Key Takeaways

- The company's strong OEM partnerships, technology commercialization, and regulatory support are driving revenue growth, diversification, and smoother earnings across expanding markets.

- Operational efficiency, disciplined cost control, and expanding royalty streams enhance profitability and reduce exposure to product sales volatility.

- Heavy dependence on unpredictable royalty income, execution risks, and intensifying competition threaten revenue stability, margins, and sustainable growth as PowerCell seeks consistent commercial traction.

Catalysts

About PowerCell Sweden- Develops and produces fuel cells and fuel cell systems for automotive, marine, and stationary applications in Sweden and internationally.

- PowerCell's growing partnerships with major OEMs such as Hitachi and Bosch, coupled with OEM-driven demand in both Europe and China, are starting to translate into consistent order intake and larger platform-based projects, laying the groundwork for rapid revenue growth and greater earnings visibility as the global push for decarbonization in marine, power generation, and mobility accelerates.

- The regulatory environment is increasingly supportive, with tightening emissions standards (e.g., IMO in marine) and government subsidies (notably US Section 45V and Chinese incentives) providing a strong structural tailwind that lowers adoption barriers and should drive sustained multi-year topline growth for PowerCell as clean hydrogen infrastructure and project financing mature.

- Successful commercialization and type approval of next-generation and modular fuel cell systems (e.g., S3 platform, 225 kW marine unit, and methanol reforming products), together with recent breakthroughs in securing both IP revenues and commercial orders, position PowerCell to expand into new high-growth verticals and geographies, supporting revenue diversification and smoother, less volatile earnings.

- Ongoing operational leverage-demonstrated by achieving positive EBITDA and reducing OpEx as a share of revenue-alongside a disciplined cost structure and stable gross profit margins, point to further improvement in net margins as scale increases, enhancing overall profitability even at relatively low volumes.

- The expansion of royalty-based models through IP licensing (particularly the renewed Bosch deal in China where hydrogen fuel cell markets are accelerating) provides PowerCell with a high-margin, recurring revenue stream that can further bolster net earnings and help insulate financials from cyclical swings in direct product sales.

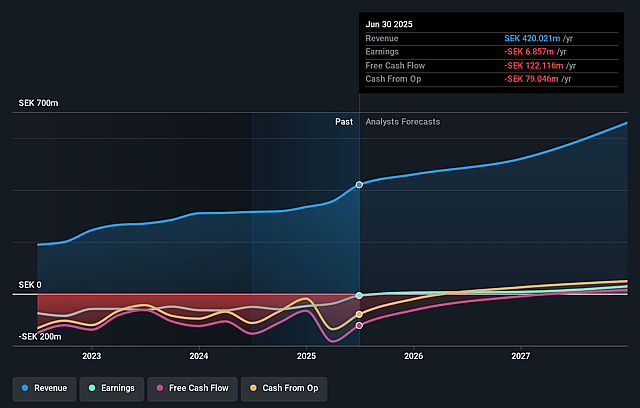

PowerCell Sweden Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PowerCell Sweden's revenue will grow by 18.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.6% today to 6.1% in 3 years time.

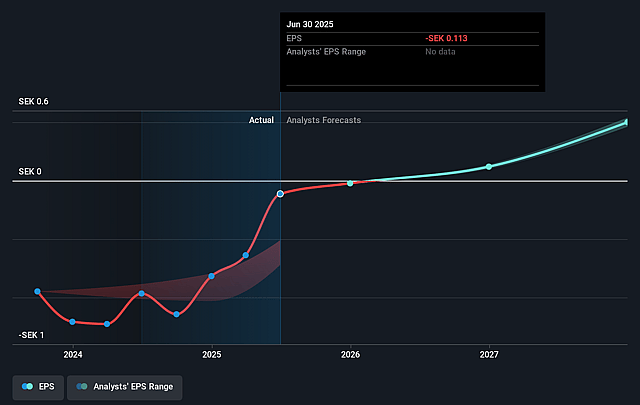

- Analysts expect earnings to reach SEK 42.7 million (and earnings per share of SEK 0.46) by about September 2028, up from SEK -6.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 74.6x on those 2028 earnings, up from -227.1x today. This future PE is greater than the current PE for the SE Electrical industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.6%, as per the Simply Wall St company report.

PowerCell Sweden Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's recent profitability is partly reliant on non-recurring IP and royalty income (notably from the Bosch agreement), which management warns cannot be expected every quarter; this adds volatility and risk to future revenue streams and net margins if underlying product sales don't compensate for lumpy IP/licensing deals.

- PowerCell operates in a market described as difficult and complex, with the CEO noting that consistent, recurring commercial revenues remain elusive, making both revenue and earnings vulnerable to order timing, project delays, and wider adoption rates of hydrogen fuel cell technology.

- Competition in key segments like marine fuel cells is increasing as the sector matures, which could lead to pricing pressures and margin compression, impacting future earnings even as overall demand grows.

- The sustainability of PowerCell's current breakeven point (SEK 400–450 million in annual sales) relies heavily on a lean operational model and cost discipline; rising working capital needs as the company grows, or the potential need to raise more capital, could strain cash flow and ultimately affect net margins and shareholder value.

- Large orders (such as the SEK 1.5 billion ZeroAvia aviation deal) are conditional on external factors like regulatory certification and successful deployment-delays or failures in these dependencies could materially impact PowerCell's anticipated revenues and long-term growth trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK37.5 for PowerCell Sweden based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK50.0, and the most bearish reporting a price target of just SEK30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK696.9 million, earnings will come to SEK42.7 million, and it would be trading on a PE ratio of 74.6x, assuming you use a discount rate of 6.6%.

- Given the current share price of SEK26.9, the analyst price target of SEK37.5 is 28.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PowerCell Sweden?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.