Catalysts

About Mentice

Mentice provides high fidelity virtual simulation solutions for image guided interventional therapies to medical device companies and healthcare providers.

What are the underlying business or industry changes driving this perspective?

- Rapid adoption of minimally invasive, image guided procedures together with pressure on hospitals to improve training efficiency positions Mentice as a core partner for medical device companies, supporting sustained double digit revenue growth as device launches increasingly require realistic simulation.

- The launch and global scale up of the portable VIST Go simulation platform opens a new, high volume usage model for sales representatives and field teams, which should lift hardware volumes and drive higher margin software and licensing revenues over time.

- Strategic workforce alignment and SEK 25 million in annual cost reductions are already visible in the EBITDA margin swing from minus 10.8 percent to plus 10.7 percent, creating operating leverage so that incremental sales translate more directly into earnings growth.

- Deepening long term master sales agreements with leading medical device partners and growing development project activity expand the installed base and embedded software content, supporting recurring licensing income and more stable order intake.

- Refined propositions for hospitals, including outcome focused training and subscription based offerings linked to annual recurring revenue of SEK 63 million, position Mentice to benefit as budget constrained health systems later resume investment, improving revenue visibility and smoothing cash flows.

Assumptions

How have these above catalysts been quantified?

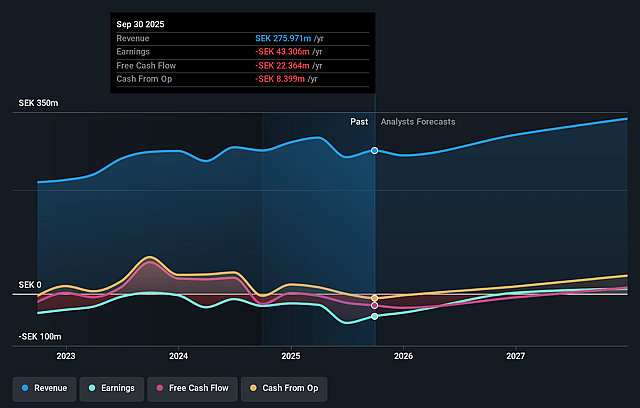

- Analysts are assuming Mentice's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -15.7% today to 4.5% in 3 years time.

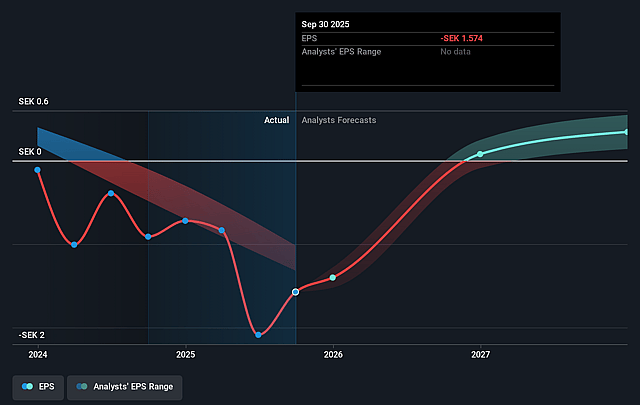

- Analysts expect earnings to reach SEK 16.2 million (and earnings per share of SEK 0.58) by about December 2028, up from SEK -43.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK30.7 million in earnings, and the most bearish expecting SEK8.0 million.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 41.5x on those 2028 earnings, up from -8.2x today. This future PE is lower than the current PE for the SE Healthcare Services industry at 55.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.31%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Persistent budget constraints and delayed investment decisions in hospitals, especially in North America and EMEA university clinics, could prolong weakness in the Healthcare segment and slow growth in high margin subscription revenue. This would weigh on net sales growth and recurring earnings over the long term.

- Flat performance in the APAC region, combined with structural challenges in China and reliance on visiting sales teams from other regions, suggests Mentice may struggle to capture secular procedure growth in Asia. This could limit geographic diversification and constrain revenue expansion and operating leverage.

- High dependence on medical device industry partners and a concentrated base of large development projects and master sales agreements means timing shifts in a few big orders or changes in partner strategies could create volatility in order intake. This could impact revenue visibility and EBITDA margins despite current cost reductions.

- Ongoing currency exposure from invoicing primarily in U.S. dollars and euros while reporting in SEK introduces FX driven variability that can offset organic growth and obscure underlying performance trends. This can put pressure on reported net sales and earnings during adverse currency cycles.

- The strategic realignment and tight cost control that improved EBITDA may limit flexibility to invest aggressively in product realism, commercial capabilities and new propositions for hospitals. This could slow innovation relative to competitors and cap long term margin expansion and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of SEK16.25 for Mentice based on their expectations of its future earnings growth, profit margins and other risk factors.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK20.5, and the most bearish reporting a price target of just SEK12.0.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be SEK363.4 million, earnings will come to SEK16.2 million, and it would be trading on a PE ratio of 41.5x, assuming you use a discount rate of 6.3%.

- Given the current share price of SEK12.6, the analyst price target of SEK16.25 is 22.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Mentice?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.