Last Update01 May 25Fair value Decreased 2.34%

Key Takeaways

- Strategic expansion in South Africa and Europe positions Magnora to capitalize on renewable energy demand and government incentives, driving significant revenue growth.

- Strong cash flow and optimal project timing enhance earnings potential through strategic sales and divestitures in high-demand markets.

- Geopolitical risks and market delays may disrupt projects, compressing margins and affecting earnings from renewable energy ventures.

Catalysts

About Magnora- Operates as a renewable energy development company in Norway, Sweden, South Africa and the United Kingdom.

- Magnora's strategic expansion in South Africa, highlighted by surpassing the 5 gigawatt mark and initiating sales for a 500-megawatt onshore wind and solar project, positions the company to capitalize on high premiums for onshore wind projects, potentially boosting revenue significantly.

- The strong cash position enables Magnora to sell projects when market conditions are optimal, enhancing potential earnings by timing exits based on favorable pricing and financial conditions.

- The establishment of significant projects, particularly in Germany with over 50 high grid potential prospects and the expansion of their land bank, supports future revenue growth through the development and eventual sale of these projects as the demand for renewables rises.

- Magnora's strategic focus on high-growth areas like battery energy storage systems (BESS) in Europe, coupled with government support in Germany and Italy's upcoming auctions, is expected to drive revenue increases and improve net margins due to high demand and policy incentives.

- Opportunities for divestitures, including anticipated farm downs and sales in multiple markets, alongside expected earn-outs and revenue sharing, are poised to contribute to strong earnings growth and an efficient return on equity.

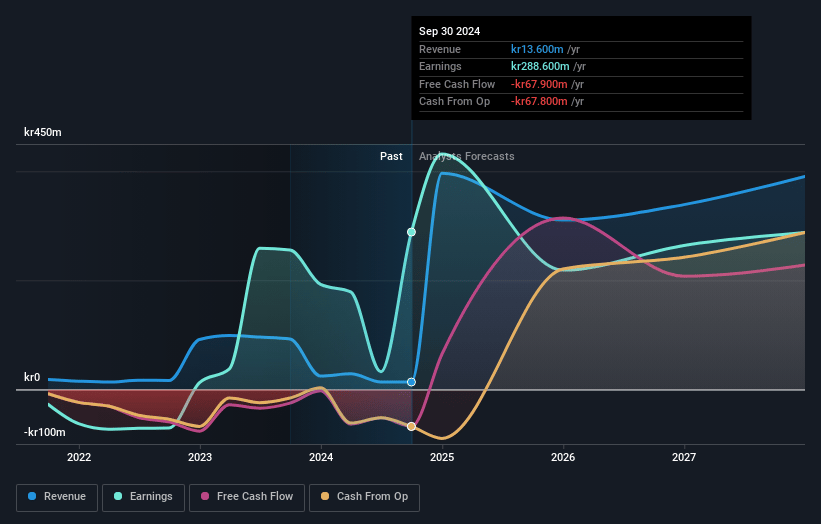

Magnora Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Magnora's revenue will grow by 108.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 648.6% today to 53.3% in 3 years time.

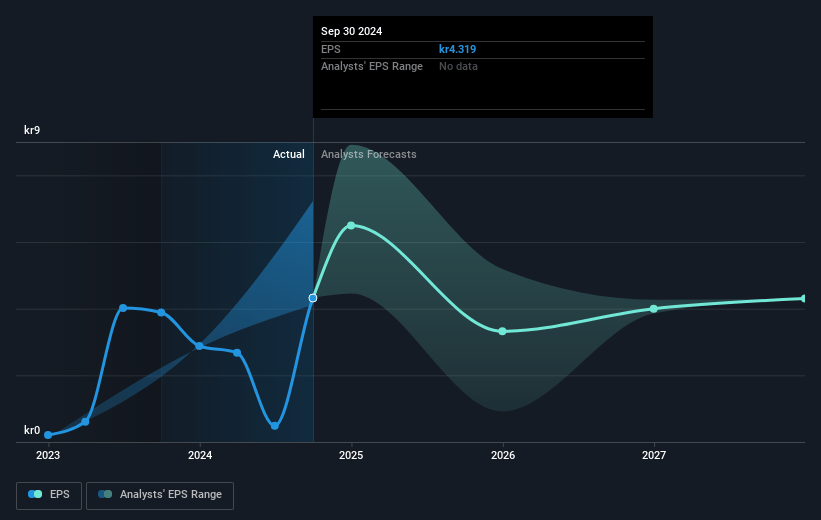

- Analysts expect earnings to reach NOK 240.3 million (and earnings per share of NOK 4.05) by about May 2028, down from NOK 321.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.2x on those 2028 earnings, up from 4.3x today. This future PE is greater than the current PE for the GB Renewable Energy industry at 9.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.94%, as per the Simply Wall St company report.

Magnora Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical risks and uncertainty could disrupt project timelines and increase costs, potentially affecting revenue growth and net margins.

- Delays or legislative changes in key markets like Sweden could slow project progress, impacting earnings and future revenue projections.

- High competition for renewable energy projects might compress margins and affect profitability.

- Increased demand from data centers and AI may outpace energy supply, creating potential shortages that could limit revenue from new developments.

- Exchange rate fluctuations, especially regarding the Norwegian krone (NOK), could impact net earnings from international operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK36.558 for Magnora based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK44.79, and the most bearish reporting a price target of just NOK29.95.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK451.0 million, earnings will come to NOK240.3 million, and it would be trading on a PE ratio of 11.2x, assuming you use a discount rate of 5.9%.

- Given the current share price of NOK22.1, the analyst price target of NOK36.56 is 39.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.