Last Update 28 Nov 25

BTS B: Rising Discount Rate Will Lead to Compelling Upside Potential

Analysts have revised the price target for BTS Group, leaving it unchanged at $172.50. Updates to their assumptions, such as a slightly higher discount rate and slower projected revenue growth, offset one another and resulted in no net change to their estimate.

What's in the News

- BTS Group revised its earnings guidance for the fiscal year 2025/26 and lowered full year revenue expectations from THB 6 billion to THB 5.5 billion. This change reflects softer macroeconomic conditions and more conservative assumptions for advertising and retail spending (Key Developments).

- The company provided new earnings guidance for the full year 2025, stating group earnings are expected to be significantly worse than the previous year. This is a departure from the outlook provided in the previous interim report (Key Developments).

Valuation Changes

- Consensus Analyst Price Target remains unchanged at $172.50 per share.

- The discount rate has risen slightly from 5.55 percent to 5.59 percent.

- The revenue growth forecast has fallen significantly from 5.00 percent to 3.43 percent.

- The net profit margin has decreased marginally from 8.56 percent to 8.55 percent.

- The future P/E has increased from 13.94x to 14.61x.

Key Takeaways

- Structural shifts toward AI, remote learning, and micro-mobility threaten traditional consulting services, risking lower client demand and pressured long-term growth.

- Higher inflation, operating costs, and increased leverage constrain profitability, while operational setbacks and acquisition risks add to lingering earnings uncertainty.

- Strong European momentum, surging AI services, efficiency gains, and resilient recurring revenues position the group for growth and margin expansion amid effective management adaptiveness.

Catalysts

About BTS Group- Operates as a professional services firm.

- The proliferation of smart mobility platforms and increased adoption of AI-powered self-service tools are intensifying competition and enabling clients to handle training, coaching, and simulation internally, which may erode BTS Group's future revenue growth and result in lower win rates in core markets.

- Heightened macroeconomic uncertainty, including persistent inflation and higher interest rates, could substantially increase BTS's financing and operating costs, putting sustained pressure on net margins and limiting the positive earnings impact from any cost-saving initiatives.

- Rising client demand for alternative learning and talent development solutions-such as micro-mobility, remote training, and telecommuting-may reduce reliance on traditional in-person consulting and leadership development, posing structural risks to BTS's core business model and potentially depressing long-term revenue growth.

- Ongoing operational setbacks in North America, especially lower sales efficiency and delays in client decision-making, suggest that the expected return to double-digit growth may take longer than anticipated, resulting in prolonged earnings weakness and negatively affecting both revenue and margins.

- Strategic acquisitions and continued investments in digital and AI capabilities have increased the company's leverage and debt burden; if revenue growth does not accelerate as expected, elevated interest expenses could further compress net margins and reduce overall profitability.

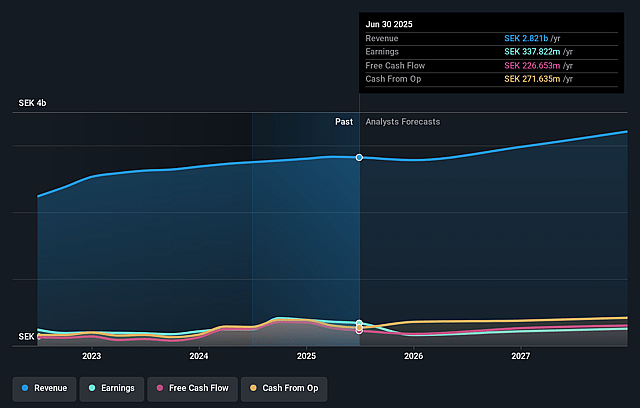

BTS Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BTS Group's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.0% today to 6.8% in 3 years time.

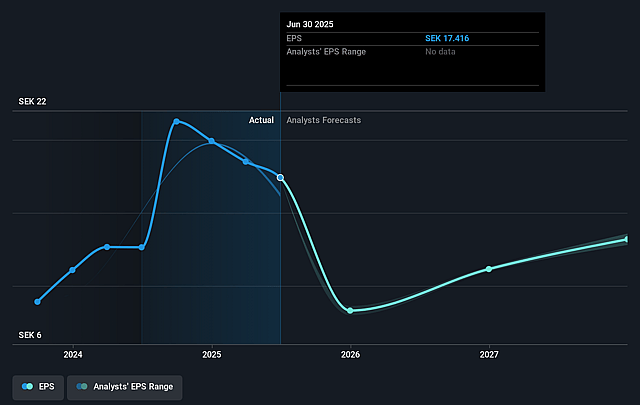

- Analysts expect earnings to reach SEK 222.8 million (and earnings per share of SEK 13.18) by about August 2028, down from SEK 337.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.2x on those 2028 earnings, up from 11.5x today. This future PE is greater than the current PE for the GB Professional Services industry at 18.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.33%, as per the Simply Wall St company report.

BTS Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong momentum in Europe and Other markets-with double-digit growth resuming, high win rates (60%+ on large deals in Europe), favorable business mix, and ongoing expansion in regions like the Middle East and Brazil-indicates diversified and resilient revenue streams that can offset weakness in one geography, supporting long-term revenue and earnings growth.

- Rapid growth in AI-related services and technology platforms (AI adoption services revenue up 425% year-on-year, subscription AI platform bookings doubling QoQ) points to a high-margin and scalable new business line, which, if sustained, could lift group net margins and drive overall earnings upward through both direct sales and ingrained digital adoption.

- AI-driven and automation cost-saving initiatives-including a reduction of 7% in core headcount and a $5 million cost-saving phase-are expected to improve operational efficiency and boost net margins. These ongoing productivity improvements provide a structural tailwind for profitability and earnings resilience over the long term.

- The coaching business is experiencing robust organic profit growth (EBITDA up 34% in Q2) with record-high renewal rates, indicating growing demand and client stickiness. This recurring and expanding revenue base can strengthen group earnings stability and improve margins through repeat business.

- Management's historical track record in successfully turning around underperforming regions-illustrated by prior double-digit growth rebound in North America and current rapid implementation of best practices and AI integration-suggests an ability to adapt and restore growth and profit, raising the potential for revenue and earnings recovery in the group's largest market.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK212.5 for BTS Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK3.3 billion, earnings will come to SEK222.8 million, and it would be trading on a PE ratio of 21.2x, assuming you use a discount rate of 5.3%.

- Given the current share price of SEK200.0, the analyst price target of SEK212.5 is 5.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.