Key Takeaways

- Ongoing global uncertainty, trade barriers, and shifting labor dynamics may delay automation investments and weaken future demand for AutoStore's solutions.

- Patent risks and competitive pressures threaten pricing power and margins, while cyclical project delays could further dampen revenue and profitability.

- Transition to a subscription model, industry-leading margins, expanding installed base, and product innovation position AutoStore for resilient growth and profitability despite macroeconomic challenges.

Catalysts

About AutoStore Holdings- Provides robotic and software technology in Norway, Germany, Europe, the United States, Asia, and internationally.

- Persistent macroeconomic and geopolitical uncertainty, including volatile global trade flows and the increasing introduction of tariffs, is leading customers to delay or suspend automation investments, which is likely to result in postponed or reduced order intake and directly suppress future revenue growth for AutoStore.

- Prolonged normalization in labor markets and potential moderation of wage inflation in key developed markets could diminish the return on investment for warehouse automation, removing a major catalyst for customer adoption and softening long-term demand, with negative implications for top-line sales.

- Escalating trade barriers and protectionist policies, if sustained or intensified, may raise input costs through higher import duties or raw material expenses, compressing already pressured gross margins and ultimately driving down net margins over the medium to long term.

- The risk of patent expiration and ongoing IP litigation, especially against major competitors like Ocado, threatens AutoStore's technology moat and pricing power, potentially eroding gross margins and placing downward pressure on future earnings as competitors catch up technologically or undercut on price.

- Capital expenditure cyclicality in logistics and warehousing-already impacting customers given the current uncertainty-may trigger a multi-year downturn or extended delays in projects, causing a contraction in AutoStore's backlog and resulting in persistently weaker revenue conversion and profitability.

