Key Takeaways

- The accelerating global transition to renewables and heightened regulatory pressures threaten OGDCL's long-term relevance, profitability, and ability to expand.

- Heavy reliance on aging assets, underinvestment, and rising costs expose the company to production risks, capital overruns, and reduced shareholder value.

- Dominant market position, technological investment, and strategic project expansion position the company for sustained profitability and diversified, resilient long-term growth.

Catalysts

About Oil and Gas Development- Explores for, develops, produces, and sells oil and gas resources in Pakistan.

- The accelerating global shift toward renewable energy sources and increasing adoption of alternative technologies is likely to undermine long-term demand for hydrocarbons, risking a future where OGDCL's core product becomes progressively less relevant, which would create sustained pressure on both its revenue base and asset valuations.

- Intensifying environmental and regulatory pressures-such as the possibility of stricter emissions controls, carbon taxes, and international climate commitments-are poised to raise compliance costs and impose operational constraints, eroding net margins and restricting future expansion.

- The company's heavy dependence on mature assets and frequent production curtailments, as highlighted by recent declines in output and forced shut-ins, signal a challenging outlook for maintaining production levels, increasing the risk of revenue contraction as depletion outpaces new discoveries.

- Persistent underinvestment in global oil and gas exploration, while potentially benefiting prices in the short term, is likely to be offset longer term by cost inflation, rising ESG-related financing hurdles, and technical challenges in monetizing underexplored or unconventional reserves-all of which threaten OGDCL's ability to deliver profitable growth.

- Severe cost pressures from inflation in exploration, equipment, and labor, combined with the growing threat of climate-related disruptions, make major capital projects more likely to experience delays or overruns, which would further weigh on earnings visibility, free cash flow, and ultimately shareholder value.

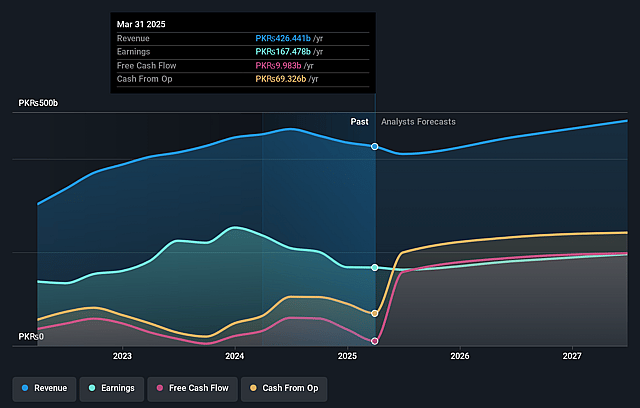

Oil and Gas Development Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Oil and Gas Development compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Oil and Gas Development's revenue will grow by 6.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 39.3% today to 41.4% in 3 years time.

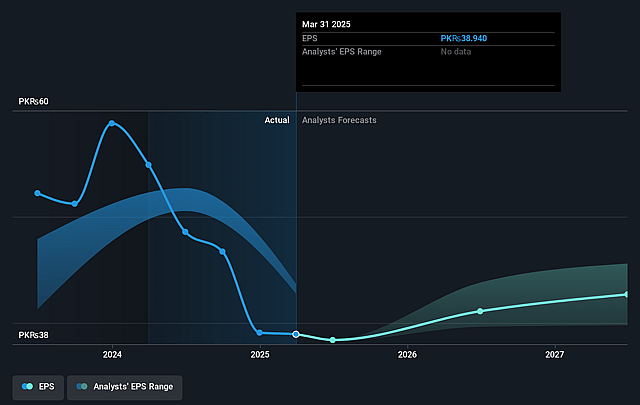

- The bearish analysts expect earnings to reach PKR 211.7 billion (and earnings per share of PKR 42.0) by about July 2028, up from PKR 167.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, up from 5.9x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 7.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 25.5%, as per the Simply Wall St company report.

Oil and Gas Development Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company maintains dominant market leadership in Pakistan with the largest share of exploration acreage and recoverable oil and gas reserves, indicating strong long-term production potential and supporting future revenue growth.

- Recent discoveries and ongoing exploration activities, including joint ventures and new wells such as those in Waziristan and other high-prospect regions, could result in meaningful reserve and production additions, underpinning improvements in long-term earnings.

- OGDCL is investing in advanced exploration and production technologies, as demonstrated by successful deployment of electrical submersible pumps and production optimization projects, which can improve operational efficiency and sustain or enhance net profit margins over time.

- Despite near-term challenges, the company is retaining high profit margins and has declared its highest ever quarterly cash dividend, reflecting robust underlying cash flow and the potential for resilient shareholder returns as earnings stabilize.

- Strategic involvement in large-scale development projects like Reko Diq, as well as stated intentions to expand into offshore drilling, could diversify revenue streams and increase asset value, supporting stronger long-term financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Oil and Gas Development is PKR210.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Oil and Gas Development's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PKR372.0, and the most bearish reporting a price target of just PKR210.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be PKR511.6 billion, earnings will come to PKR211.7 billion, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 25.5%.

- Given the current share price of PKR228.02, the bearish analyst price target of PKR210.0 is 8.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.