Last Update 28 Nov 25

TLV: Dividend Payout And Stable Margins Will Guide Near Term Outlook

Analysts have made a marginal downward revision to their price target for Banca Transilvania. The new target is set at RON 30.65, reflecting slight changes in discount rate and projected future valuation multiples.

What's in the News

- Banca Transilvania will hold a Special/Extraordinary Shareholders Meeting on October 28, 2025, to consider the approval of RON 700,000,000 in cash dividends and a gross dividend per share of RON 0.6420341921 (Key Developments).

- The meeting will also address the approval of dividend distribution dates. These include a registration date of November 25, 2025, an ex-date of November 24, 2025, and a payment date of December 11, 2025 (Key Developments).

- A separate Special/Extraordinary Shareholders Meeting is scheduled at Banca Transilvania headquarters in Cluj Napoca, following the first meeting on October 28, 2025 (Key Developments).

- Banca Transilvania is set to organize an Analyst/Investor Day. This event will provide updates and facilitate engagement with investors (Key Developments).

Valuation Changes

- Consensus Analyst Price Target remains unchanged at RON 30.65.

- The discount rate has decreased slightly from 14.45% to 14.44%.

- The revenue growth projection is virtually unchanged, holding steady at approximately 6.34%.

- The net profit margin estimate remains stable at around 35.98%.

- The future P/E ratio has decreased slightly from 11.18x to 11.16x.

Key Takeaways

- Fiscal tightening, increased taxes, and demographic challenges threaten revenue growth, loan demand, and long-term retail banking prospects.

- Intensifying fintech competition and higher regulatory costs could compress margins and slow fee income growth despite ongoing digitization efforts.

- Strong digital leadership, effective acquisitions, robust risk profile, and long-term sector trends drive sustained revenue and profit growth, enhancing market position and shareholder returns.

Catalysts

About Banca Transilvania- Provides various banking products and services in Romania, Italy, and the Republic of Moldova.

- The market may be overestimating Banca Transilvania's ability to sustain high credit growth amid Romania's fiscal tightening and higher taxes, which could dampen domestic demand for loans and impact revenue growth in the coming periods.

- There are forward indications of rising cost pressures as new fiscal measures-most notably turnover and dividend tax increases-are being phased in for the full year, likely contributing to higher operating expenses and potential net margin compression.

- Despite digitization investments, the bank remains dependent on its branch-heavy, domestic-focused model and faces increasing competition from fintechs and digital-first banks, suggesting potential for net margin pressure and slower fee income growth compared to best-in-class digital peers.

- Demographic headwinds, including possible outward migration and aging, are expected to gradually erode the long-term consumer lending and deposit base, negatively affecting Banca Transilvania's ability to grow retail revenues and achieve above-market earnings growth over time.

- Regulation-driven increases in compliance burdens (such as ESG) and the phasing out of favorable capital treatment for certain sovereign exposures are set to raise structural costs and risk weights, which may offset gains from loan growth and impact long-term profitability.

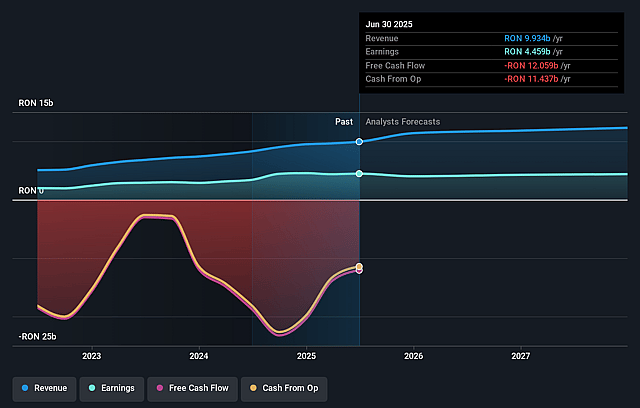

Banca Transilvania Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Banca Transilvania's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 44.9% today to 35.9% in 3 years time.

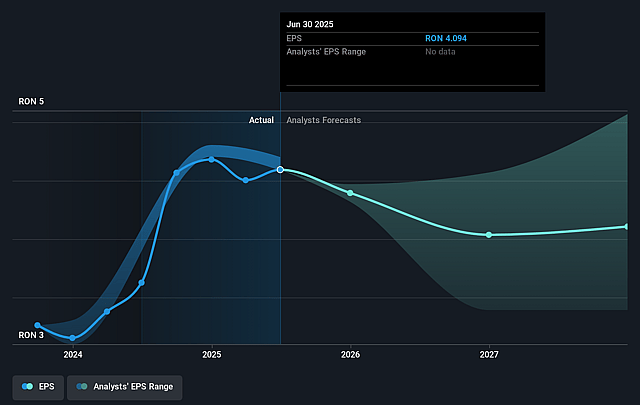

- Analysts expect earnings to reach RON 4.4 billion (and earnings per share of RON 3.39) by about September 2028, down from RON 4.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting RON5.0 billion in earnings, and the most bearish expecting RON3.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, up from 6.9x today. This future PE is greater than the current PE for the RO Banks industry at 7.3x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.45%, as per the Simply Wall St company report.

Banca Transilvania Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Romania's continued rapid economic growth, economic convergence with Western Europe, increasing GDP per capita, and rising foreign direct investment provide a long-term secular tailwind for banking sector credit growth and fee income, supporting Banca Transilvania's revenue and net margins.

- The bank's leadership in digital banking, strong adoption of its BT Pay and BT Go platforms, and ongoing investment in digital transformation boost operational efficiencies, customer engagement, and cross-selling opportunities, which should underpin higher revenue growth and improved cost-to-income ratios.

- Successful integration of OTP Bank has resulted in meaningful synergies, higher loan-to-deposit ratios, and added competencies, strengthening market share and supporting further above-average revenue and net profit growth.

- Robust capital adequacy ratios, high liquidity levels, proven resilience in European stress tests, and below-market-average NPL ratios position Banca Transilvania to withstand economic or sector shocks, supporting stable earnings and potentially higher dividends for shareholders.

- Secular trends such as increased financial inclusion, urbanization, and strong household/corporate deposit growth-alongside expanding products in SME/microfinance, asset management, and insurance-provide long-term growth avenues that can drive sustained improvement in revenue, net margins, and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of RON30.193 for Banca Transilvania based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of RON33.8, and the most bearish reporting a price target of just RON25.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be RON12.4 billion, earnings will come to RON4.4 billion, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 14.4%.

- Given the current share price of RON28.16, the analyst price target of RON30.19 is 6.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.