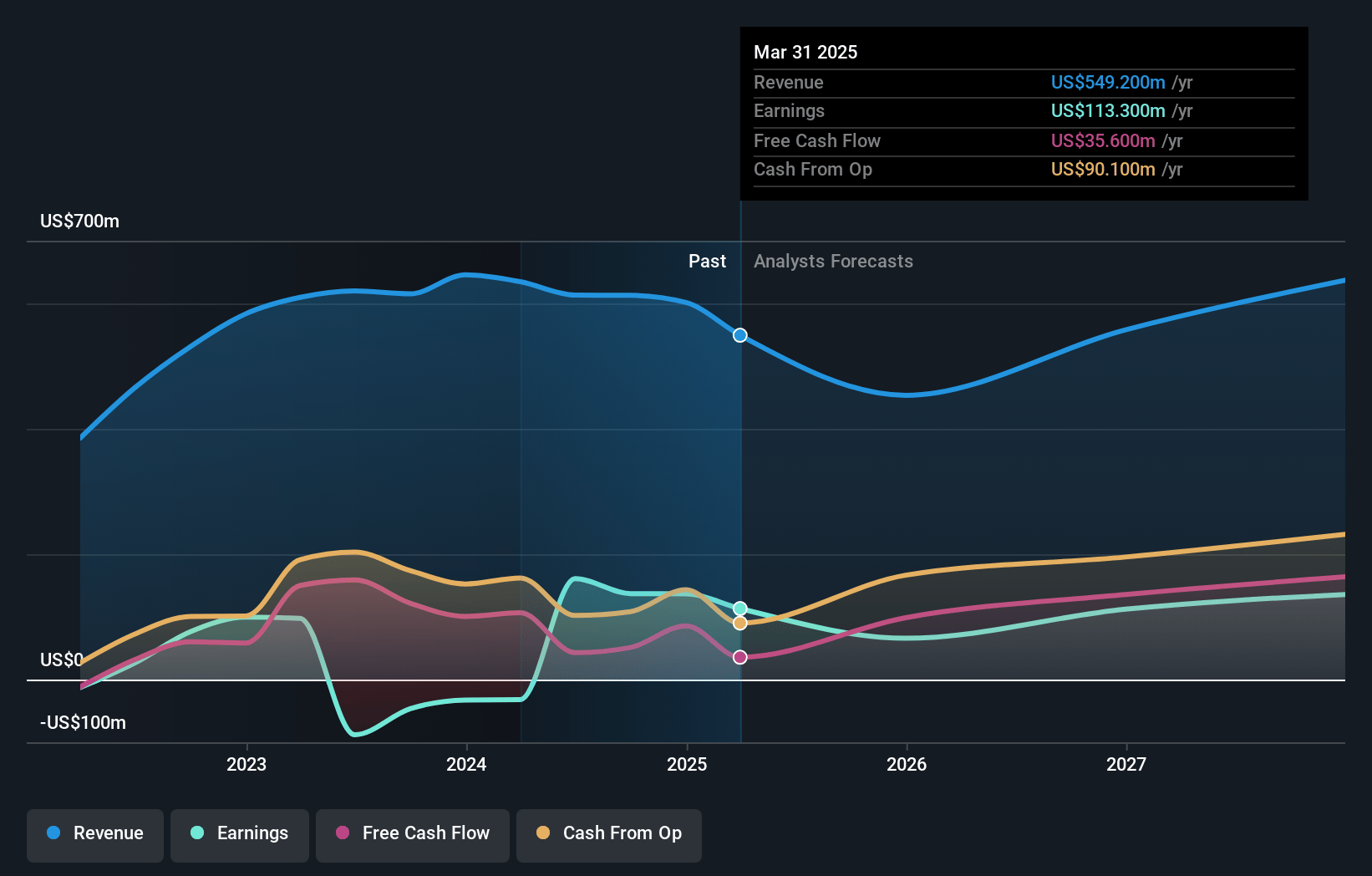

AutoStore Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on AutoStore Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming AutoStore Holdings's revenue will decrease by 4.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 20.6% today to 6.9% in 3 years time.

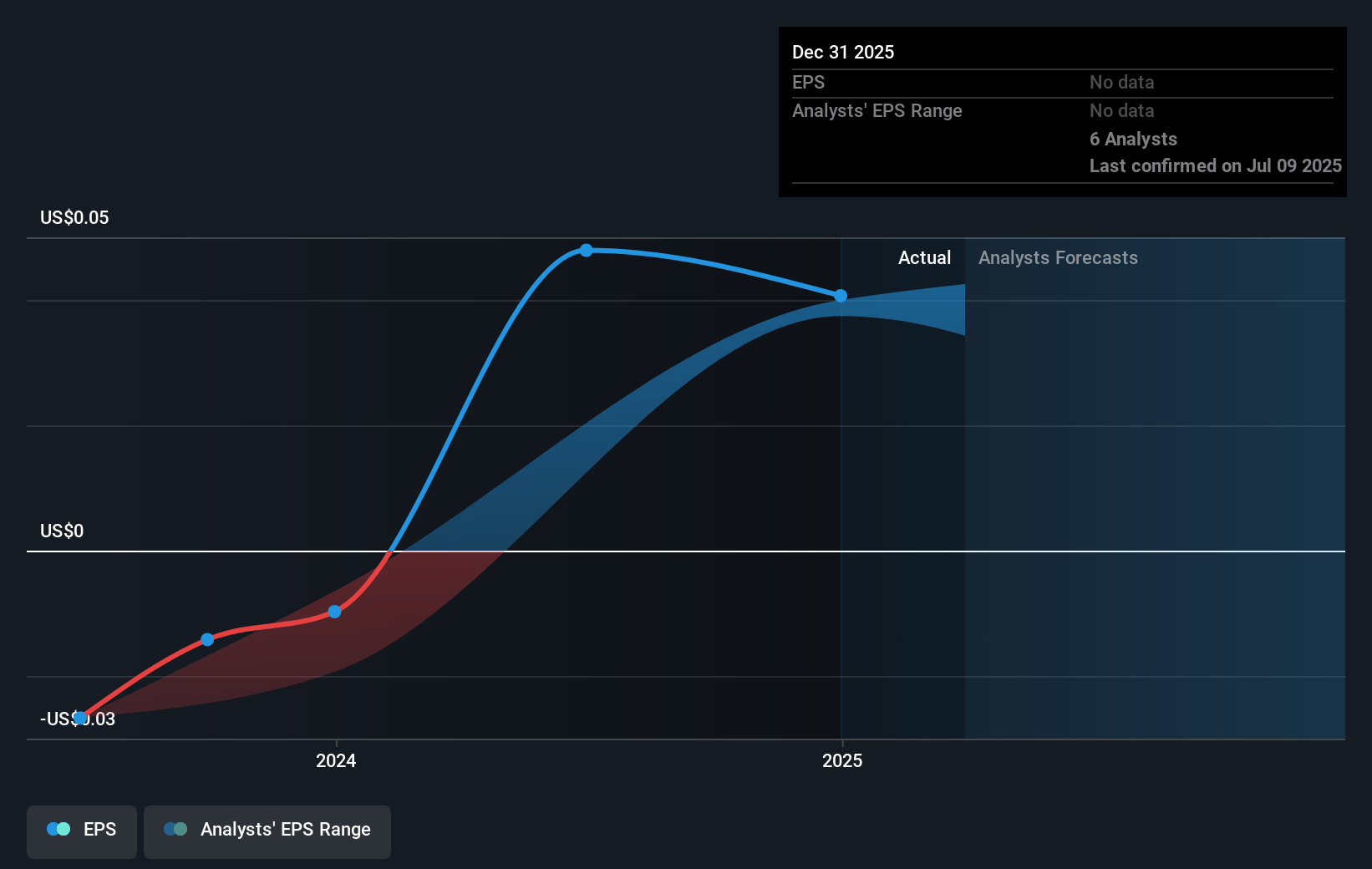

- The bearish analysts expect earnings to reach $33.0 million (and earnings per share of $nan) by about July 2028, down from $113.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 60.0x on those 2028 earnings, up from 19.8x today. This future PE is greater than the current PE for the NO Machinery industry at 27.0x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.75%, as per the Simply Wall St company report.

AutoStore Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's transition to a subscription-based AutoStore-as-a-Service model boosts recurring revenue, broadens customer accessibility, and has contract terms often running 7 to 10 years with cumulative contract values higher than the traditional CapEx model, which enhances revenue visibility and may increase long-term top-line growth.

- Despite macroeconomic and geopolitical uncertainty, AutoStore maintains industry-leading gross margins above 70% for five consecutive quarters, which demonstrates strong pricing power and operational efficiency, supporting continued robust net margins and earnings resilience.

- The company's expanding installed base and land-and-expand strategy with over 1,700 systems deployed and 78,500 robots in 58 countries creates opportunities for upselling, cross-selling, and deepening high-margin software and service revenues, which could offset market cyclicality and drive margin improvement.

- Product innovation remains a core strength, including launches like CarouselAI (AI-powered piece picking), Essentials Software Package, and expansion of Pio (plug-and-play for smaller businesses), positioning AutoStore to capture growth in AI-driven warehouse automation and micro-fulfillment trends, thus supporting future revenue and earnings growth.

- With a strong cash position of $282 million and total liquidity of $432 million, along with cost efficiency programs expected to reduce annualized operating expenses by $10 million, AutoStore is well-capitalized to invest in innovation, weather downturns, and emerge stronger from periods of macroeconomic turbulence, supporting long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for AutoStore Holdings is NOK4.85, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AutoStore Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK15.01, and the most bearish reporting a price target of just NOK4.85.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $478.1 million, earnings will come to $33.0 million, and it would be trading on a PE ratio of 60.0x, assuming you use a discount rate of 7.7%.

- Given the current share price of NOK6.88, the bearish analyst price target of NOK4.85 is 42.1% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives