Key Takeaways

- Early EBITDA inflection and strong margin expansion are expected due to disciplined costs, operating leverage, and validated demand from major OEM partners.

- PowerCell's technology leadership, recurring revenues, and exposure to global zero-emission policies position it for accelerated growth, superior financing access, and higher long-term margins.

- Reliance on irregular large contracts, uncertain industry dynamics, and possible shareholder dilution threaten consistent profitability and long-term revenue growth for PowerCell Sweden.

Catalysts

About PowerCell Sweden- Develops and produces fuel cells and fuel cell systems for automotive, marine, and stationary applications in Sweden and internationally.

- Analyst consensus expects scaling and OEM partnerships to result in gradual revenue growth and profitability, but the combination of sustained cost discipline, positive operating leverage, and already-achieved positive EBITDA on relatively modest volumes sets up PowerCell to deliver an EBITDA inflection much earlier and with stronger net margin expansion than most peers, driving upside to earnings forecasts.

- Analysts broadly agree that commercial orders for new products validate the demand for PowerCell's innovation; however, the type approval and commercial deployment of next-generation fuel cell stacks, together with long-term IP deals with major OEMs like Bosch, establish PowerCell as a core technology supplier to global leaders, which can result in a step-change in high-margin licensing revenue and product sales as hydrogen adoption accelerates worldwide.

- PowerCell is uniquely positioned to benefit from the rapid policy-driven shift to zero-emission industrial solutions in Europe and China, which, combined with increasing hydrogen infrastructure investment and tighter emissions regulations, could trigger multi-year surges in order intake well ahead of current market expectations, dramatically boosting the company's top-line.

- The successful expansion of PowerCell's platform-based, standardized product lines (such as the Marine System 2025) and the growing share of aftermarket and service revenues offer a path toward higher recurring revenue, improved revenue visibility, and structurally higher long-term gross margins.

- With ESG-mandates and climate-linked capital flows accelerating globally, PowerCell's strong balance sheet, proven ability to secure major industrial partners, and demonstrated technology leadership provide a significant advantage in winning large-scale project financing and access to high-growth sustainability funds, resulting in lower cost of capital and potentially outsized investment-fueled expansion.

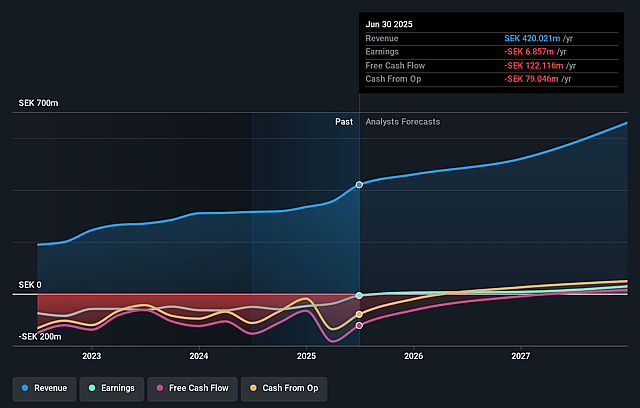

PowerCell Sweden Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on PowerCell Sweden compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming PowerCell Sweden's revenue will grow by 21.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -1.6% today to 9.4% in 3 years time.

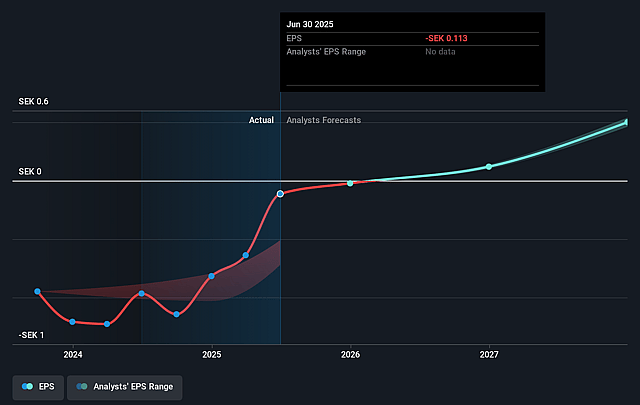

- The bullish analysts expect earnings to reach SEK 70.9 million (and earnings per share of SEK 1.19) by about September 2028, up from SEK -6.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 59.8x on those 2028 earnings, up from -233.7x today. This future PE is greater than the current PE for the SE Electrical industry at 26.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.59%, as per the Simply Wall St company report.

PowerCell Sweden Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's recent profitability milestone is heavily influenced by one-off IP licensing transactions, such as the Bosch deal, which management notes should not be expected as regular occurrences, suggesting future revenues and earnings may be volatile and not consistently profitable if product sales underperform.

- Management continually emphasizes that the market remains complex, choppy and difficult, with order flow described as non-recurring and dependent on large contracts from a few OEMs like Hitachi, Bosch, and specific marine/aviation clients, highlighting ongoing customer concentration risk and threatening both revenue growth and earnings stability.

- Capital requirements may increase if growth accelerates, as management clarifies that positive operating cash flow cannot be guaranteed each quarter and that future working capital or investment needs could necessitate new share issuance, risking shareholder dilution and impacting net profit per share.

- Industry dynamics remain uncertain, with increasing competition acknowledged in key segments and the company reliant on the pace of hydrogen infrastructure and regulatory support, especially in geographies that are currently described as subsidy-driven and patchy, which could restrict long-term revenue growth and margin expansion.

- Despite operational leverage and cost control, the company lacks recurring aftermarket service revenue at scale and faces uncertainty over the durability of high-margin service streams compared to established combustion engine players, putting long-term gross margins and earnings at risk as price competition intensifies and commoditization pressures rise.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for PowerCell Sweden is SEK50.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of PowerCell Sweden's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK50.0, and the most bearish reporting a price target of just SEK30.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK753.2 million, earnings will come to SEK70.9 million, and it would be trading on a PE ratio of 59.8x, assuming you use a discount rate of 6.6%.

- Given the current share price of SEK27.68, the bullish analyst price target of SEK50.0 is 44.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.