Key Takeaways

- Accelerating renewables adoption and stricter regulations threaten Romgaz's demand, margins, and market share in the face of rising costs and sector-specific taxes.

- Project execution risks and heavy investment demands may strain financial health, limit shareholder returns, and increase downside risk amidst uncertain long-term outlook.

- Growth in offshore projects, infrastructure investment, and strong domestic market share position Romgaz to sustain profitability amid regulatory changes and evolving European energy demand trends.

Catalysts

About SNGN Romgaz- Explores for, produces, and supplies natural gas in Romania.

- The rapid acceleration of EU decarbonization policies and the falling cost curve for renewables threaten to erode long-term natural gas demand in Romania and the wider region, making it likely that Romgaz's revenues and growth prospects will face structural headwinds as energy consumers increasingly substitute away from gas.

- With a growing share of Romgaz's gas volumes subject to extended regulated pricing-expected to rise above 87 percent of sales by early 2026-profitability and earnings quality are poised to deteriorate as regulated prices cap upside potential while unit costs and sector-specific taxes such as windfall profit and energy transition levies are rising.

- The company's domestic upstream assets are already maturing, resulting in stagnant or marginally declining production volumes, and ongoing field depletion implies steadily rising extraction costs, which will likely compress net margins even if gas prices remain stable.

- Intensifying regional competition from LNG imports and EU gas interconnectors, coupled with potential implementation of stricter future carbon pricing, may squeeze Romgaz's market share and sharply increase operating costs, negatively impacting both revenues and operational profitability.

- Delays and cost overruns at major projects such as the Iernut CCGT plant or the Neptun Deep offshore development, combined with substantial new capex demands and the risk of weaker-than-expected project economics (especially if energy transition accelerates), could place significant strain on the company's balance sheet, compromise shareholder returns, and lead to further downside risk for earnings.

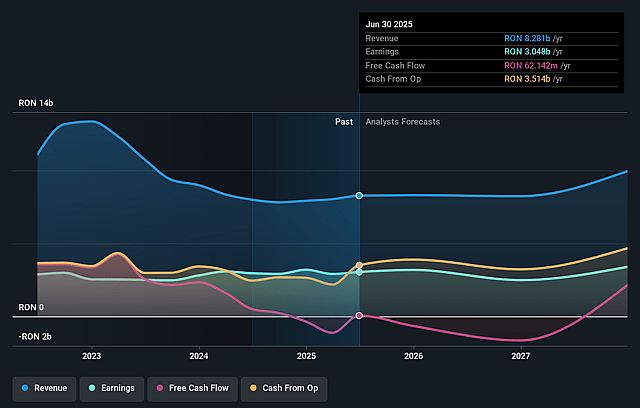

SNGN Romgaz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SNGN Romgaz compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SNGN Romgaz's revenue will decrease by 5.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 36.8% today to 38.6% in 3 years time.

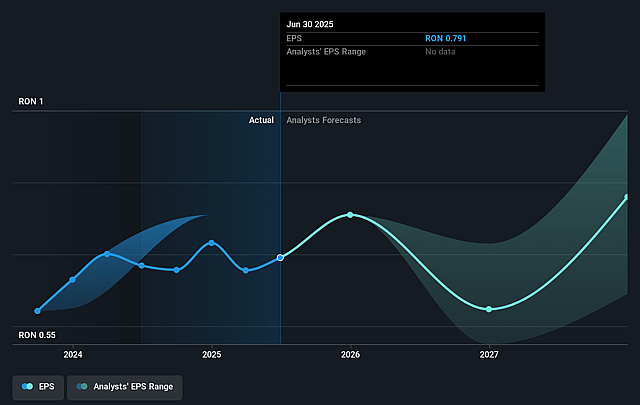

- The bearish analysts expect earnings to reach RON 2.7 billion (and earnings per share of RON 0.71) by about September 2028, down from RON 3.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, up from 9.8x today. This future PE is lower than the current PE for the GB Oil and Gas industry at 14.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

SNGN Romgaz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing development of the Neptun Deep offshore project, with first gas expected in 2027, could materially boost Romgaz's production volumes and top-line revenue from the late 2020s onward, potentially offsetting declines in maturing onshore fields and supporting higher future earnings.

- Romgaz's proactive investment in modernizing and expanding gas infrastructure, including storage and transmission, has already led to improved operational efficiency and higher condensate output, which may enhance net profit margins and strengthen future profitability.

- The company maintains a strong market position domestically, holding a 64% share of domestically produced gas consumption and a 47% share in total gas deliveries, which provides a foundation for ongoing revenue stability even amid sector volatility.

- Despite current regulatory headwinds with a high portion of gas sold at regulated prices through March 2026, Romgaz's ability to flexibly manage gas flows, storage, and optimize sales volumes-as evidenced by a 9.4% year-over-year increase in gas revenue-demonstrates operational agility that could sustain or grow earnings after the regulated regime ends.

- The European transition from coal to gas in power generation, combined with regional energy security priorities and Romgaz's robust gas storage infrastructure, may ensure steady or rising long-term demand for the company's products, supporting both revenue resilience and future margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SNGN Romgaz is RON5.21, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SNGN Romgaz's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of RON7.4, and the most bearish reporting a price target of just RON5.21.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be RON7.0 billion, earnings will come to RON2.7 billion, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 12.6%.

- Given the current share price of RON7.78, the bearish analyst price target of RON5.21 is 49.3% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.