Last Update01 May 25Fair value Decreased 12%

AnalystConsensusTarget has decreased revenue growth from 31.7% to 26.9%.

Read more...Key Takeaways

- Solid organic growth in Europe and strategic Moto expansion could boost Mips' market share and revenue, despite tariff challenges.

- Product innovation in the Safety category is driving substantial demand and revenue growth, reinforcing its competitive market position.

- Vulnerability to U.S. market uncertainties and legal costs could impact Mips' revenue stability and profit margins amid trade, demand, and competition risks.

Catalysts

About Mips- Develops, manufactures, and sells helmet-based safety systems in North America, Europe, Sweden, Asia, and Australia.

- Mips is experiencing strong organic growth, particularly in Europe, which may lead to an increase in revenue. As European consumer markets continue improving, Mips has the potential to boost its market share and sales volume in this region.

- The company’s strategic expansion in the Moto segment, including a successful rollout of the Integra TX product and a strong retail activation program, could positively influence future revenue growth and market penetration.

- The launch of new helmet models in the Safety category is generating significant demand, contributing to a substantial 60% growth in the segment for the quarter. Continued innovation and product rollouts are likely to support revenue and earnings growth.

- Mips’ robust financial position, with improvements in EBIT and operating cash flow, demonstrates operational efficiency. This could lead to elevated margins and sustained earnings growth despite short-term challenges such as tariff issues.

- While tariffs introduce uncertainty in the U.S. market, Mips’ ability to maintain strong growth in local markets and its strategy to innovate rather than relying on opportunistic price increases could safeguard its net margins and competitive positioning.

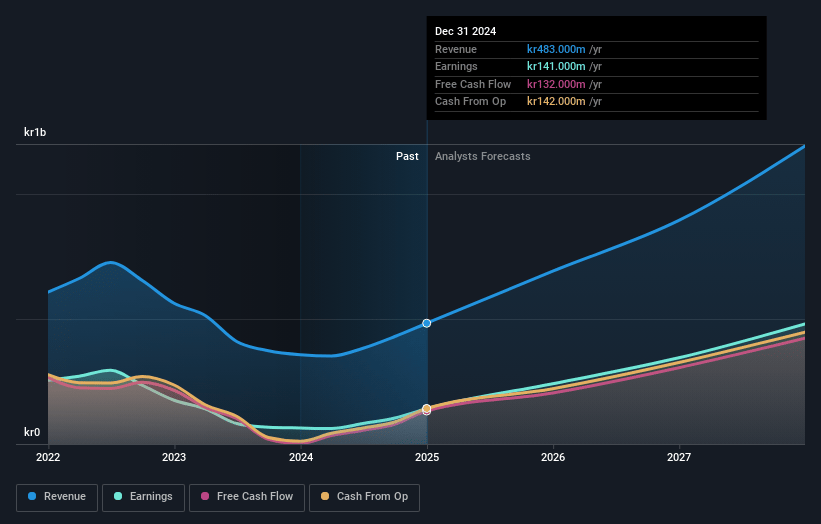

Mips Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mips's revenue will grow by 26.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 28.7% today to 41.1% in 3 years time.

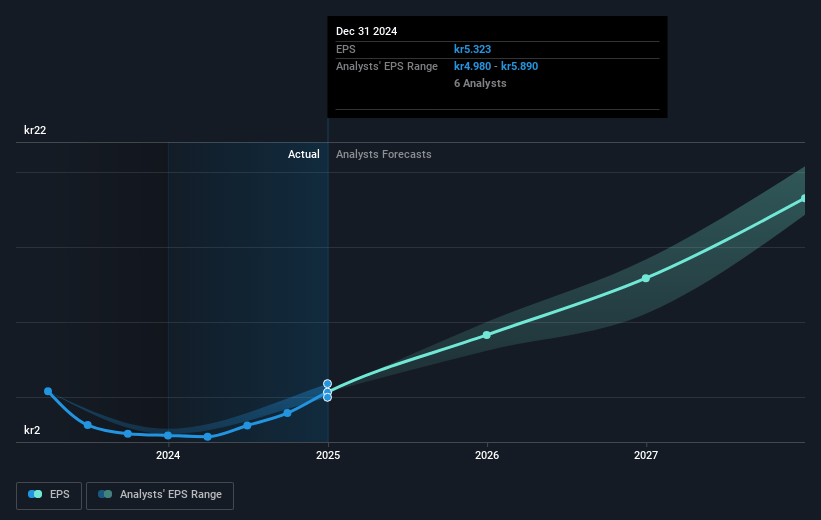

- Analysts expect earnings to reach SEK 433.5 million (and earnings per share of SEK 14.23) by about May 2028, up from SEK 148.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SEK372.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.6x on those 2028 earnings, down from 61.2x today. This future PE is lower than the current PE for the GB Leisure industry at 41.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.79%, as per the Simply Wall St company report.

Mips Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing legal dispute, although Mips is not directly involved, incurs significant legal costs that could negatively impact net margins and profits if such costs persist or escalate.

- The rapid implementation of tariffs has led to considerable uncertainty for Mips' customers, especially U.S.-based brands, affecting their ability to price products appropriately, which could result in volatile revenues and profit margins.

- A large portion of Mips’ sales are to U.S.-based brands, making the company particularly vulnerable to changes in U.S. consumer demand and any further trade conflicts, which could impact overall revenue stability.

- There is potential for short-term demand swings due to the uncertainty around tariffs, particularly for the U.S. market, which could lead to temporary decreases in sales volumes and cash flows.

- Increased competition or claims over intellectual property rights in key markets could divert resources and potentially impact market share or earnings if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK588.75 for Mips based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK1.1 billion, earnings will come to SEK433.5 million, and it would be trading on a PE ratio of 40.6x, assuming you use a discount rate of 4.8%.

- Given the current share price of SEK341.8, the analyst price target of SEK588.75 is 41.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.