Key Takeaways

- Accelerating renewable energy shifts and stricter regulations threaten Aker BP's demand outlook, cost structure, and long-term profitability.

- High capital intensity, geographic concentration, and global oil oversupply heighten risks to cash flow, revenue stability, and dividend growth.

- Low-cost operations, strong project discipline, and industry-leading sustainability initiatives position the company for resilient cash flow, growth investment, and enhanced shareholder returns.

Catalysts

About Aker BP- Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

- Rapid acceleration in the global transition to renewable energy and electrification could undermine demand for oil and gas long before Aker BP's capital-intensive expansion projects reach peak production, resulting in persistently weaker revenue growth and potential long-term demand destruction even as new fields come online.

- Intensifying regulatory scrutiny, heightened carbon taxes, and stricter emissions compliance, especially across Europe, are likely to significantly raise ongoing operating costs and erode net margins for North Sea producers such as Aker BP, directly constraining earnings resilience in the face of tightening environmental policy.

- Aker BP's dependence on the Norwegian Continental Shelf exposes it to severe geographical concentration risk, limiting revenue diversification and exposing earnings to local operational, logistical, and regulatory setbacks, with future cash flow and dividend growth at risk if region-specific challenges materialize.

- High and escalating capital expenditure on both legacy and new developments, combined with the reality of maturing assets and field decline rates, means that return on capital and free cash flow could be squeezed over time, particularly if recent exploration success or cost containment efforts fail to consistently offset increased spending and higher breakeven levels.

- Global oil oversupply from persistent advances in shale and non-OPEC production, coupled with disruptive technologies like electric vehicle adoption, threaten long-term benchmark price stability and can compress Aker BP's realized prices, reducing top-line revenues and putting sustained pressure on profitability and cash generation even if operational execution remains strong.

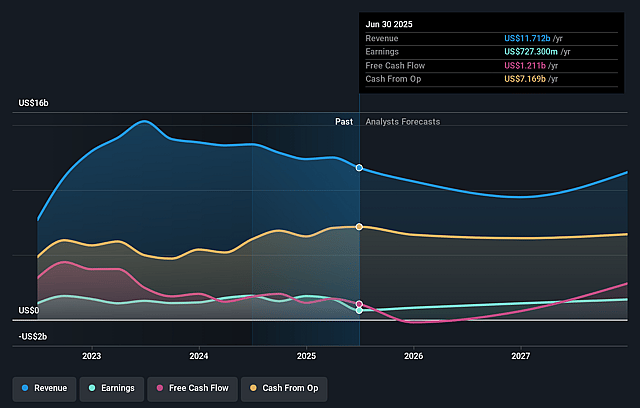

Aker BP Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Aker BP compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Aker BP's revenue will decrease by 4.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.2% today to 13.4% in 3 years time.

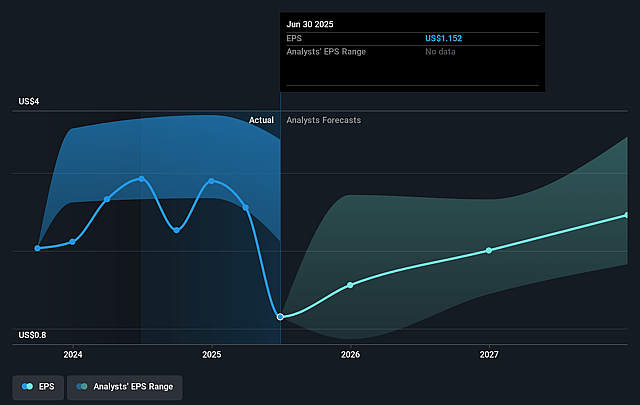

- The bearish analysts expect earnings to reach $1.4 billion (and earnings per share of $2.05) by about September 2028, up from $727.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, down from 21.5x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 8.5x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.91%, as per the Simply Wall St company report.

Aker BP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued success in exploration, particularly in the Yggdrasil area and surrounding tie-backs, could add significant new resources at a low incremental cost, supporting production growth and potentially boosting revenues and long-term cash flows.

- Industry-leading low emissions intensity and an active decarbonization strategy position Aker BP favorably with regulators and ESG investors, which could help sustain lower costs of capital and stronger net margins despite broader fossil fuel divestment trends.

- Disciplined project execution, demonstrated by limited cost overruns (3% to 4% on like-for-like basis for major projects) and robust contingency planning, may mitigate inflationary pressures, reducing risks to earnings and preserving free cash flow.

- Strong operational efficiency with production costs among the lowest in the industry, combined with resilient financial health (ample liquidity and low leverage), increases the company's flexibility to invest in growth, offsetting maturity-driven declines and supporting dividend growth which positively impacts shareholder returns.

- The company's clear pathway to sustain or even increase production above 500,000 barrels per day beyond 2030, underpinned by advanced digitalization, technological improvements in exploration and drilling, and a deep reserve base, provides structural support for higher long-term revenues and stable or growing earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Aker BP is NOK191.33, which represents two standard deviations below the consensus price target of NOK256.82. This valuation is based on what can be assumed as the expectations of Aker BP's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK300.0, and the most bearish reporting a price target of just NOK190.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $10.2 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 6.9%.

- Given the current share price of NOK248.2, the bearish analyst price target of NOK191.33 is 29.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.