Key Takeaways

- Regulatory pressures are offset by resilient volume growth, rising market share, and upside potential from price liberalization and new production projects.

- European energy security needs and expanded export access position Romgaz for sustained pricing power, diversified revenues, and long-term margin improvement.

- Ongoing operational strength, major investment projects, stable production, and strong market position reinforce Romgaz's financial stability and potential to sustain profitability amid sector challenges.

Catalysts

About SNGN Romgaz- Explores for, produces, and supplies natural gas in Romania.

- While analyst consensus highlights the burden of regulated pricing and slow power plant progress, this may actually understate Romgaz's resilience, as the company is already demonstrating volume growth, robust market share, and rising condensate output despite regulations-positioning it for a sharp rebound in revenues and margins once price liberalization resumes.

- Analysts broadly agree that high CapEx and project delays could strain near-term free cash flow, but this likely overlooks the acceleration effect of Neptun Deep and the incremental impact of CCGT commissioning-both of which are on track to unlock step-changes in gas production and power generation, potentially boosting both revenue and EBITDA in the medium term well beyond market expectations.

- Europe's drive for energy security and domestic supply amid ongoing geopolitical tensions is cementing long-term demand for Romanian natural gas, allowing Romgaz to maintain pricing power and secure large-scale offtake agreements, which could structurally elevate future revenue and earnings.

- The company's expanding export access through cross-border interconnectors and enhanced gas storage utilization sets the stage for Romgaz to capitalize on future export market liberalization in the EU, enabling diversification of sales channels and the potential for higher realized prices, directly supporting future revenue growth and cash flow predictability.

- Accelerated upstream modernization and efficiency gains, such as mature field rehabilitation, recompletions, and automation, are likely to support sustained cost control and net margin improvements-mitigating tax headwinds and amplifying earnings growth as production scales up.

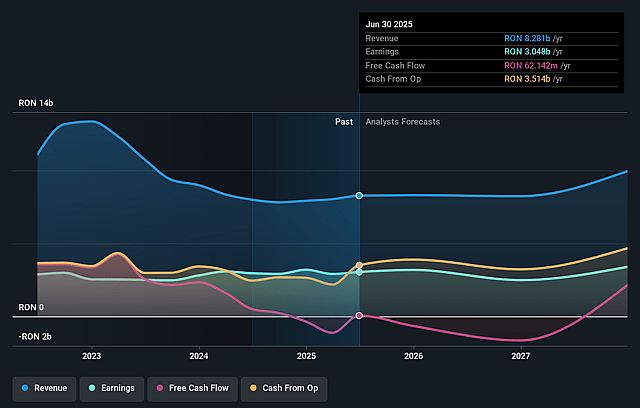

SNGN Romgaz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SNGN Romgaz compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SNGN Romgaz's revenue will grow by 20.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 36.8% today to 34.0% in 3 years time.

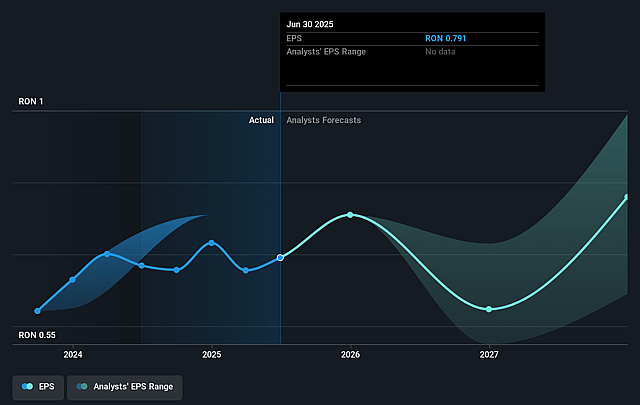

- The bullish analysts expect earnings to reach RON 4.9 billion (and earnings per share of RON 1.22) by about August 2028, up from RON 3.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, down from 10.7x today. This future PE is lower than the current PE for the GB Oil and Gas industry at 14.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.4%, as per the Simply Wall St company report.

SNGN Romgaz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Romgaz continues to deliver strong financial results, with total revenues up 9 percent year-on-year in the first half of 2025 driven by higher gas volumes sold, while maintaining a robust EBITDA margin of 54 percent and a net profit margin above 39 percent, suggesting ongoing profitability that could support share price resilience.

- The company's large-scale investment projects, notably Neptune Deep and the near-completed Iernut CCGT power plant, are progressing, with Neptune Deep on track for first gas in 2027 and Iernut expected to be operational soon, pointing to future production growth and potential new revenue streams that may help offset declining legacy fields.

- Romgaz has demonstrated its ability to sustain or even modestly grow production volumes through intensive rehabilitation of mature fields, reactivation of wells, and successful interventions, as seen in the flat production in the first half and specific advances in condensate output, which could moderate longer-term production declines and revenue erosion.

- The firm has consistently held a dominant market share in Romania's domestic gas market, increasing to 64 percent of domestically produced gas delivered and 47 percent overall share, which may allow continued strong revenue generation and a degree of pricing power even as the market evolves.

- Romgaz's conservative dividend policy and ability to partially self-finance its investments, along with flexible access to bond markets and low current funding pressure, help underpin its financial stability, which could cushion net earnings and support share price performance despite sector headwinds.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SNGN Romgaz is RON7.4, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SNGN Romgaz's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of RON7.4, and the most bearish reporting a price target of just RON5.21.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be RON14.5 billion, earnings will come to RON4.9 billion, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 12.4%.

- Given the current share price of RON8.49, the bullish analyst price target of RON7.4 is 14.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.