Last Update 28 Aug 25

Fair value Decreased 2.48%Aboitiz Power’s lower net profit margin and higher future P/E signal deteriorating profitability and a more expensive forward valuation, leading to a modest decrease in the consensus fair value from ₱46.70 to ₱45.82.

What's in the News

- Aboitiz Power's joint venture with Scatec ASA (SNAP) received Energy Regulatory Commission approval for an increased rate on long-term ancillary services contracts, raising it from PHP 1.5 to PHP 2.25/kWh effective July 2025.

- The rate adjustment results in a retroactive revenue impact of approximately NOK 231 million for Scatec, to be recognized in Q2 2025 and received over the next 12 months.

- Since September 2023, volumes have been delivered under the new contracts, but payments were made at the lower rate pending regulatory approval.

Valuation Changes

Summary of Valuation Changes for Aboitiz Power

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from ₱46.70 to ₱45.82.

- The Net Profit Margin for Aboitiz Power has significantly fallen from 18.79% to 16.11%.

- The Future P/E for Aboitiz Power has significantly risen from 11.27x to 12.84x.

Key Takeaways

- Expansion in renewables and storage, plus rising contracted volumes, positions Aboitiz Power for stronger revenue growth and improved margins with stable earnings.

- Adoption of smart grid technology and access to green financing enhance efficiency, reduce costs, and provide financial flexibility for accelerated growth investments.

- Heavy exposure to spot price volatility, rising debt, coal dependence, competition, and renewable project execution risk threaten profitability, financial flexibility, and long-term growth.

Catalysts

About Aboitiz Power- Through its subsidiaries, engages in the power generation and distribution, and electricity retail businesses in the Philippines.

- The rapid growth in electricity demand-driven by ongoing electrification and urbanization in the Philippines, alongside surging data center and industrial loads-positions Aboitiz Power to benefit from higher contracted volumes and expansion opportunities, supporting sustained revenue growth.

- The company's active expansion and pipeline in renewables (solar, wind, hydro) and its entry into battery energy storage are aligned with government-mandated energy transition policies and heightened demand for sustainable power, likely to enhance net margins via higher average tariffs, incentives, and lower operating costs over time.

- Rising allocation toward bilateral contracts (expected to reach 90% of baseload by year-end) and continued contract wins are set to reduce spot market exposure and earnings volatility; with contract prices higher than current spot rates, this shift should support improved EBITDA margins and more stable earnings.

- Ongoing integration of digital and smart grid technologies across both generation and distribution segments will further boost operational efficiency, reduce system losses, and strengthen long-term EBITDA and net margins.

- Enhanced access to green financing and capital via increasing ESG investment trends will likely reduce borrowing costs and improve financial flexibility, enabling Aboitiz Power to accelerate growth investments and improve earnings potential.

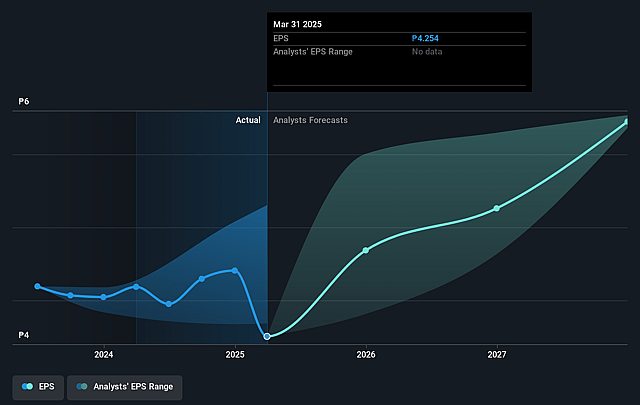

Aboitiz Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aboitiz Power's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.7% today to 13.9% in 3 years time.

- Analysts expect earnings to reach ₱34.5 billion (and earnings per share of ₱4.56) by about September 2028, up from ₱29.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₱40.9 billion in earnings, and the most bearish expecting ₱26.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, up from 10.5x today. This future PE is greater than the current PE for the PH Renewable Energy industry at 8.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.14%, as per the Simply Wall St company report.

Aboitiz Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent and significant declines in spot market electricity prices-driven by oversupply from new gas plants, renewables, and growing rooftop solar adoption-have already led to sharply lower EBITDA and net profit, and if this trend continues, it could further erode Aboitiz Power's revenue and margins, especially as 10% of the portfolio remains exposed to spot prices.

- Escalating debt levels due to major acquisitions (Chromite) and ongoing capital expenditures for new projects raise financial risk; the net debt-to-equity ratio rose to 1.17x, which could pressure interest expenses, reduce financial flexibility, and limit the company's ability to maintain dividends or reinvest in growth.

- Continued high reliance on coal-fired generation-highlighted by the upcoming 150MW expansion at Therma Visayas-exposes Aboitiz Power to long-term regulatory, ESG, and carbon cost risks, which may result in stranded assets or penalties, hurting both future earnings and net margins as global decarbonization accelerates.

- Intensifying competition from both local and foreign players aggressively increasing renewable generation may lead to long-term compression of contract and PPA margins as supply consistently outpaces demand (especially in Luzon), undermining revenue growth and market share.

- Execution risk in ramping up the pipeline of renewable and battery projects-including delays, technology integration challenges, and project cost overruns-could lead to missed market opportunities, lost incentive revenues, and potential financial strain, ultimately impacting long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₱45.538 for Aboitiz Power based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱54.3, and the most bearish reporting a price target of just ₱31.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₱247.4 billion, earnings will come to ₱34.5 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₱42.9, the analyst price target of ₱45.54 is 5.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.