Key Takeaways

- AutoStore's transition to a platform offering full-spectrum automation and AI positions it for strong, recurring revenues and margin expansion via high customer stickiness and premium solutions.

- Rapid growth in e-commerce and automation needs, supported by a sizeable installed base, creates strong network effects and positions AutoStore for outsized market share gains and operating leverage.

- Macroeconomic uncertainty, reliance on existing regions, and a shift to subscription-based revenue may squeeze margins and threaten long-term growth and competitiveness.

Catalysts

About AutoStore Holdings- Provides robotic and software technology in Norway, Germany, Europe, the United States, Asia, and internationally.

- Analyst consensus sees the AutoStore-as-a-Service (ASaaS) model as a major driver of recurring revenue, but this view may actually underappreciate the structural upside, since multi-decade customer stickiness and built-in expansion clauses could lead to revenue compounding far beyond typical SaaS contract lengths, creating highly visible, accelerating top-line and earnings growth.

- While analysts widely anticipate product innovation like CarouselAI and Essentials Software to drive annual recurring revenue, this is likely too conservative, as AutoStore's move beyond cube storage into full-spectrum automation and AI-powered solutions positions it as an indispensable platform at the heart of customers' automation strategies, potentially unlocking premium pricing, category leadership, and margin expansion.

- The global surge in e-commerce and the shift to micro-fulfillment and urban distribution centers are structurally expanding AutoStore's addressable market at a faster-than-expected rate, positioning the company to capture outsize share gains, drive sustained double-digit revenue growth, and outpace automation peers, given its space-efficient, modular systems.

- Intensifying automation adoption amid persistent labor shortages and rising costs increases urgency for AutoStore's solutions, suggesting that once macro uncertainty abates, pent-up demand could drive a rapid rebound in orders and significant operating leverage, accelerating both revenue growth and net margin improvement.

- AutoStore's installed base of 1,150+ customers and over 1,700 systems forms a powerful network effect for software upgrades, data analytics, and AI-enabled features, laying the groundwork for exponential growth in high-margin recurring revenues and structurally higher EBITDA margin over the next decade.

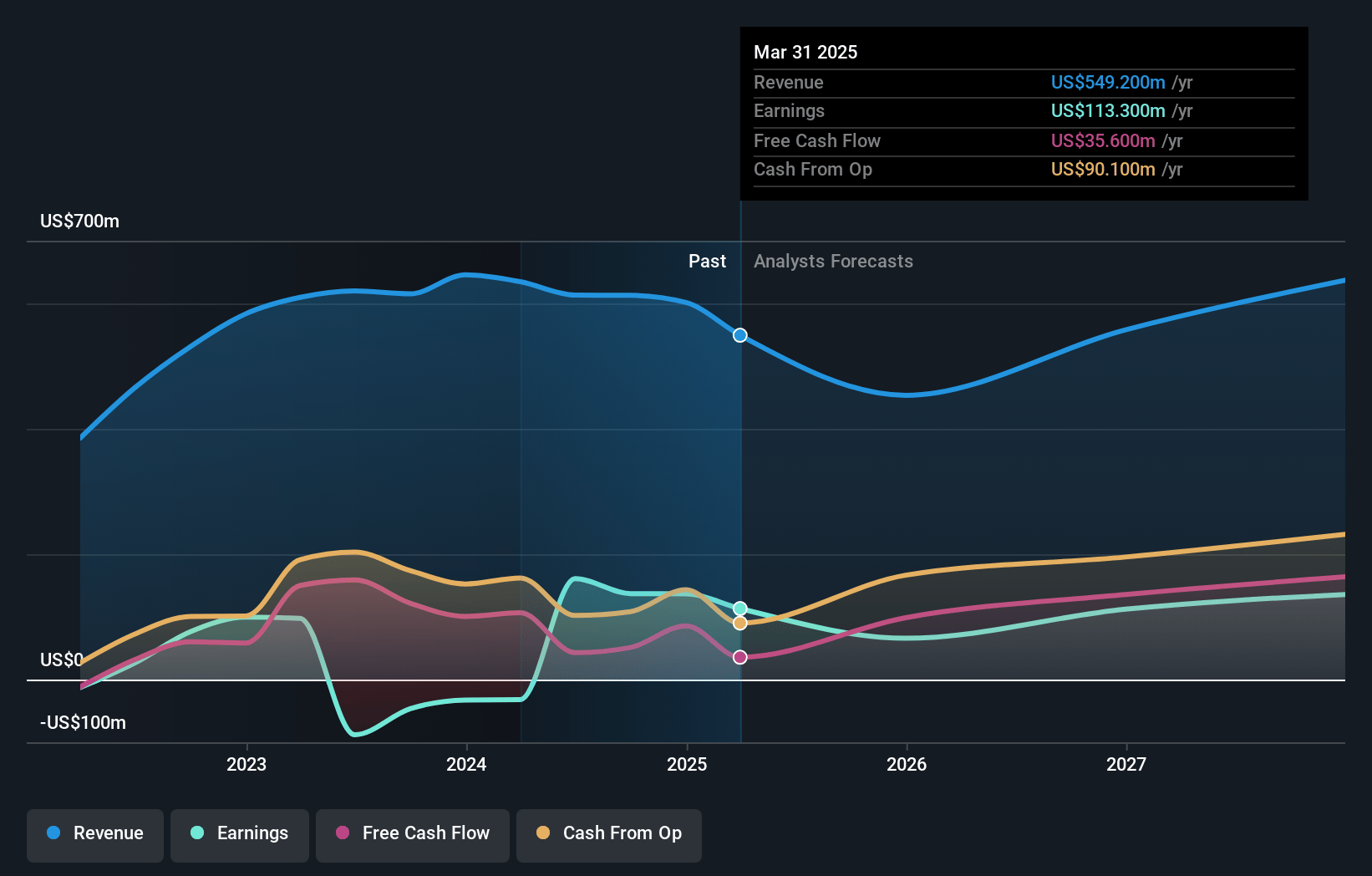

AutoStore Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AutoStore Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AutoStore Holdings's revenue will grow by 15.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 20.6% today to 26.6% in 3 years time.

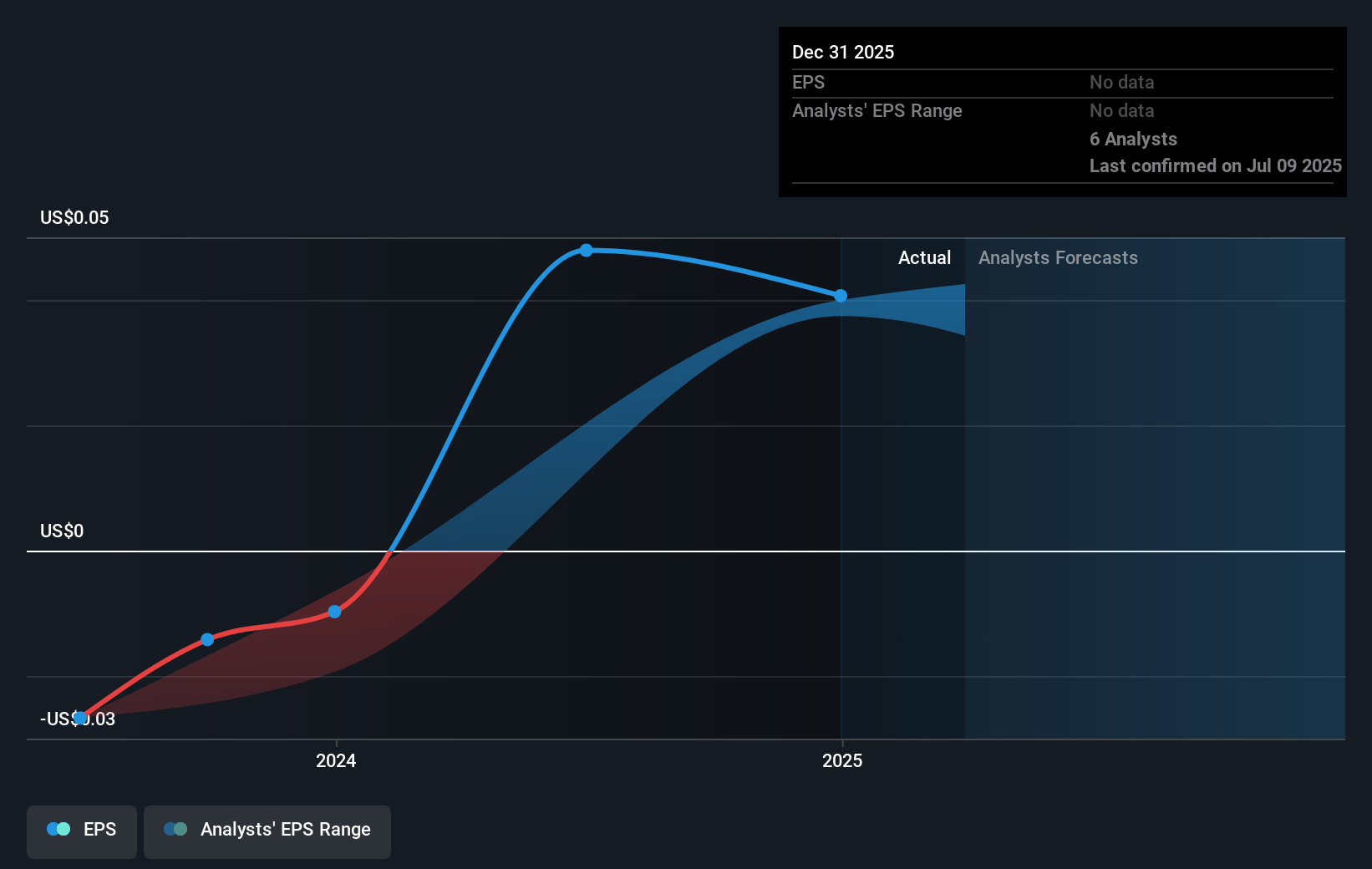

- The bullish analysts expect earnings to reach $224.4 million (and earnings per share of $nan) by about July 2028, up from $113.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.8x on those 2028 earnings, up from 19.3x today. This future PE is greater than the current PE for the NO Machinery industry at 27.2x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.77%, as per the Simply Wall St company report.

AutoStore Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The text highlights persistent geopolitical and macroeconomic volatility, including rising tariffs and deglobalization, which is leading to customer hesitancy, delayed deals, and a contraction in the warehouse automation market that could reduce AutoStore's future revenue growth.

- Growing customer caution and a trend of pushing backlog to future quarters-fueled by economic and trade uncertainties-indicate revenue recognition risk and potential gaps in short

- and medium-term revenue, which could challenge earnings predictability.

- The AutoStore-as-a-Service model, while creating long-term recurring revenue, extends revenue recognition over several years rather than the traditional upfront model, potentially resulting in shorter-term revenue and cash flow compression and increasing near-term margin pressure.

- Cost-saving measures, including a $10 million annual expense reduction and R&D project cutbacks, could temporarily protect margins but may hamper AutoStore's ability to keep pace with rapid technological change and evolving customer needs, possibly eroding long-term competitiveness and future earnings potential.

- The company remains highly exposed to existing customers and certain regions (Europe is over 65% of revenue), heightening vulnerability to changes in client behavior, market saturation, or regional downturns, which could lead to revenue concentration risk and affect overall financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AutoStore Holdings is NOK15.01, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AutoStore Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK15.01, and the most bearish reporting a price target of just NOK4.85.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $843.6 million, earnings will come to $224.4 million, and it would be trading on a PE ratio of 27.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of NOK6.61, the bullish analyst price target of NOK15.01 is 56.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives