainty in the U.S. and potential extension of trade measures to other Asian production hubs could offset scale advantages and hold back earnings growth.

- Although owning tooling and maintaining a strong net cash position enable Fractal to accelerate product development and secure supply for future launches, misjudging demand or overbuilding inventory in a normalizing PC market could tie up working capital and dampen operating cash flow and return on invested capital.

Assumptions

This narrative explores a more pessimistic perspective on Fractal Gaming Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

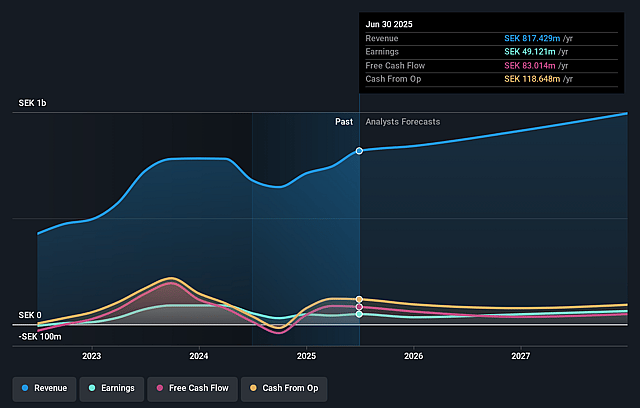

- The bearish analysts are assuming Fractal Gaming Group's revenue will grow by 6.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.5% today to 6.9% in 3 years time.

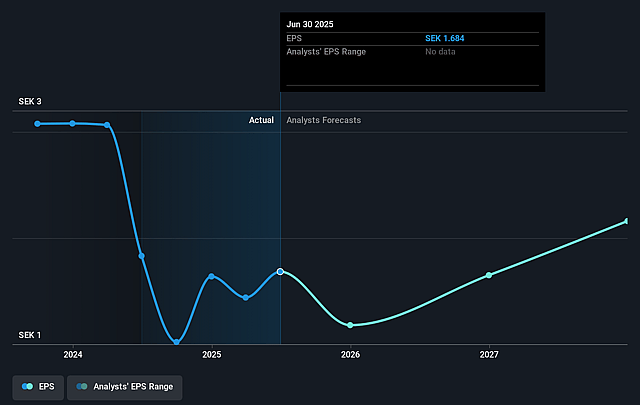

- The bearish analysts expect earnings to reach SEK 70.8 million (and earnings per share of SEK 2.43) by about December 2028, up from SEK 54.8 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as SEK104.2 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.8x on those 2028 earnings, up from 17.1x today. This future PE is greater than the current PE for the SE Tech industry at 17.1x.

- The bearish analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.22%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The current upgrade cycle in the global PC market, supported by Windows 11 migration and new GPUs, may prove temporary. If hardware refresh slows after 2026, Fractal could see weaker demand for cases and peripherals, which would reduce revenue and constrain earnings growth over the long term.

- Heavy reliance on strong momentum in EMEA and renewed growth in APAC means any regional slowdown, competitive share loss or saturation in these core markets could erode Fractal's premium pricing power. This would limit net margin expansion and ultimately drag on earnings.

- Persistent or escalating U.S. tariffs, alongside the risk that similar measures extend to alternative Asian production hubs, may structurally raise Fractal's cost base. This could force either further price increases that hurt volumes or margin sacrifice on key products, which would pressure product margins and EBITDA over time.

- The strategy to broaden into headsets, chairs and other accessories increases category complexity in segments with fast product cycles and intense competition. If new launches like Scape and Refine fail to sustain their early success, mix benefits could reverse and marketing and R and D spending may outpace sales growth, which would weigh on net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Fractal Gaming Group is SEK42.0, which represents up to two standard deviations below the consensus price target of SEK51.0. This valuation is based on what can be assumed as the expectations of Fractal Gaming Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK60.0, and the most bearish reporting a price target of just SEK42.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be SEK1.0 billion, earnings will come to SEK70.8 million, and it would be trading on a PE ratio of 20.8x, assuming you use a discount rate of 6.2%.

- Given the current share price of SEK32.1, the analyst price target of SEK42.0 is 23.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Fractal Gaming Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.