Catalysts

About LPP

LPP is a fast growing fashion retailer operating multi brand apparel and home chains across Central, Eastern and Southern Europe, supported by an expanding online channel.

What are the underlying business or industry changes driving this perspective?

- Accelerated international roll out of Sinsay, with hundreds of new stores planned across Central, Eastern Europe and Central Asia, is structurally lifting store count and selling space, supporting double digit revenue growth and scale driven EBIT expansion.

- Heavy multi year investments in robotics enabled logistics and new warehouses, including in Romania and Brzesc, are already cutting unit handling costs by more than two times. This provides a clear runway for higher operating margins and cash generation as volumes ramp up.

- Rapid adoption of the Sinsay app, a growing loyalty base and AI supported personalization are shifting more sales into higher return omnichannel journeys. This reduces performance marketing spend as a share of e commerce revenue and supports rising net margins.

- LPP’s value focused formats, especially Sinsay, are positioned to gain share as consumers in Central and Eastern Europe trade towards affordable fashion. This creates sustained traffic and ticket growth that should compound group revenues and earnings over several years.

- Disciplined cost control, including lower online advertising intensity, optimized SG&A per square meter and a conservative approach to openings and inventory, is embedding structurally leaner operations that should translate into durable EBITDA margin improvement and stronger net profit growth.

Assumptions

This narrative explores a more optimistic perspective on LPP compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

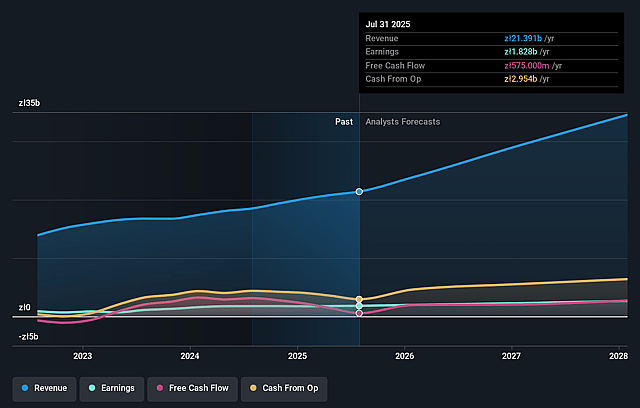

- The bullish analysts are assuming LPP's revenue will grow by 27.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 8.5% today to 8.3% in 3 years time.

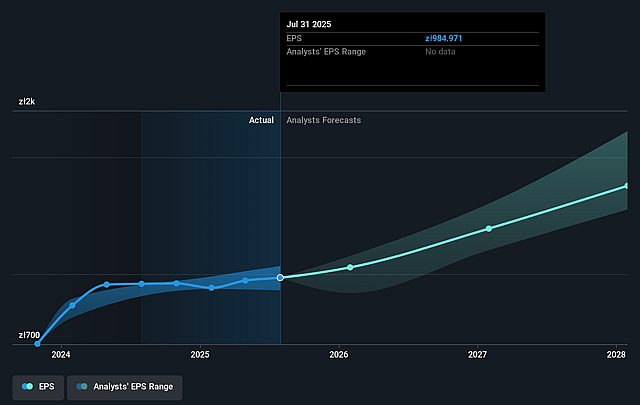

- The bullish analysts expect earnings to reach PLN 3.6 billion (and earnings per share of PLN 1792.08) by about December 2028, up from PLN 1.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as PLN2.7 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, up from 17.3x today. This future PE is greater than the current PE for the GB Luxury industry at 13.1x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.94%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The aggressive multi year store rollout, with several hundred openings a year and rapidly rising floor space, risks oversaturating certain Central and Eastern European markets. This could structurally cap like for like growth and weigh on long term revenue and earnings.

- The shift in mix toward lower margin value formats such as Sinsay, combined with the need to actively discount to clear elevated inventories, points to a secular downtrend in gross margin percentage. This may offset volume gains and limit net margin expansion.

- High and still growing capital expenditure on logistics and robotics, alongside temporary inefficiencies from the Romanian warehouse fire and potential rebuilding, could embed structurally higher depreciation and operating costs. This may constrain future free cash flow and earnings.

- Prolonged and uncertain recovery of large Russian receivables, already pushed out to 2029 and partially written down, exposes LPP to a multi year drag from credit risk and weaker balance sheet quality. This could ultimately pressure net profit and shareholder returns.

- Continued dependence on favorable macro tailwinds such as consumer strength in Central and Eastern Europe and beneficial currency moves, together with intensifying competition from low cost online players, leaves LPP vulnerable to a cyclical or structural slowdown in discretionary fashion spending. This would hit revenue growth and operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for LPP is PLN26747.23, which represents up to two standard deviations above the consensus price target of PLN20135.62. This valuation is based on what can be assumed as the expectations of LPP's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PLN28370.0, and the most bearish reporting a price target of just PLN13000.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be PLN43.9 billion, earnings will come to PLN3.6 billion, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 11.9%.

- Given the current share price of PLN17040.0, the analyst price target of PLN26747.23 is 36.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.