Last Update 01 May 25

Key Takeaways

- New product certifications face delays, endangering sales and revenue during key shopping periods, impacting future financial outcomes.

- Investments in brand restructuring and marketing could initially raise costs, affecting short-term margins and earnings.

- Doro's robust market share growth, strong margins, and improved cash position enhance financial resilience and potential for future revenue and earnings stability.

Catalysts

About Doro- A technology company, develops telecom and technology products and services for seniors in Nordic, West and South Europe, Africa, Central- and Eastern Europe, the United Kingdom, Ireland, and internationally.

- The launch of the new Leva feature phones could face delays in certification from operators, impacting Doro's sales expectations during peak periods like Black Week and Christmas, potentially affecting future revenue negatively.

- The transition to new product categories complying with USB-C directives may lead to challenges in inventory management, risking future sales and possibly compressing net margins due to increased complexity and costs.

- Planned investments in a brand restage project and increased marketing spend, especially into digital campaigns, are expected, which might temporarily elevate operating expenses and thus impact net margins and earnings in the short term.

- Growth in the D2C business and structural improvements in margins are reported; however, reliance on one-off events and provisions could inflate perceived stability, potentially leading to overestimation of sustaining future earnings margins.

- Market fluctuations, such as shifts in the competitive landscape in regions like the UK, could sway Doro’s sales environment, making future revenue projections uncertain depending on competition and supply chain reliability.

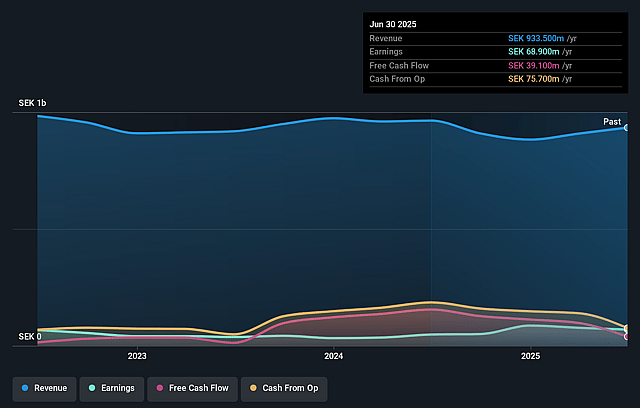

Doro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Doro's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.8% today to 7.7% in 3 years time.

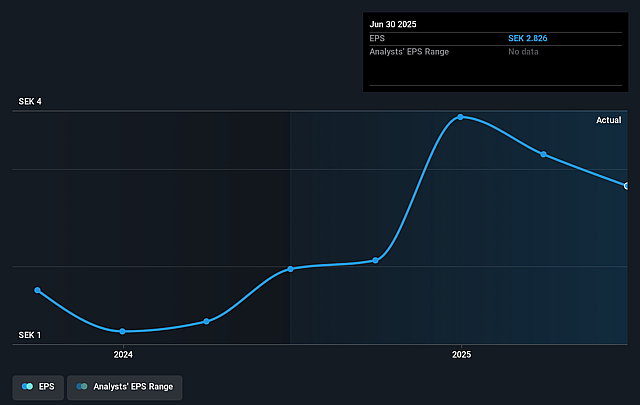

- Analysts expect earnings to reach SEK 76.7 million (and earnings per share of SEK 3.2) by about May 2028, down from SEK 86.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, up from 9.7x today. This future PE is lower than the current PE for the GB Tech industry at 22.2x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.34%, as per the Simply Wall St company report.

Doro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Doro has increased its market share in feature phones, outpacing the market despite challenging conditions, suggesting potential revenue stability or growth.

- The company maintains strong margins, achieving over 50% due to structural improvements and product portfolio shifts, indicating potential for sustained earnings stability.

- Doro's D2C business is experiencing substantial growth, contributing to improved long-term margins and potential earnings increases.

- The company's cash position has improved significantly, ending the quarter with a net cash position of SEK 200.2 million, which strengthens its financial resilience and supports potential operational investments.

- Marketing and brand initiatives, like the brand restage project and upcoming digital campaigns, aim to enhance brand presence and may lead to revenue growth by attracting more customers.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK33.0 for Doro based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK995.9 million, earnings will come to SEK76.7 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 6.3%.

- Given the current share price of SEK34.15, the analyst price target of SEK33.0 is 3.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Doro?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.