Narratives are currently in beta

Key Takeaways

- Expansion in wind and solar energy capacity is set to boost revenue growth through increased electricity generation and enhanced portfolio.

- Strategic product innovation and customer growth initiatives aim to improve market presence and bolster revenue and margins.

- External challenges, including hydro shortage, economic shifts, rising costs, fuel uncertainty, and project delays, threaten revenue stability and profit margins.

Catalysts

About Meridian Energy- Engages in the generation, trading, and retailing of electricity to residential, business, and industrial customers in New Zealand, Australia, and the United Kingdom.

- The completion of the Harapaki wind farm has already led to a 40% increase in wind generation volumes. This increased capacity is expected to drive future revenue growth as it allows for more electricity generation to be sold.

- The company's move to enhance its retail business by offering new two-way products and services is expected to improve customer acquisition and retention, potentially increasing future revenue and supporting margins.

- Despite current regulatory setbacks, the planned solar developments and battery projects, like the Ruakaka battery system and solar build, are expected to contribute to future revenue growth as they expand Meridian's generation portfolio and capacity.

- The ability to bring forward the return to service of the Manapouri Unit 6 to December 2024 could lead to increased generation capabilities sooner than expected, potentially driving revenue and earnings growth in fiscal 2025.

- The continued growth in customer numbers, despite the volatile market conditions, indicates strong market presence and potential for sustained revenue growth, which could positively impact future earnings.

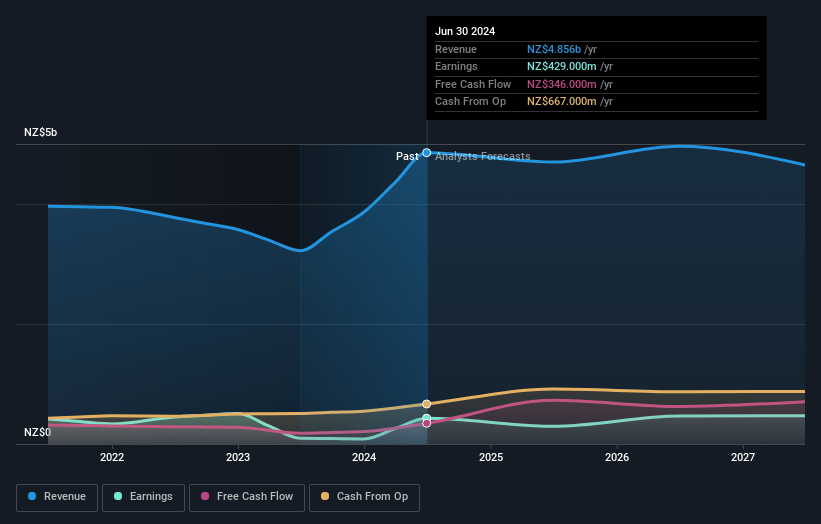

Meridian Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Meridian Energy's revenue will decrease by -0.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.8% today to 9.9% in 3 years time.

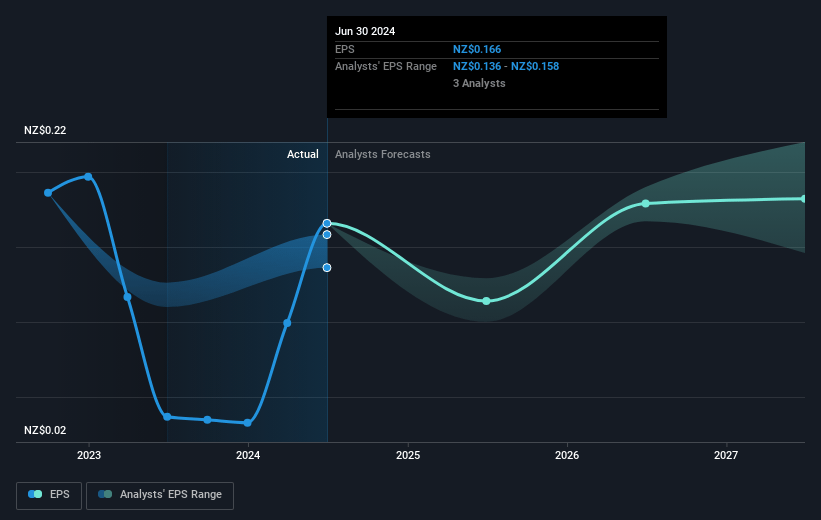

- Analysts expect earnings to reach NZ$472.3 million (and earnings per share of NZ$0.18) by about January 2028, up from NZ$429.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NZ$565 million in earnings, and the most bearish expecting NZ$377.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.1x on those 2028 earnings, up from 35.5x today. This future PE is lower than the current PE for the AU Renewable Energy industry at 178.0x.

- Analysts expect the number of shares outstanding to decline by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.33%, as per the Simply Wall St company report.

Meridian Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of a winter drought and low hydro inflows initially reduced electricity generation, leading to volatility in wholesale electricity prices, which could negatively affect profitability and revenue predictability.

- A decline in electricity demand due to economic factors or specific demand response agreements, such as the one with NZAS, could result in reduced revenues and lower profit margins.

- Increasing operating costs, partly due to provisions related to retail business restructuring, could strain net margins and harm overall earnings.

- Uncertainty in gas and fuel supply, leading to reliance on alternative resources like coal, could result in higher generation costs, impacting revenue and profitability negatively.

- Delays and potential opposition in capital projects, such as the Ruakaka solar development facing appeals, could affect planned capital expenditure and future revenue streams dependent on renewable energy expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NZ$6.53 for Meridian Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$7.3, and the most bearish reporting a price target of just NZ$5.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NZ$4.8 billion, earnings will come to NZ$472.3 million, and it would be trading on a PE ratio of 43.1x, assuming you use a discount rate of 6.3%.

- Given the current share price of NZ$5.85, the analyst's price target of NZ$6.53 is 10.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives