Key Takeaways

- Rapid expansion into both youth and senior segments and swift Doro integration could quickly increase high-margin recurring revenues ahead of market expectations.

- Strong ecosystem and platform leverage, paired with untapped international opportunities and regulatory tailwinds, position Xplora for sustained revenue and margin growth.

- Heavy reliance on kids smartwatches, regulatory risk, intense competition, high customer acquisition costs, and challenging expansion into senior/youth segments undermine long-term growth and profitability.

Catalysts

About Xplora Technologies- An information technology company, develops wearable smart devices and connectivity services for kids and families in Germany, Sweden, Norway, the United Kingdom, Finland, Denmark, Spain, the United States, and France.

- Analyst consensus often points to significant benefit from recurring service revenue expansion as youth and senior products roll out, but this may vastly understate Xplora's potential: full commercial launches across both categories in 2024–2025 could rapidly push subscription penetration far beyond current levels, potentially tripling high-margin service revenue and materially boosting net margins sooner than expected.

- Analysts broadly agree that Doro integration expands Xplora's total addressable market, yet underestimate the speed and ease of platform leverage: the group's rapid technical integration and unique multi-tenant platform approach allow for immediate cross-selling and upselling of value-added services, which could drive recurring revenues and operating leverage at a pace not reflected in consensus earnings models.

- The accelerating adoption of connected devices among children, combined with Xplora's deep proprietary integrations (such as the youth phone's system-layer parental controls), sets the company up as the default safety solution in markets with increasingly strict digital well-being regulations, offering the potential for market share acceleration and premium pricing power that would fuel both revenue growth and margin expansion.

- Xplora's scalable ecosystem strategy, including licensing and "powered by Xplora" initiatives that allow partner and third-party IoT devices to connect through its platform, introduces a new high-margin revenue stream independent of hardware sales, directly enhancing long-term earnings potential and the sustainability of elevated returns on capital.

- Significant international growth opportunities, particularly in North America, Canada, and Asia, remain largely untapped; with robust cash reserves and an established MVNO infrastructure, Xplora can accelerate market entries and rollouts in these regions, sharply expanding revenue while optimizing and sustaining gross margins through increased scale and network effects.

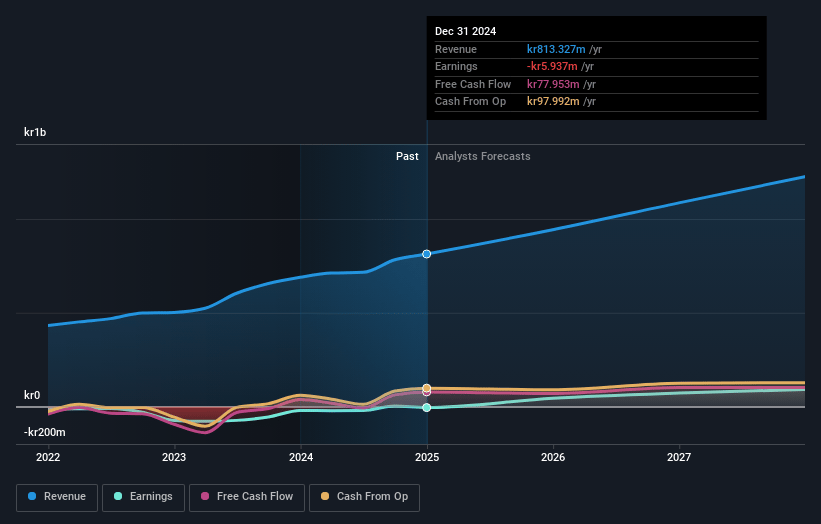

Xplora Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Xplora Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Xplora Technologies's revenue will grow by 41.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -7.6% today to 8.5% in 3 years time.

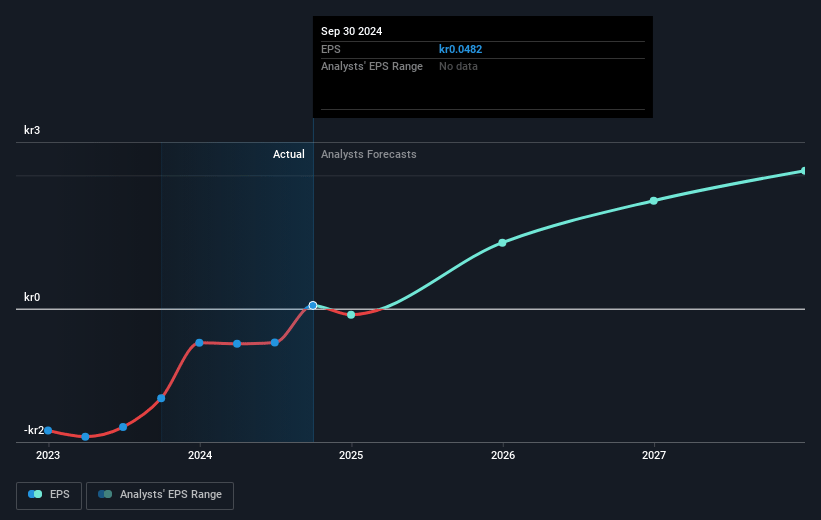

- The bullish analysts expect earnings to reach NOK 251.5 million (and earnings per share of NOK 5.59) by about July 2028, up from NOK -79.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from -26.6x today. This future PE is lower than the current PE for the NO Electronic industry at 41.6x.

- Analysts expect the number of shares outstanding to grow by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.51%, as per the Simply Wall St company report.

Xplora Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy dependence on the kids smartwatch category, with most recurring service revenue and subscriber growth still coming from this segment, exposes Xplora to risk from shifting consumer preferences away from standalone children's wearables as younger children increasingly prefer full-feature smartphones, potentially threatening long-term revenue streams.

- Continued strong regulatory headwinds, such as stricter data privacy laws (GDPR, Children's Online Privacy Protection Act) and growing societal concerns over children's screen time, could lead to future restrictions or requirements that increase compliance costs or limit Xplora's product offerings, negatively impacting net margins and market growth.

- Xplora faces significant competitive pressure from global consumer electronics brands such as Apple, Samsung, and Xiaomi, whose larger R&D investments and more extensive app ecosystems raise the risk of product commoditization for Xplora and could erode gross margins as the industry moves towards multifunctional, AI-integrated devices.

- Elevated customer acquisition costs combined with lagging brand recognition outside of core markets present a challenge to Xplora's ability to efficiently scale new segments (e.g., youth and senior), placing long-term pressure on earnings and profitability even as they expand their addressable market.

- The company's recent acquisition of Doro and expansion into the senior category carries integration and execution risk; with the stated goal of reaching 1 million subscriptions heavily reliant on successful uptake in both youth and senior markets, any delays, missteps, or inability to differentiate versus established competitors would jeopardize future revenue growth and EBITDA targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Xplora Technologies is NOK69.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Xplora Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK69.0, and the most bearish reporting a price target of just NOK48.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NOK3.0 billion, earnings will come to NOK251.5 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 8.5%.

- Given the current share price of NOK47.0, the bullish analyst price target of NOK69.0 is 31.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.