Catalysts

About Mentice

Mentice develops virtual reality simulation solutions for image guided interventional procedures used by medical device companies and healthcare providers.

What are the underlying business or industry changes driving this perspective?

- The rapid shift toward portable, lower cost simulation tools risks commoditizing Mentice's core hardware platforms. This could pressure average selling prices and constrain long term revenue growth despite near term enthusiasm for products like VIST Go.

- As major medical device companies increasingly internalize training and digital simulation capabilities, Mentice may face greater insourcing and pricing pressure on its master service agreements. This may limit renewal uplift and compress net margins over time.

- Hospitals' ongoing budget constraints and slower decision cycles for capital intensive training solutions could structurally cap adoption in the healthcare segment. This may prolong weak growth in recurring SaaS revenues and delay earnings leverage from the installed base.

- Expansion efforts in APAC, particularly in structurally challenging markets like China, may require sustained commercial investment and discounting. This could raise customer acquisition costs and dilute the EBITDA improvements achieved through recent workforce realignment.

- Greater customer demand for hyper realistic, real time clinical workflow simulation will necessitate continued heavy R&D and platform modernization. This could outpace topline growth and erode operating margins if scale benefits fail to materialize as currently implied by the valuation.

Assumptions

This narrative explores a more pessimistic perspective on Mentice compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

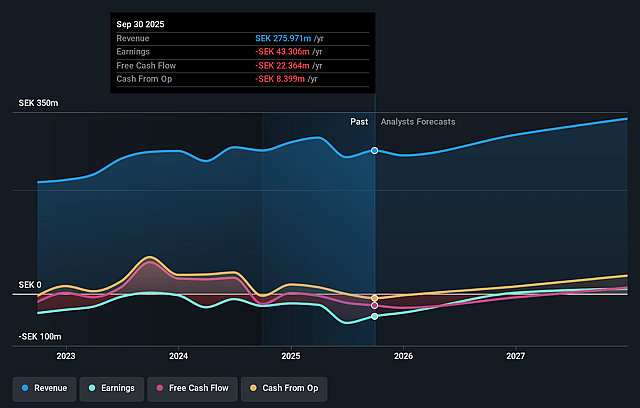

- The bearish analysts are assuming Mentice's revenue will grow by 8.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -15.7% today to 2.2% in 3 years time.

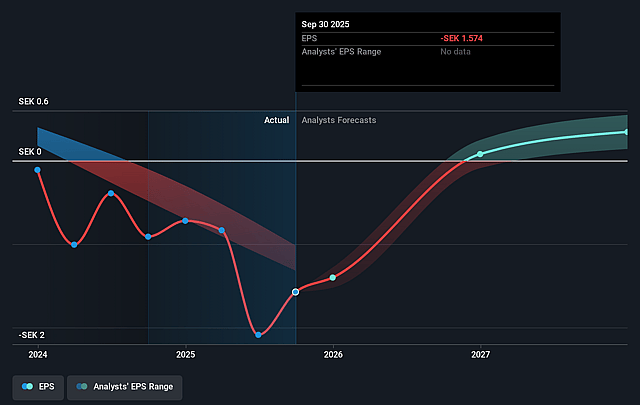

- The bearish analysts expect earnings to reach SEK 7.7 million (and earnings per share of SEK 0.27) by about December 2028, up from SEK -43.3 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as SEK29.9 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 64.0x on those 2028 earnings, up from -10.0x today. This future PE is greater than the current PE for the SE Healthcare Services industry at 63.3x.

- The bearish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.26%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Sustained double digit organic growth in net sales, exemplified by 30% organic growth in the third quarter and strong momentum in the Americas and EMEA medical device industry segment, may support a structurally higher revenue trajectory than implied by a bearish view and improve long term earnings power.

- The successful launch and strong market reception of the portable VIST Go simulation system, including early orders and interest from multiple large medical device partners, could open new scalable use cases and expand the addressable market, which may lift revenue growth and operating leverage.

- Ongoing strategic workforce alignment and SEK 25 million in annual cost savings, together with tight OpEx control and an improving EBITDA margin from minus levels to above 10% in the latest quarter, may lead to a faster and more durable margin recovery and earnings expansion than expected.

- Reinforced long term relationships with major medical device companies through signed and renewed master service agreements, combined with an expanding order book of SEK 97 million and stable annual recurring revenue of SEK 63 million, could underpin more resilient revenue and cash flow than assumed in a bearish scenario.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Mentice is SEK12.0, which represents up to two standard deviations below the consensus price target of SEK16.25. This valuation is based on what can be assumed as the expectations of Mentice's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK20.5, and the most bearish reporting a price target of just SEK12.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be SEK351.3 million, earnings will come to SEK7.7 million, and it would be trading on a PE ratio of 64.0x, assuming you use a discount rate of 6.3%.

- Given the current share price of SEK15.35, the analyst price target of SEK12.0 is 27.9% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.