Key Takeaways

- Extensive exploration portfolio and discoveries could drive future growth by increasing revenue when developed and online.

- Optimized production techniques and new exploratory wells improve production efficiency, enhancing net margins through reduced operational costs.

- Production curtailment and increased exploration costs are challenging OGDCL, while exchange rate and circular debt issues threaten financial stability and earnings.

Catalysts

About Oil and Gas Development- Explores for, develops, produces, and sells oil and gas resources in Pakistan.

- OGDCL's extensive exploration portfolio and recent gas condensate discoveries could drive future growth, potentially increasing revenue as these discoveries are developed and brought online.

- Implementation of state-of-the-art production optimization techniques and rapid integration of new exploratory wells is expected to enhance production efficiency, likely improving net margins by reducing operational costs.

- Ongoing development projects, such as the Jhal Magsi development project and various compression projects, when completed, are anticipated to boost production capacity and revenue streams.

- Strategic efforts to sustain and maximize hydrocarbon output, including workover jobs and the installation of electrical submersible pumps, are aimed at mitigating production decline in mature fields, which should maintain or increase earnings.

- Participation in offshore blocks and potential involvement in projects like Reko Diq indicate long-term growth prospects, possibly enhancing future revenues and increasing the company's asset base.

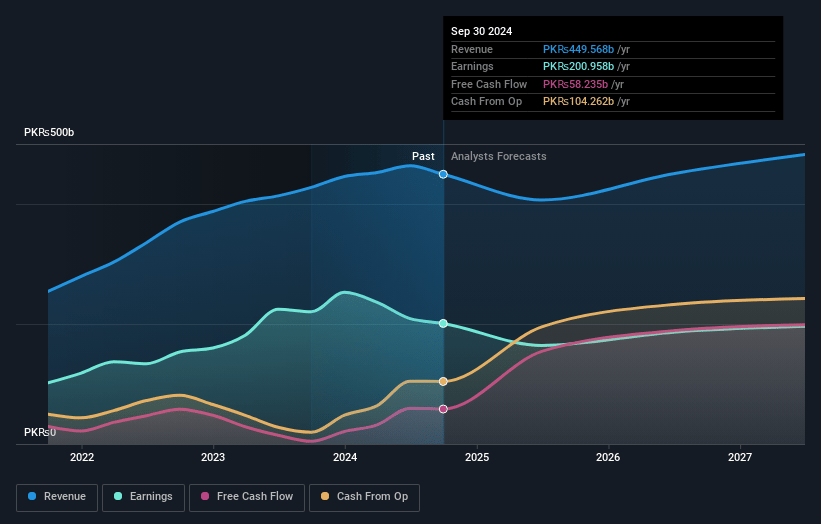

Oil and Gas Development Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oil and Gas Development's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 39.3% today to 41.4% in 3 years time.

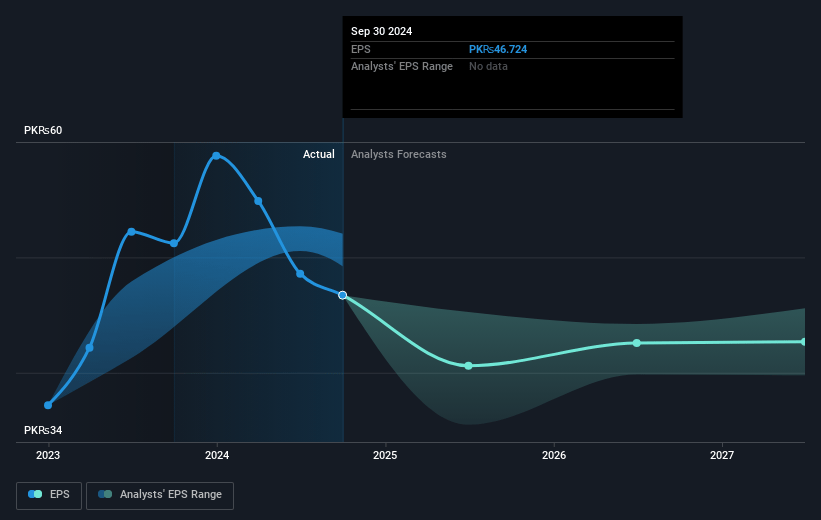

- Analysts expect earnings to reach PKR 207.8 billion (and earnings per share of PKR 44.59) by about July 2028, up from PKR 167.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 5.8x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 7.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 25.5%, as per the Simply Wall St company report.

Oil and Gas Development Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- OGDCL's sales revenue has decreased by approximately PKR 29 billion due to forced production curtailment, impacting revenue negatively.

- The company faced challenges due to a dip in realized oil prices and strengthened PKR against USD, which negatively affected earnings.

- Exploration and prospecting expenditures increased by 57% due to dry holes, consuming financial resources with no short-term revenue return.

- The company experienced significant forced curtailment due to LNG influx and reduced gas demand, leading to reduced production and lower revenue potential.

- Potential circular debt issues and its impact on the company's cash flow and recovery rates could affect net margins and future financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of PKR299.514 for Oil and Gas Development based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PKR371.0, and the most bearish reporting a price target of just PKR248.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be PKR502.5 billion, earnings will come to PKR207.8 billion, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 25.5%.

- Given the current share price of PKR226.23, the analyst price target of PKR299.51 is 24.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.