Key Takeaways

- Rising smartphone adoption and intense hardware competition threaten long-term growth and could limit Xplora's ability to sustain revenues in its core wearable segments.

- Data privacy regulations and heavy reliance on niche offerings create operational risks that may constrain scalability and expose Xplora to earnings volatility.

- Overdependence on maturing niche markets, integration challenges, competitive pressures, high debt, and regulatory risks threaten Xplora's growth, profitability, and long-term market position.

Catalysts

About Xplora Technologies- An information technology company, develops wearable smart devices and connectivity services for kids and families in Germany, Sweden, Norway, the United Kingdom, Finland, Denmark, Spain, the United States, and France.

- While Xplora is seeing strong near-term growth from parental concerns about safety and digital wellbeing, especially as seen in the expansion into youth and senior markets, the company still faces the risk that rising smartphone adoption among children and younger teens could shrink the dedicated smartwatch market over the long term, potentially limiting revenue growth as the primary hardware segment matures.

- Although the proliferation of IoT and digital connectivity plays to Xplora's core strengths, tighter data privacy regulations and increasing complexity around compliance in key markets such as the European Union and United States could result in higher costs and operational challenges, weighing on scalability and future margin expansion.

- While international expansion, particularly with Doro's strong positioning in the senior segment, diversifies the company's revenue and broadens the total addressable market, Xplora's reliance on a niche set of product verticals (kids, youth, senior connected devices) leaves it exposed to shifts in consumer preferences, which could result in periods of low or stagnant earnings if new products or services underperform.

- Despite momentum in recurring service revenues and high gross margins on these services, persistent hardware competition and potential commoditization in wearables could put gross profits under pressure, especially if cost inflation or technology-driven obsolescence leads to pricing pressures in Xplora's target segments.

- While regulatory focus on children's and seniors' digital privacy continues to favor Xplora's compliant and specialized platforms, the highly competitive landscape-with larger consumer electronics brands poised to enter or strengthen in the children's and seniors' wearable markets-could cap Xplora's market share gains, possibly flattening long-term net margin and earnings growth.

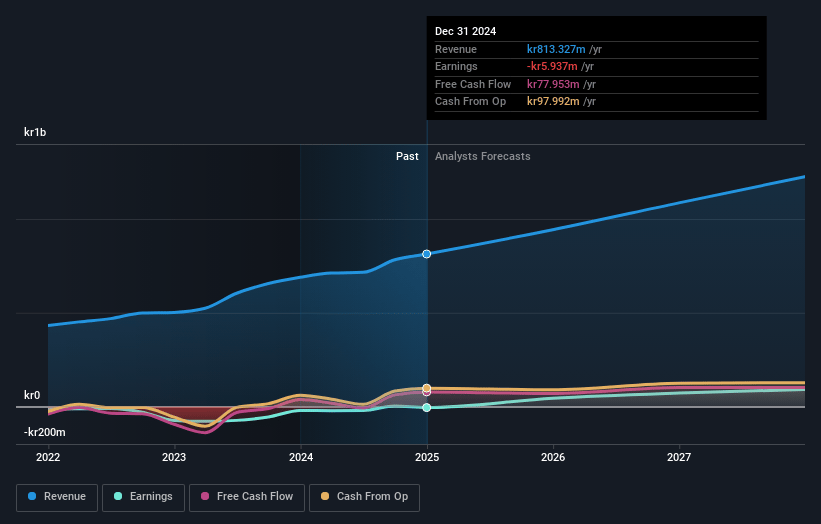

Xplora Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Xplora Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Xplora Technologies's revenue will grow by 32.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -7.6% today to 5.5% in 3 years time.

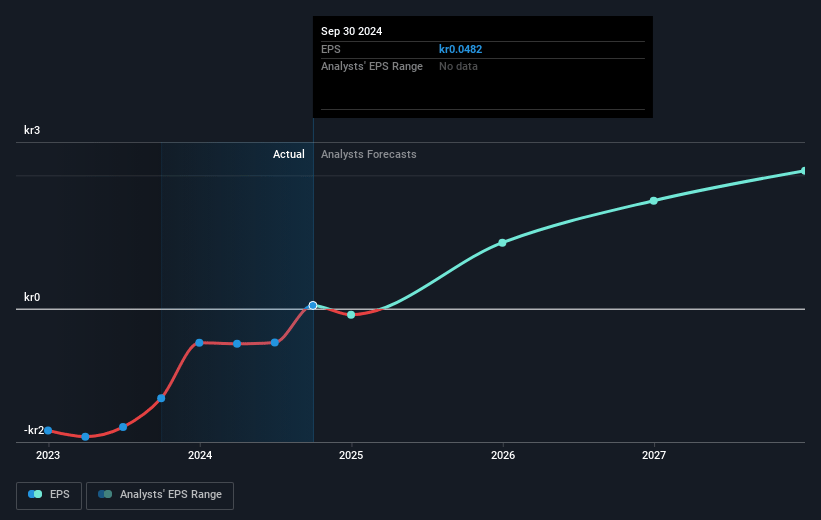

- The bearish analysts expect earnings to reach NOK 131.7 million (and earnings per share of NOK 2.97) by about July 2028, up from NOK -79.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.6x on those 2028 earnings, up from -26.6x today. This future PE is lower than the current PE for the NO Electronic industry at 41.6x.

- Analysts expect the number of shares outstanding to grow by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.51%, as per the Simply Wall St company report.

Xplora Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Xplora's heavy reliance on sustained growth in recurring subscription revenues from a niche product segment, such as kids' smartwatches, exposes the company to risk if consumer preferences shift more rapidly towards smartphones for younger users, potentially reducing future revenues as their core segment matures or contracts.

- The ambitious integration and scaling strategies following the acquisition of Doro introduce significant operational and execution risks, where challenges in culture, processes, and technical implementation could delay or undermine projected synergies, negatively impacting net margins and EBITDA growth.

- Xplora is dependent on successful market expansion in highly competitive regions, including the US and Asia; strong incumbents and potential entry from global electronics brands could increase pricing pressure, erode market share, and impact medium

- to long-term earnings.

- The company's balance sheet now carries a substantial NOK 936 million debt for the Doro acquisition, which may constrain financial flexibility or require higher outflows on interest and repayment, thereby lowering net profits in the coming years if anticipated revenue and subscription growth do not materialize as expected.

- Xplora's growth projections rely on ongoing technological leadership and consumer trust; failure to keep pace with rapid innovations, or new data privacy regulations and increased parental or societal concerns over children's device usage, could hinder adoption and limit both revenue and margin expansion over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Xplora Technologies is NOK48.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Xplora Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK69.0, and the most bearish reporting a price target of just NOK48.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be NOK2.4 billion, earnings will come to NOK131.7 million, and it would be trading on a PE ratio of 21.6x, assuming you use a discount rate of 8.5%.

- Given the current share price of NOK47.0, the bearish analyst price target of NOK48.5 is 3.1% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.