Key Takeaways

- Significant capacity additions in the US and strategic asset rotation are expected to boost future revenue and enhance earnings by consolidating value.

- Efficiency improvements and long-term PPAs with major tech firms are poised to enhance margins and ensure stable revenue growth.

- Declines in electricity prices and renewable generation shortfalls, combined with political and financial risks, threaten EDP Renováveis’ future profitability and revenue.

Catalysts

About EDP Renováveis- A renewable energy company, plans, constructs, operates, and maintains electricity power stations.

- EDPR's significant increase in capacity additions, particularly in the US solar projects, sets a strong foundation for future growth and is expected to boost revenue once these capacities are fully operational.

- The company's focus on efficiency improvements, resulting in a 7% year-on-year decline in core OpEx per average megawatt, is poised to enhance net margins by reducing operational costs.

- Significant demand growth for electricity in the US, driven by data centers, crypto mining, and industrial activities, indicates potential upward pressure on revenue as EDPR expands its capacity to meet this demand.

- EDPR's strategic asset rotation, including the acquisition of a minority stake in a European wind portfolio, aimed at reducing minority leakage and simplifying the portfolio, is expected to positively impact earnings through enhanced control and value consolidation.

- The strong demand and high prices for new PPAs, with 65% of agreements made with major tech companies, suggest robust future revenue growth from long-term contracts as the company capitalizes on stable cash flows amid fluctuating market prices.

EDP Renováveis Future Earnings and Revenue Growth

Assumptions

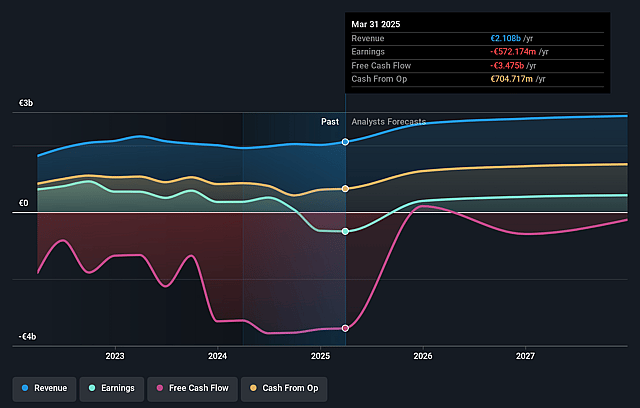

How have these above catalysts been quantified?- Analysts are assuming EDP Renováveis's revenue will grow by 13.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 20.3% in 3 years time.

- Analysts expect earnings to reach €605.7 million (and earnings per share of €0.56) by about January 2028, up from €74.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €694.5 million in earnings, and the most bearish expecting €482 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.4x on those 2028 earnings, down from 125.6x today. This future PE is lower than the current PE for the GB Renewable Energy industry at 125.1x.

- Analysts expect the number of shares outstanding to grow by 1.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.03%, as per the Simply Wall St company report.

EDP Renováveis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has suffered a decrease in average selling prices due to lower electricity prices in Iberia, which could negatively impact future revenues.

- The renewable generation resources have been below expectations, especially in Brazil, impacting total renewable generation growth and future revenue forecasts.

- There is uncertainty around the U.S. political climate following the election results, which may cause policy changes that could impact the company's growth efforts and future earnings.

- Lower capital gains from asset rotations year-on-year have affected net profit despite top-line growth efforts, raising concerns about future profitability.

- Financial exposure to projects in countries like Colombia remains a risk; significant delays and slow progress in negotiations could impact future earnings and debt levels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €13.44 for EDP Renováveis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €19.0, and the most bearish reporting a price target of just €8.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €3.0 billion, earnings will come to €605.7 million, and it would be trading on a PE ratio of 30.4x, assuming you use a discount rate of 8.0%.

- Given the current share price of €8.94, the analyst's price target of €13.44 is 33.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on EDP Renováveis?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.