Key Takeaways

- Heavy reliance on declining oil and gas markets, rising carbon costs, and client concentration threaten revenue stability and profitability.

- Uncertain renewable growth, intensified competition, and required tech investment may pressure margins and challenge future earnings reliability.

- Strong performance and innovation across energy sectors, digitalization, and risk management positions the company for stable, growing, and increasingly predictable profitability.

Catalysts

About Aker Solutions- Provides solutions, products, systems, and services to the oil and gas industry in Norway, the United States, Brazil, the United Kingdom, Malaysia, Angola, Brunei, Canada, India, and internationally.

- The accelerating shift away from oil and gas infrastructure is set to erode Aker Solutions' core revenue base over the coming decade, as even its current tender pipeline remains dominated by traditional hydrocarbons projects while long-term demand for these services declines, raising risks of sustained revenue stagnation or decline.

- Persistent regulatory tightening and rising carbon compliance costs threaten to erode profitability for oil-linked contracts, putting pressure on Aker Solutions' net margins as governments introduce stricter carbon pricing and emission limits that disproportionately increase costs for legacy energy service providers.

- The company remains highly exposed to a small concentration of major energy clients, especially Aker BP; any loss, renegotiation, or delay of these critical contracts could cause significant volatility or sharp declines in reported revenues and earnings, undermining the reliability of its backlog and forward growth visibility.

- Increased competition from low-cost international service providers and continued technological disruption-requiring ongoing investment in digitalization and automation-are likely to accelerate margin compression and may necessitate substantial capital expenditures that will exert further pressure on long-term net earnings and return on capital.

- Despite incremental progress in renewables and CCS, the company's pace of diversification and ability to deliver consistently higher-margin, large-scale renewable projects is uncertain, given execution risks and the need to win significant new orders to compensate for the structural decline in oil and gas-potentially leading to underperformance against revenue and profitability expectations embedded in the current stock valuation.

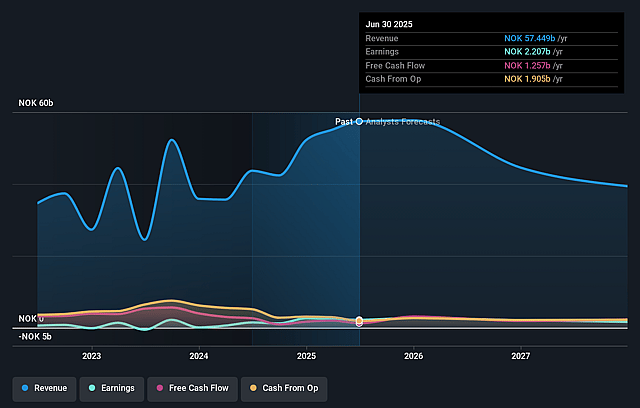

Aker Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Aker Solutions compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Aker Solutions's revenue will decrease by 19.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 3.8% today to 3.0% in 3 years time.

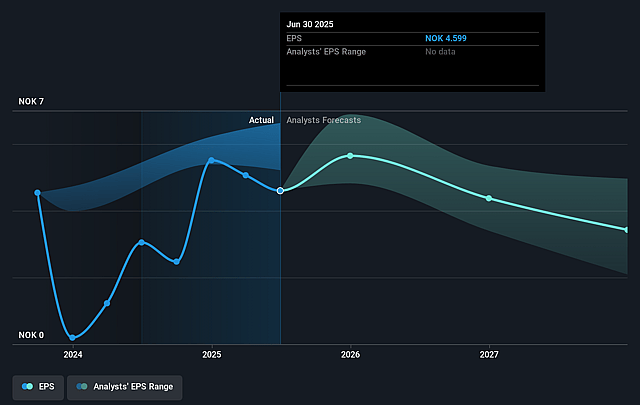

- The bearish analysts expect earnings to reach NOK 910.9 million (and earnings per share of NOK 1.89) by about September 2028, down from NOK 2.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, up from 6.6x today. This future PE is greater than the current PE for the GB Energy Services industry at 6.8x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.14%, as per the Simply Wall St company report.

Aker Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Aker Solutions continues to deliver solid financial and operational performance, reporting a 20% year-over-year revenue increase in the second quarter and expecting 2025 revenues to exceed NOK 55 billion, which points to resilience in revenue growth supported by a robust backlog and strong market demand.

- The company is securing and executing long-term contracts in both oil and gas and renewables, with a significant share of Life Cycle contracts and frame agreements in the tender pipeline, which provides improved earnings visibility and stability for future net margins and profits.

- Rapid development and success in the carbon capture and storage (CCS) market, showcased by projects like Brevik and Celsio and further growth opportunities signaled by a tenfold global capacity increase projected in the coming years, positions Aker Solutions to benefit from expanding addressable markets, supporting top-line growth and margin expansion.

- Advances in digitalization, operational innovation, and strategic alliances-such as using Cognite Data Fusion and autonomous drones in project execution-are improving project efficiency, reducing risk, and driving cost savings, which are likely to enhance both gross and net margin performance over time.

- The transition to Generation 2 project execution and a more selective approach to contract risk, along with positive client relationships and mature risk-sharing frameworks in renewables, are expected to improve margins and reduce volatility, contributing to more predictable earnings and healthier profitability in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Aker Solutions is NOK29.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Aker Solutions's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK44.0, and the most bearish reporting a price target of just NOK29.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be NOK30.0 billion, earnings will come to NOK910.9 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of NOK30.4, the bearish analyst price target of NOK29.0 is 4.8% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Aker Solutions?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.