Key Takeaways

- Accelerated digital transformation and expansion into new international markets enhance operational efficiency, diversify income streams, and boost long-term resilience.

- Strong housing loan growth and proactive asset quality management position the bank for medium-term earnings growth and improved profitability.

- Persistent asset quality concerns, margin pressures, rising costs, muted growth, and approaching tax changes all threaten profitability and increase uncertainty about future performance.

Catalysts

About Doha Bank Q.P.S.C- Provides various banking products and services to individual and corporate clients in Qatar, India, and internationally.

- Doha Bank's accelerated digital transformation-including a 44% increase in digital subscriptions and strong mobile app adoption-positions it to capitalize on region-wide fintech adoption, likely driving improved operational efficiency and future cost-to-income ratio reduction, thereby boosting net margins over the long term.

- Expansion of housing loans (33.6% year-on-year growth) and a strong loan pipeline delayed by temporary geopolitical events set up a rebound in lending for H2 2025 and beyond, aligning with expected economic diversification and rising retail banking demand, which should support medium-term revenue and earnings growth.

- The bank's push into new international markets (euro-denominated syndicated loan, tie-ups like the Blackstone MOU) diversifies funding sources and fee-income streams, enhancing topline growth resilience and contributing to higher non-interest income.

- Ongoing efforts in NPL resolution, combined with forecasted loan growth and stable asset quality in new lending, indicate the potential for a reduction in NPL ratios and cost of risk, thereby underpinning future improvements in net margins and profitability.

- Forward guidance targets reducing the cost-to-income ratio to 30-31% over three years and increasing fee income as a share of revenue, supporting earnings growth as digital initiatives and diversified business lines mature.

Doha Bank Q.P.S.C Future Earnings and Revenue Growth

Assumptions

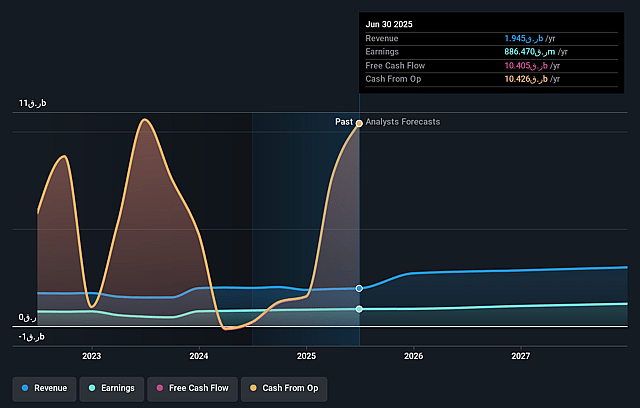

How have these above catalysts been quantified?- Analysts are assuming Doha Bank Q.P.S.C's revenue will grow by 17.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 45.6% today to 38.1% in 3 years time.

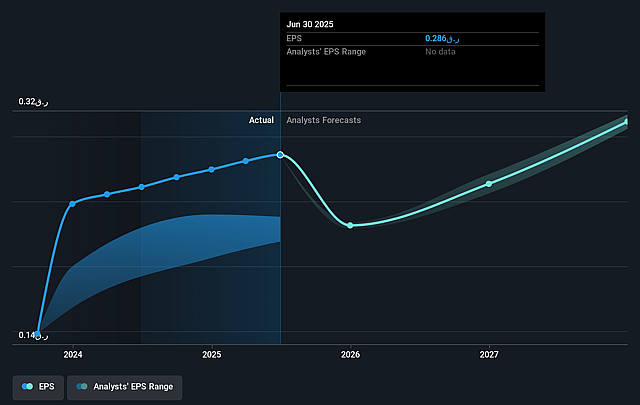

- Analysts expect earnings to reach QAR 1.2 billion (and earnings per share of QAR 0.31) by about September 2028, up from QAR 886.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the QA Banks industry at 12.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 24.78%, as per the Simply Wall St company report.

Doha Bank Q.P.S.C Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank's elevated non-performing loan (NPL) ratio, currently at 7.66% (notably above GCC peer averages), signals ongoing concerns about asset quality; if the anticipated loan growth and NPL resolution do not materialize, sustained credit risk and elevated provisions could erode future net margins and profits.

- Net interest margins have compressed to 1.74%, with management only projecting a moderate improvement tied to cost of funding reductions; should regional/global interest rates remain volatile or trend lower, long-term margin pressure could persist, negatively impacting core revenue streams and earnings.

- Despite strong digital adoption metrics, operating expenses have risen 8% year-on-year, and management expects continued cost escalation due to transformation initiatives through next year; failure to translate these investments into sustainable productivity gains risks long-term cost-to-income ratio deterioration and earnings pressure.

- The muted customer deposit growth (0.2% year-to-date) and loan growth constrained by geopolitical tensions expose the bank to risks from regional instability and potential funding volatility, which may limit growth opportunities and heighten earnings uncertainty.

- The five-year tax exemption under Pillar Two regulations will eventually expire, potentially resulting in a material increase in tax liabilities; unless the bank successfully adapts its business model, higher taxation could depress future net profits and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of QAR2.867 for Doha Bank Q.P.S.C based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of QAR3.1, and the most bearish reporting a price target of just QAR2.55.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be QAR3.2 billion, earnings will come to QAR1.2 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 24.8%.

- Given the current share price of QAR2.5, the analyst price target of QAR2.87 is 12.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.