Key Takeaways

- Leadership in new basins, digitalization, and recovery technology could drive lasting volume growth and margin gains far outpacing expectations, even in downturns.

- Strategic positioning, robust financials, and supportive regulation may enable asset growth, reduced risks, and sustained shareholder returns amid global supply uncertainty.

- Multiple headwinds-including supply constraints, falling prices, energy transition, and regulatory challenges-threaten the company's revenue growth, profitability, and long-term asset value.

Catalysts

About Oil and Gas Development- Explores for, develops, produces, and sells oil and gas resources in Pakistan.

- While analyst consensus sees OGDCL's recent gas condensate discoveries and development projects as a steady growth driver, they may be underestimating the magnitude and acceleration of production uplift-OGDCL's dominance in new high-potential basins and rapid well integration could drive a sharp, sustained increase in both oil and gas volumes, leading to a significantly higher revenue trajectory than anticipated.

- The consensus highlights improved production efficiency from advanced techniques, but OGDCL's leadership in digitalization, field automation, and successful piloting of new recovery technologies in mature fields positions it for a step-change in operating margins-potentially doubling the pace of margin improvement and boosting earnings resilience even during commodity downturns.

- OGDCL stands uniquely positioned to benefit from rising global energy demand and security concerns, given its unrivaled domestic acreage and forthcoming entry into offshore blocks, which could transform reserve growth and guarantee a durable long-term revenue expansion.

- Ongoing underinvestment in global upstream oil and gas will likely amplify future supply shortages and price volatility; OGDCL's robust cash flows and balance sheet enable opportunistic asset acquisitions and sustained output just as competitors face capacity constraints, setting the stage for extraordinary earnings leverage in upcycles.

- Regulatory incentives and accelerating partnerships in the local market may allow OGDCL to fast-track both project approval and execution, reducing project lead times and risk, which should support higher dividends and a structurally improved return on equity over the next cycle.

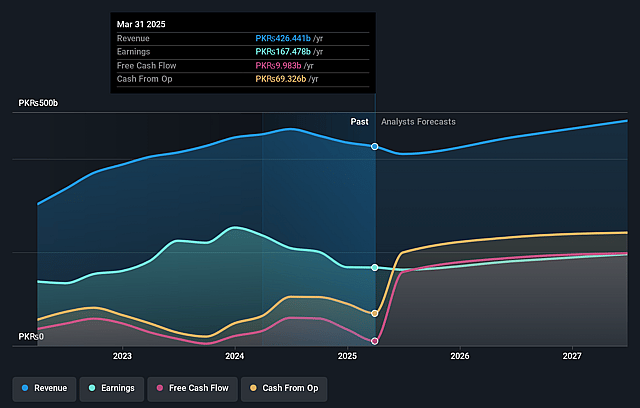

Oil and Gas Development Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Oil and Gas Development compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Oil and Gas Development's revenue will grow by 6.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 39.3% today to 41.5% in 3 years time.

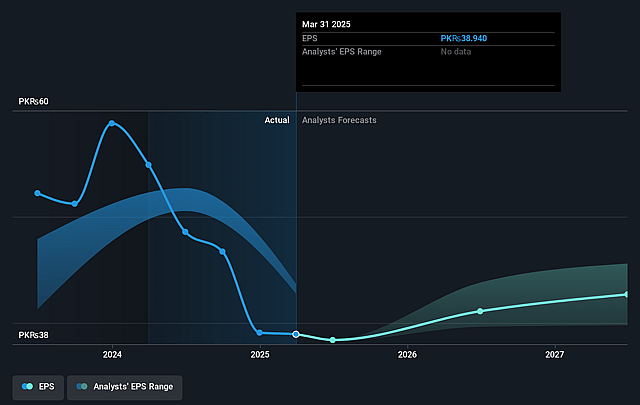

- The bullish analysts expect earnings to reach PKR 214.6 billion (and earnings per share of PKR 48.15) by about September 2028, up from PKR 167.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.3x on those 2028 earnings, up from 7.0x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 8.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 26.59%, as per the Simply Wall St company report.

Oil and Gas Development Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent production curtailments due to infrastructure and demand constraints in Pakistan, including forced well shut-ins and reduced gas uptake from the power sector, could restrict the company's ability to grow or sustain revenues in the future.

- Declining realized oil prices, as evidenced by the drop from $69.78 to $62.57 per barrel, along with strengthening of the Pakistani rupee against the US dollar, are putting downward pressure on topline revenue and profitability.

- Rising exploration risk, indicated by the increased number of dry holes and higher exploration and prospecting expenditure, may signal challenges in replacing reserves and thus threaten long-term revenue growth.

- The transition to renewable energy and slow global demand for hydrocarbons, combined with increasing regulatory and tax pressures in key regions like Pakistan, could erode OGDCL's margins and earnings over time as carbon regulations tighten and investors shift away from fossil fuels.

- Growing risks of stranded assets and intensifying competition from national oil companies for exploration acreage may limit attractive new opportunities for OGDCL and lead to potential write-downs and long-term balance sheet pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Oil and Gas Development is PKR400.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Oil and Gas Development's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PKR400.0, and the most bearish reporting a price target of just PKR248.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be PKR517.1 billion, earnings will come to PKR214.6 billion, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 26.6%.

- Given the current share price of PKR272.92, the bullish analyst price target of PKR400.0 is 31.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.