Key Takeaways

- Intensifying pricing pressures and consolidated buyer power threaten margins and profitability, as healthcare cost controls and hospital alliances focus on affordability over innovation.

- High operating expenses from R&D and limited product diversification expose the company to disruptive competition, slow commercial progress, and volatile earnings.

- Robust clinical results, rapid US market adoption, and strengthened financial position support continued high-margin revenue growth and credible long-term expansion into new orthopedic segments.

Catalysts

About OssDsign- Designs, manufactures, and sells implants and material technology for bone regeneration in Sweden, Germany, the United States, the United Kingdom, rest of Europe, and internationally.

- Downward pricing pressure on OssDsign's products is likely to intensify due to heightened cost containment in healthcare systems across developed markets, constraining revenue growth over time and potentially eroding net margins as buyers increasingly focus on affordability rather than innovation.

- Ongoing high R&D and CapEx requirements for product portfolio expansion, large-scale clinical trials and U.S. production capacity are set to drive operating expenses significantly higher, while the slow path to commercializing new products will weigh on earnings and cash flow generation well into the coming years.

- The company's limited product diversification and disproportionate reliance on a single flagship product leave it highly vulnerable to technological disruption or superior innovations, risking sharp revenue declines and greater earnings volatility if OssDsign fails to keep pace with accelerating advances in orthobiologics or next-generation regenerative materials.

- The consolidation of hospital systems and group purchasing organizations within OssDsign's core U.S. market will concentrate buyer power, intensifying competition and pushing for tougher price negotiations, which is expected to compress gross margins and restrict OssDsign's ability to achieve or sustain attractive levels of profitability.

- Growing global protectionism and the threat of trade barriers present a tangible risk of disrupted supply chains and increased costs, undermining OssDsign's access to key markets and putting long-term revenue growth at risk, particularly as international expansion underpins a substantial part of the company's growth narrative.

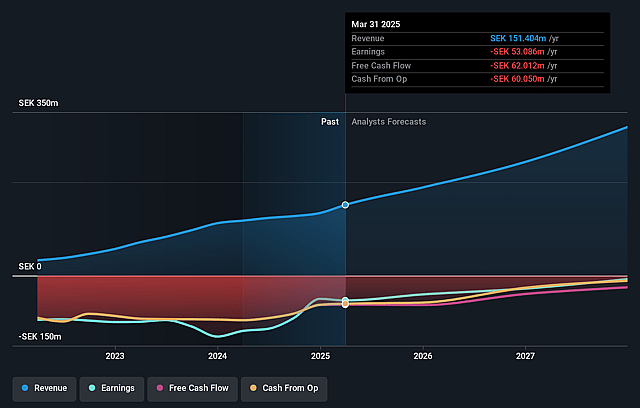

OssDsign Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on OssDsign compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming OssDsign's revenue will grow by 28.1% annually over the next 3 years.

- The bearish analysts are not forecasting that OssDsign will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate OssDsign's profit margin will increase from -27.2% to the average SE Medical Equipment industry of 10.2% in 3 years.

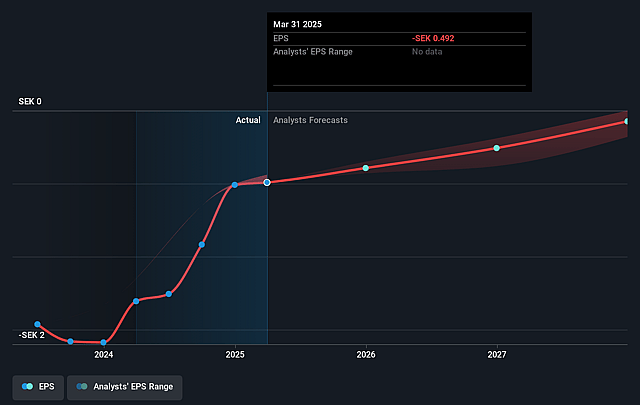

- If OssDsign's profit margin were to converge on the industry average, you could expect earnings to reach SEK 36.0 million (and earnings per share of SEK 0.27) by about September 2028, up from SEK -45.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 52.9x on those 2028 earnings, up from -36.8x today. This future PE is greater than the current PE for the SE Medical Equipment industry at 50.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.54%, as per the Simply Wall St company report.

OssDsign Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has demonstrated exceptionally strong organic growth, with 73% year-on-year in the recent quarter and a 68% increase in its trailing twelve-month momentum, suggesting revenue growth may continue at a high rate due to successful commercialization efforts.

- OssDsign's products, particularly Catalyst, have generated outstanding clinical results in complex patient populations, leading to rapid adoption and strong surgeon and hospital endorsements in the U.S., which supports higher pricing power and robust net margins in the long term.

- The company is pursuing a clearly defined growth strategy (ScaleToProfit) including doubling its U.S. sales force, expanding into adjacent orthopedic segments, and scaling production, indicating a credible path to significant topline and earnings expansion by broadening its addressable market.

- Ongoing generation and publication of high-quality clinical evidence, such as a planned large randomized controlled trial, strengthens OssDsign's competitive differentiation, potentially sustaining gross margin at the current high level and supporting future revenue and net profit growth.

- Recent successful capital raising and strong investor demand equip OssDsign with the resources required to invest in commercialization and R&D, lowering liquidity risk and reinforcing the company's ability to deliver future profitability and positive cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for OssDsign is SEK12.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of OssDsign's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK18.0, and the most bearish reporting a price target of just SEK12.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK353.3 million, earnings will come to SEK36.0 million, and it would be trading on a PE ratio of 52.9x, assuming you use a discount rate of 5.5%.

- Given the current share price of SEK15.22, the bearish analyst price target of SEK12.0 is 26.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.