Last Update16 Sep 25Fair value Increased 26%

Upgraded forecasts for both revenue growth and net profit margin have driven a substantial increase in Fractal Gaming Group's consensus analyst price target from SEK43.00 to SEK54.00.

What's in the News

- Fractal Design has expanded into the gaming headset market with the launch of Scape, a wireless headset featuring memory foam cushions, lightweight frame, detachable microphone, customizable ambient lighting, and inductive charging, aiming to blend performance, comfort, and Scandinavian design aesthetics.

Valuation Changes

Summary of Valuation Changes for Fractal Gaming Group

- The Consensus Analyst Price Target has significantly risen from SEK43.00 to SEK54.00.

- The Consensus Revenue Growth forecasts for Fractal Gaming Group has significantly risen from 8.0% per annum to 11.1% per annum.

- The Net Profit Margin for Fractal Gaming Group has significantly risen from 6.23% to 8.49%.

Key Takeaways

- Expansion into new regions and premium product focus positions the brand for sustained growth and higher margins.

- Supply chain adjustments and direct sales channel growth aim to counter external margin pressures and support profitability.

- Overdependence on the shrinking DIY PC case market, weak diversification efforts, and external cost pressures threaten future revenue growth and profitability.

Catalysts

About Fractal Gaming Group- Offers PC gaming products in Sweden an internationally.

- The continued global expansion, especially in North America and APAC, provides a long-term growth runway as Fractal Gaming successfully increases market share and broadens its customer base, supporting future revenue growth.

- Rising consumer preference for premium, design-led and ergonomic gaming setups favors Fractal's innovation in modular and customizable products, positioning the brand to capitalize on increased demand for high-quality, aesthetic hardware and enabling revenue premiumization and higher gross margins.

- Ongoing adoption of new hardware (e.g., GPUs) and the robust upgrade cycle in the global gaming and esports community are expected to sustain elevated demand for Fractal's high-end cases and peripherals, fueling top-line growth beyond the latest product launch cycles.

- Strengthening direct-to-consumer and e-commerce channels, along with reduced reliance on intermediaries, is likely to improve operational leverage and increase net margins over time.

- Margin headwinds from tariffs, freight, and currency are being actively mitigated through price increases and strategic supply chain relocation, which are expected to deliver margin recovery and bolster earnings in the coming quarters.

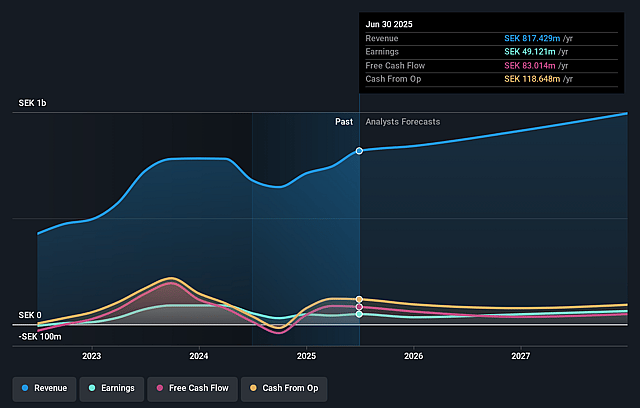

Fractal Gaming Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fractal Gaming Group's revenue will grow by 8.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.0% today to 6.2% in 3 years time.

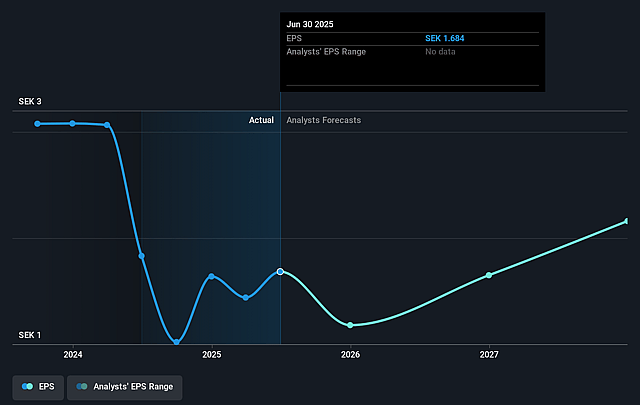

- Analysts expect earnings to reach SEK 64.1 million (and earnings per share of SEK 2.16) by about September 2028, up from SEK 49.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.3x on those 2028 earnings, up from 21.6x today. This future PE is lower than the current PE for the SE Tech industry at 28.0x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.19%, as per the Simply Wall St company report.

Fractal Gaming Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on PC cases-accounting for nearly 90% of sales-exposes Fractal Gaming Group to shifts in consumer behavior away from DIY desktop PCs, especially as long-term trends indicate rising adoption of compact computing devices, gaming laptops, and all-in-ones, which could reduce future revenue growth.

- Ongoing external headwinds such as U.S. tariffs, global supply chain disruptions, and currency fluctuations have already eroded product margins and may continue to pressure net margins and earnings if global trade tensions or regulatory risks persist or worsen.

- Expansion into new product categories (e.g., headsets and chairs) is still nascent, and with early evidence of lower margins and launch-related sales volatility in these segments, diversification away from the core business may not offset potential declines in the main PC case market, thereby limiting revenue growth and compressing overall margins.

- Rising operating and inventory costs tied to strategic initiatives-increased warehousing, kickbacks, and inventory buildup-could persist if demand slows or market conditions change, further impacting net margins and cash flow.

- The broad PC hardware market is subject to longer and less pronounced upgrade cycles, and future consumer upgrading may slow as cloud/mobile gaming grows and the DIY PC market matures, posing a risk of stagnating or declining top-line revenue and profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK43.0 for Fractal Gaming Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK1.0 billion, earnings will come to SEK64.1 million, and it would be trading on a PE ratio of 23.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of SEK36.4, the analyst price target of SEK43.0 is 15.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.