Last Update 13 Jun 25

Updating the Valuator. It does not completely display my ideas, because my analysis is statistical in nature and not a single point estimation as shown in the SimplyWallSt Valuator.

To identify the value of MAG Interactive I did a Discounted Free Cash Flow (FCF) analysis for the next 16 years. A statistical approach was used. By statistical approach I mean the following:

- From the last 12 years of available FCF data one can identify the trend of the FCF change.

- Next, the residual between the trend of the FCF change and the actual FCF change is used to characterize a Gaussian distribution of the residual

- The trend and the Gaussian distribution thus determined can now together be used to estimate future change of FCF

- Also, it is assumed that the FCF variation will reach 63% of current variation in the next 8 years and reach a steady value in the next 16 years

- The past data of Federal Funds Rate is used to develop a model of the same. This model is used to generate future Federal Funds Rate (FFR). In the past the FFR has been seen to change by as much as 6.3% and hence the future FFR is also allowed to change by as much as 8%.

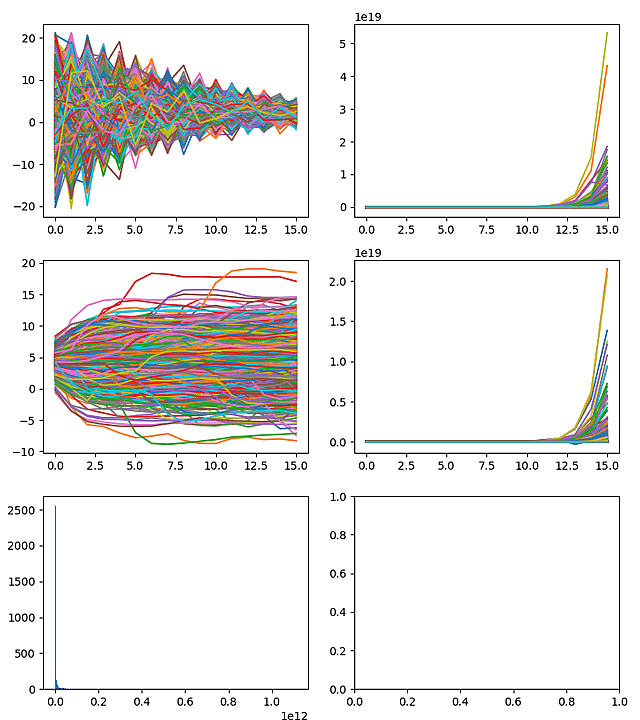

Once these models are developed, the simulation is done 3000 times to get the result below.

The picture (1,1) shows all possible variations (3000) of the FCF change.

Picture (1,2) shows the resulting possible (3000) future FCFs for the next 16 years.

Picture (2,1) shows the possible trajectories of the FFR

Picture (2,2) is the resulting discounted FCF

Picture (3,1) shows the histogram of the possible value per share obtained from the discounted FCF in picture (2,2)

From the histogram is picture (3,1) we can see the given the present nature of FCF variation MAGI is more likely to have a value per share of SEK 1, than any other value in the future. MAGI should thus increase its FCF, consecutively for a few years to justify the current stock price. Investors should thus hold, and not buy MAGI now.

Have other thoughts on MAG Interactive?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user Acc_phy_Krish holds no position in OM:MAGI. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.