Key Takeaways

- Aker Solutions' first-mover advantage in carbon capture and project digitalization positions it for rapid margin expansion and leadership in a growing, policy-driven decarbonization market.

- Transition to recurring contracts and a global, diversified pipeline supports sustainable revenue growth, top-line expansion, and resilience through the energy transition and infrastructure megatrends.

- Heavy dependence on oil and gas, execution and margin risks, capital access pressures, and slow renewables growth threaten long-term financial stability and returns.

Catalysts

About Aker Solutions- Provides solutions, products, systems, and services to the oil and gas industry in Norway, the United States, Brazil, the United Kingdom, Malaysia, Angola, Brunei, Canada, India, and internationally.

- Analyst consensus sees high order intake in offshore wind and carbon capture as fueling future revenue growth, but this likely underestimates the compounding effect of Aker's successful project delivery and first-mover advantage in CCS, which positions the company to capture outsized market share and accelerate earnings growth dramatically as the decarbonization agenda gains pace globally.

- Analysts broadly agree that the transition to balanced risk-reward contracts will improve margins, but this view overlooks the structural margin uplift as Aker replaces all legacy lump-sum work with recurring, incentivized contracts, unlocking substantial, sustained EBITDA and net margin expansion from 2026 onward.

- The company's early, proven application of digitalization-highlighted by autonomous drone inspections and data platforms-is set to drive step-change operational efficiency, potentially enabling best-in-class cost structure and margin resilience as digital solutions are scaled across the portfolio.

- Successive breakthroughs and high-profile reference projects in carbon capture and storage uniquely position Aker to dominate as global capacity for carbon capture grows nearly tenfold by 2030, making Aker a structural winner in an explosive, policy-supported market and delivering exponential growth in long-duration revenues.

- With a robust, geographically diversified tender pipeline exceeding NOK 80 billion and an expanding footprint in Asia-Pacific through local engineering hubs, Aker is poised to capture outsized revenue growth from both the global energy transition and infrastructure investment megatrends-substantially enlarging its long-term addressable market while supporting top-line expansion.

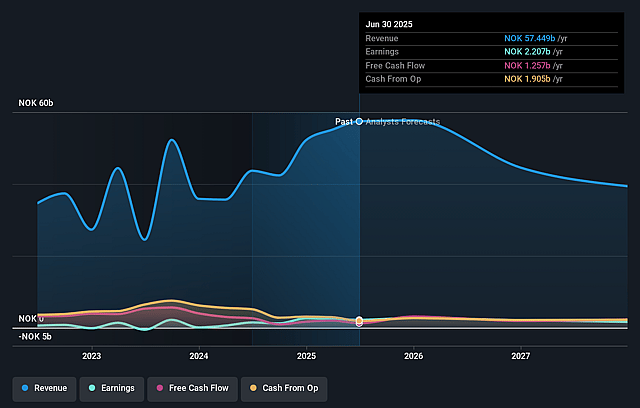

Aker Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Aker Solutions compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Aker Solutions's revenue will decrease by 9.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.8% today to 5.1% in 3 years time.

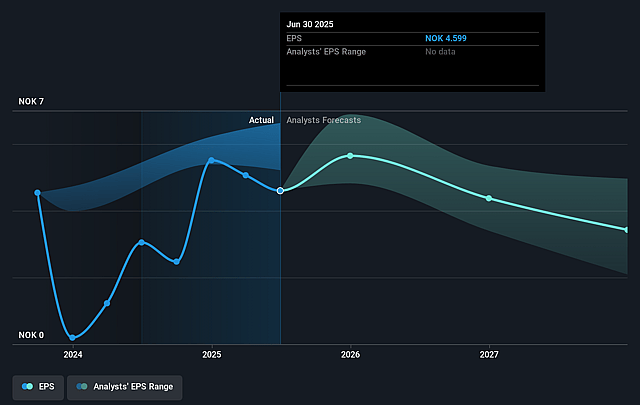

- The bullish analysts expect earnings to reach NOK 2.1 billion (and earnings per share of NOK 4.47) by about September 2028, down from NOK 2.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from 6.8x today. This future PE is greater than the current PE for the GB Energy Services industry at 6.7x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.21%, as per the Simply Wall St company report.

Aker Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global transition to renewable energy and increasing regulatory pressure on fossil fuel projects may lead to significant long-term declines in demand for Aker Solutions' core oil and gas engineering and project services, putting downward pressure on its forward revenue and potential for order backlog replenishment.

- The company's heavy reliance on large, technically complex lump sum projects, as reflected by ongoing challenges and margin drag in its Renewables and Field Development segment, exposes it to substantial execution risks and the likelihood of cost overruns or commercial disputes, which could continue to compress net margins and impact earnings volatility.

- Growing ESG mandates and the risk of reduced institutional investor appetite for traditional oilfield service providers may increase the company's cost of capital and could restrict access to new equity or debt, affecting future ROE and financial flexibility.

- Intensifying competition from both established global peers and new entrants in renewables as well as traditional oil and gas could force Aker Solutions to accept tighter contract terms or lower pricing, reducing project margins and slowing overall profitability and earnings growth.

- There are ongoing challenges in profitably scaling the renewables and low-carbon business segments, highlighted by a backlog still dominated by oil and gas and a limited track record in renewables, which could result in slower-than-expected revenue growth and threaten long-term returns if industry transition outpaces Aker Solutions' diversification efforts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Aker Solutions is NOK43.33, which represents two standard deviations above the consensus price target of NOK33.88. This valuation is based on what can be assumed as the expectations of Aker Solutions's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK44.0, and the most bearish reporting a price target of just NOK29.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NOK42.4 billion, earnings will come to NOK2.1 billion, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.2%.

- Given the current share price of NOK30.88, the bullish analyst price target of NOK43.33 is 28.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.