Key Takeaways

- Prolonged infrastructure delays and rapid battery advancements threaten sustained demand and revenue stability despite strong partnerships and policy support.

- High capital intensity and volatile order flow expose the company to risks of margin pressure, potential dilution, and unpredictable profitability.

- Reliance on large deals, concentrated partners, and market uncertainties exposes PowerCell Sweden to volatile revenue, profit pressure, and potential cash flow challenges during expansion.

Catalysts

About PowerCell Sweden- Develops and produces fuel cells and fuel cell systems for automotive, marine, and stationary applications in Sweden and internationally.

- While PowerCell Sweden has achieved record revenues, a strong order intake, and its first positive EBITDA on a rolling 12-month basis-indicative of growing demand tied to decarbonization in sectors like marine and aviation-the slow pace of hydrogen infrastructure build-out and regional policy fragmentation continue to limit the scale and speed of industry-wide adoption, posing a persistent risk to revenue momentum.

- Although government incentives and tightening emissions standards globally are increasing the addressable market for fuel cell solutions, rapid advancements in battery technology and electrification may eventually reduce the long-term competitiveness of hydrogen fuel cells, threatening future demand and therefore top-line growth prospects.

- While expanding partnerships with major OEMs such as Bosch and Hitachi as well as entry into Asian markets, particularly China, have the potential to drive higher order volumes and licensing income, PowerCell's business model remains exposed to revenue volatility if these collaborations weaken or if customers opt for alternative technologies, which could impact both revenues and margins over time.

- Even as proprietary next-generation fuel cell stacks and industrialization of core platforms offer a path to improved product efficiency and cost structure, the heavy capital requirements to support scaling production and working capital needs mean PowerCell may be forced into additional dilutive equity raises or higher leverage if demand accelerates rapidly, putting pressure on net margins and earnings per share.

- Despite improved operational leverage and cost discipline-evidenced by operating expenses declining as a share of revenue-the underlying market is not yet stable, with order flow still characterized by lumpiness and uncertainty; this could lead to fluctuations in cash flow and profitability if the expected transition to recurring, large-scale orders does not materialize as envisioned.

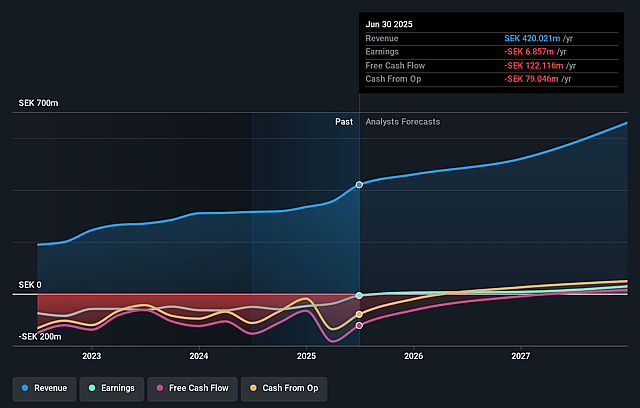

PowerCell Sweden Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on PowerCell Sweden compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming PowerCell Sweden's revenue will grow by 19.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.6% today to 6.1% in 3 years time.

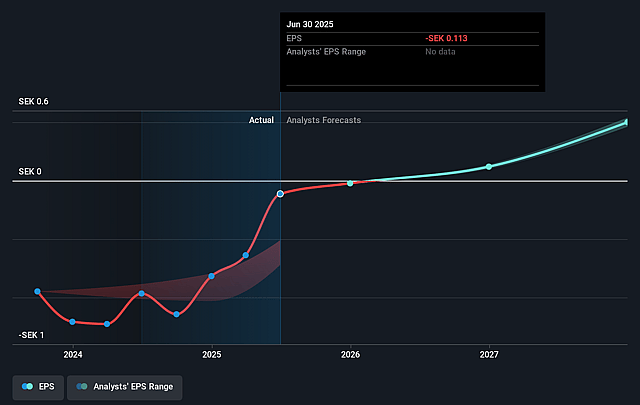

- The bearish analysts expect earnings to reach SEK 44.0 million (and earnings per share of SEK 0.76) by about September 2028, up from SEK -6.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 57.8x on those 2028 earnings, up from -227.1x today. This future PE is greater than the current PE for the SE Electrical industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.6%, as per the Simply Wall St company report.

PowerCell Sweden Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened competition in the marine segment and from other fuel cell providers-including rapid growth in the China market-could put downward pressure on pricing and margins, ultimately constraining PowerCell Sweden's profitability and earnings.

- A significant portion of revenue in the current quarter relied on a large, non-recurring IP transaction with Bosch, which may not be sustainable or repeatable each quarter, introducing the risk of unpredictable revenue streams and weaker financial visibility.

- The company's underlying business, while showing improvement, is still sensitive to working capital demands, exposing it to periods of negative cash flow as it grows, which could necessitate dilutive capital raises and erode earnings per share.

- Although demand from OEMs like Hitachi, Bosch, and marine clients is encouraging, PowerCell Sweden remains reliant on concentrated orders and key partnerships, exposing it to revenue volatility should any major relationship falter or be delayed.

- The slow pace and complexity of hydrogen infrastructure rollout, along with policy uncertainty and regionally fragmented support (evident in the US and other geographies), could limit the addressable market and impact PowerCell Sweden's long-term revenue growth and market expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for PowerCell Sweden is SEK30.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of PowerCell Sweden's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK50.0, and the most bearish reporting a price target of just SEK30.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK723.8 million, earnings will come to SEK44.0 million, and it would be trading on a PE ratio of 57.8x, assuming you use a discount rate of 6.6%.

- Given the current share price of SEK26.9, the bearish analyst price target of SEK30.0 is 10.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.