Last Update01 May 25Fair value Increased 2.27%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Crayon's focus on international growth and strategic renewals in public sector deals is expected to boost revenue despite initial low margins.

- Emphasis on CSP business integration and high-growth areas like cybersecurity could enhance revenue, margins, and earnings through strategic partnerships and service expansions.

- Reduced gross profit margins due to market uncertainties and execution issues, alongside strategic changes, pose risks to revenue growth and earnings stability.

Catalysts

About Crayon Group Holding- Operates as an IT consultancy company.

- Crayon's strategic focus on international growth, particularly in public sector software deals, is expected to drive future revenue growth as they scale their presence in key markets such as Germany, France, and the U.S. This is anticipated to enhance revenue despite initial low margins.

- Plans to increase profitability in lower-margin public sector contracts by expanding software sales, providing value-added services, and implementing strategic renewals are likely to improve net margins over the long term.

- A clear focus on scaling Crayon's CSP (Cloud Solution Provider) business and integrating AWS and Google Cloud offerings are expected to drive future growth in revenue and accretive margins, which could potentially boost earnings.

- Enhanced focus on high-growth areas such as cybersecurity and cloud modernization, supported by strategic hiring, is anticipated to drive growth in consulting revenue and improve EBITDA margins due to the higher-margin nature of these services.

- The strategic combination with SoftwareOne may create significant value opportunities by expanding the customer footprint and enhancing service offerings, potentially resulting in increased revenue, improved margins, and higher earnings due to synergies.

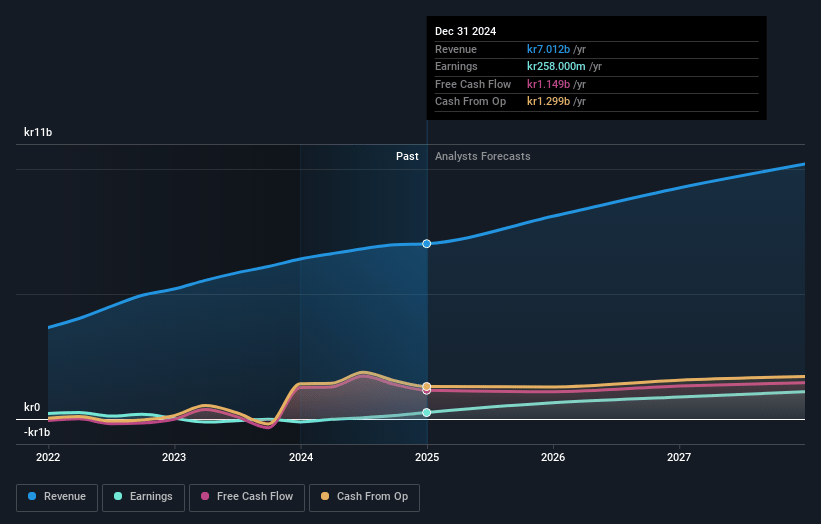

Crayon Group Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Crayon Group Holding's revenue will grow by 12.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 9.7% in 3 years time.

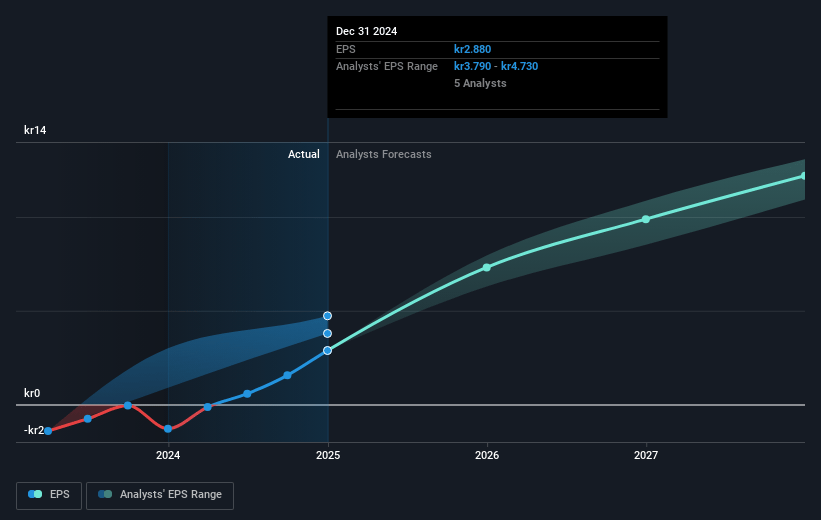

- Analysts expect earnings to reach NOK 973.8 million (and earnings per share of NOK 10.87) by about May 2028, up from NOK 258.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NOK1.1 billion in earnings, and the most bearish expecting NOK814 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, down from 42.4x today. This future PE is lower than the current PE for the NO Software industry at 40.3x.

- Analysts expect the number of shares outstanding to grow by 4.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

Crayon Group Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The unexpected Q4 '24 gross profit shortfall with a decline in margins, especially from public sector contracts done at lower margins than historically experienced, raises concerns about near-term revenue pressures, impacting net margins.

- The Microsoft effect and changes in Microsoft's incentive programs introduced market uncertainties and reduced gross profit margins, posing risks to earnings stability.

- The lack of execution in the Enterprise Software segment due to a lower demand environment and weak sales execution could impact future revenue growth and profitability.

- The closure of non-core operations such as the South Korea business and a call center in the Philippines, although aiming for strategic focus, suggests potential challenges in maintaining revenue streams and controlling costs.

- The ongoing strategic merger talks with SoftwareOne, while presenting potential growth opportunities, also create uncertainty among employees and could potentially distract management, affecting operational efficiency and future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK133.667 for Crayon Group Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK160.0, and the most bearish reporting a price target of just NOK112.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK10.0 billion, earnings will come to NOK973.8 million, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 7.9%.

- Given the current share price of NOK124.0, the analyst price target of NOK133.67 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.