Catalysts

About LPP

LPP is a Central and Eastern European fashion retailer that grows through a mix of large scale Sinsay value stores and heritage brands across both offline and e commerce channels.

What are the underlying business or industry changes driving this perspective?

- Acceleration of omnichannel growth, including 20% plus annual increases in both offline and online sales and rapid app adoption in Sinsay, is expected to structurally lift top line revenue and support stable EBITDA expansion.

- Ongoing logistics automation and robotization, with more than PLN 1 billion of recent and planned CapEx and new hubs such as Bucharest and Bydgoszcz, is expected to lower unit distribution costs and improve operating margins.

- Continued roll out of Sinsay in smaller towns across Central and Eastern Europe and Central Asia, supported by fast payback periods of around 16 months per store, is expected to underpin sustained floor space growth and higher consolidated earnings.

- Refinancing that secures 3 to 5 years of funding at attractive margins gives LPP financial flexibility to keep investing in expansion and technology while maintaining its dividend policy, supporting both earnings growth and shareholder returns.

- Tight inventory and working capital discipline, including reduced stock per square meter and negative working capital, is expected to protect gross margins and support stronger free cash flow generation relative to revenue growth.

Assumptions

How have these above catalysts been quantified?

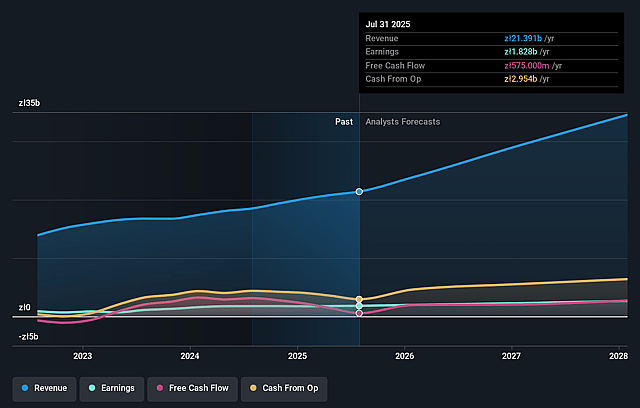

- Analysts are assuming LPP's revenue will grow by 20.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.5% today to 9.0% in 3 years time.

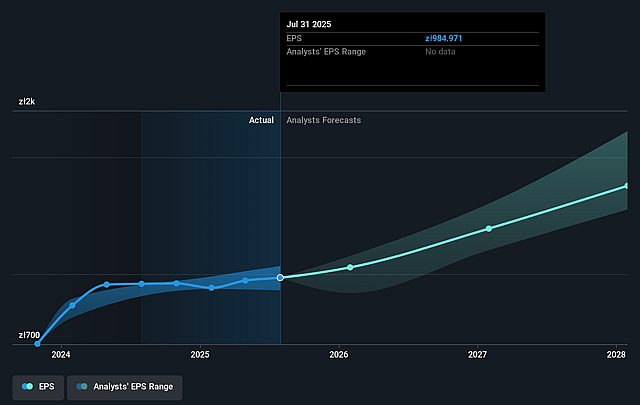

- Analysts expect earnings to reach PLN 3.5 billion (and earnings per share of PLN 1794.08) by about December 2028, up from PLN 1.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting PLN4.2 billion in earnings, and the most bearish expecting PLN3.0 billion.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, down from 31.7x today. This future PE is greater than the current PE for the GB Luxury industry at 12.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.79%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company is guiding for sustained high double digit revenue growth of around 20% per year through 2027, driven by continued store roll out, e commerce expansion and logistics investments. If this is delivered, it would make it unlikely that the share price simply moves sideways, as strong and compounding top line growth typically supports a higher valuation and market capitalization through rising revenue and earnings.

- Management is targeting structurally higher profitability through improved gross margins, tighter SG&A control and logistics automation, with EBITDA margin expected to trend in the low twenties. If these margin gains materialize alongside already visible operating leverage, the resulting step up in net profit could prompt a market re rating and upward share price movement supported by higher net margins and earnings.

- LPP is committing more than PLN 1.6 billion of annual CapEx focused on high returning logistics robotization and rapid payback Sinsay stores. If these investments continue to generate 12 to 16 month payback periods and significant cost savings, the compounding effect on cash flow and profitability would argue for a higher rather than flat equity value through stronger free cash flow and higher EBIT.

- The group has secured attractive long term refinancing with leverage at roughly 1.1 times EBITDA and has reiterated a rising dividend policy with a yield near 4 percent. If investors continue to reward this combination of balance sheet strength, growing payouts and visible growth, the valuation multiple may remain elevated or expand, supporting share price appreciation through sustained earnings and dividend growth.

- Long term expansion into Central and Eastern Europe, Central Asia and selected Western European markets, combined with successful app driven omnichannel growth where online sales are already growing above 20 percent, creates a structural growth runway beyond the current three year plan. If LPP keeps gaining market share in these regions, the market is likely to price in higher future earnings, challenging the idea that the share price will remain unchanged as revenue and operating profit scale.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of PLN21050.0 for LPP based on their expectations of its future earnings growth, profit margins and other risk factors.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PLN28370.0, and the most bearish reporting a price target of just PLN13000.0.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be PLN38.7 billion, earnings will come to PLN3.5 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 11.8%.

- Given the current share price of PLN21100.0, the analyst price target of PLN21050.0 is 0.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on LPP?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.