Key Takeaways

- Technological leadership and rapid project execution position Aker BP for industry-beating margins, accelerated production growth, and recurring upside to cash flow and returns.

- Concentration in Norway, strong ESG credentials, and low carbon intensity secure market premiums, investment flows, and sustained earnings resilience amid regional energy security priorities.

- Heavy reliance on mature North Sea assets and oil-focused growth strategy exposes Aker BP to regulatory, demand, and execution risks that threaten future profitability and stability.

Catalysts

About Aker BP- Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

- While analysts broadly agree Aker BP can sustain production above 500,000 barrels per day through 2030 via major projects and incremental tiebacks, the scale of ongoing exploration success-especially with technological breakthroughs at Yggdrasil and the potential unlocking of the Frigg area-indicates the production base could materially exceed conservative estimates, underpinning sharp upside surprises in long-term revenues and operating cash flow.

- The consensus sees Yggdrasil as technologically advanced and low-cost, but this view understates the rapidly compounding margin impact as Aker BP leverages proprietary digitalization, highly standardized infrastructure, and pioneering drilling techniques, allowing for faster, lower-cost, and lower-emission resource additions that can push net margins and long-term project returns decisively above peers.

- Aker BP's unique asset concentration in Norway, a highly stable and reliable supplier to Europe, positions it to capture price and market premium as energy security concerns persist in the region, supporting higher realized selling prices and sales stability that can boost revenue per barrel and reduce earnings volatility.

- Its industry-leading emissions intensity and acceleration of electrified, low-carbon developments are likely to attract inflows from ESG-focused institutional capital and lower its cost of capital more than expected, translating into higher valuation multiples, reduced financing costs, and more competitive reinvestment economics over the investment cycle.

- The company's demonstrable ability to rapidly derisk and shorten the timeline between discovery and production-enabled by digital, modular, and alliance execution models-could set a new pace for reserves monetization and project cycle times, driving more frequent inflection points in free cash flow and earnings growth than currently modeled by the market.

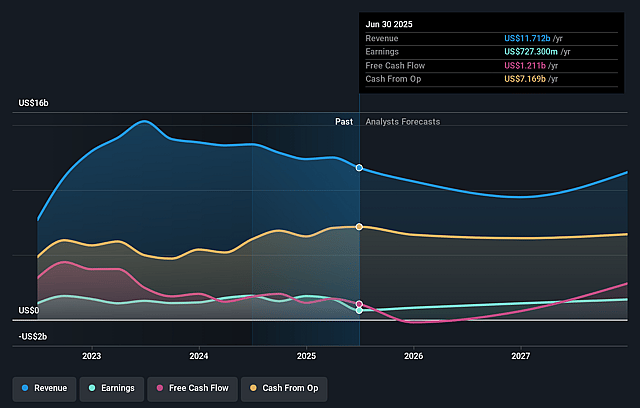

Aker BP Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Aker BP compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Aker BP's revenue will grow by 4.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.2% today to 16.1% in 3 years time.

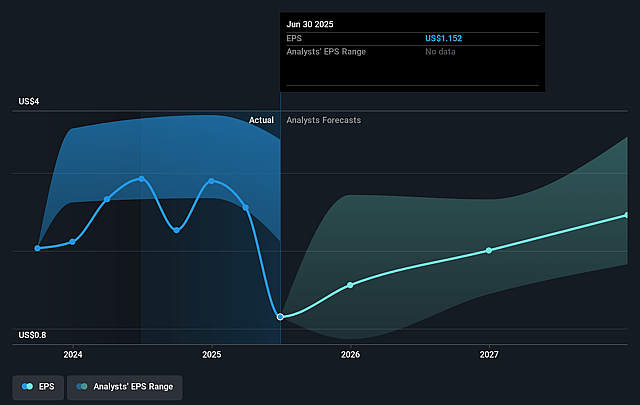

- The bullish analysts expect earnings to reach $2.1 billion (and earnings per share of $3.89) by about September 2028, up from $727.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, down from 21.7x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 8.3x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.01%, as per the Simply Wall St company report.

Aker BP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global shift towards decarbonization and increasing renewable energy adoption poses a long-term risk by structurally reducing oil and gas demand, likely pressuring Aker BP's future revenues and valuations as their growth strategy remains heavily dependent on new North Sea oil projects and continued high production.

- Heavy exposure to mature North Sea fields and reliance on aggressive infill drilling and tiebacks to sustain production levels means Aker BP faces ongoing challenges with resource maturation and natural field decline, creating risk of declining future revenues and tighter EBITDA margins as production becomes more costly and difficult to maintain.

- Rising regulatory pressures, including higher carbon taxes, stricter emissions targets, and potentially tighter European investment restrictions for fossil fuel firms, could increase Aker BP's operating costs and restrict access to new capital over time, directly impacting net profit margins and longer-term earnings growth.

- Elevated capital expenditures, cost inflation (notably a 6% current project CapEx increase and pronounced macroeconomic/currency volatility), and dependence on major development projects (e.g., Johan Sverdrup Phase 3, Yggdrasil, Valhall PWP-Fenris) expose the company to significant execution risk from cost overruns and delays, which can erode net margins and depress free cash flow if project timelines or budgets slip.

- Long-term oil demand uncertainty, coupled with the anticipated shift to electric vehicles and alternative fuels, suggests that even successful exploration and operational execution may not offset the industry's structural weakening pricing power, elevating revenue volatility and threatening Aker BP's ability to deliver sustained shareholder returns as currently planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Aker BP is NOK300.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Aker BP's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK300.0, and the most bearish reporting a price target of just NOK190.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $13.2 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 7.0%.

- Given the current share price of NOK248.5, the bullish analyst price target of NOK300.0 is 17.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.