Last Update 06 Sep 25

Both the discount rate and future P/E multiple for SpareBank 1 Sør-Norge remained largely unchanged, resulting in the consensus analyst price target holding steady at NOK188.75.

Valuation Changes

Summary of Valuation Changes for SpareBank 1 Sør-Norge

- The Consensus Analyst Price Target remained effectively unchanged, at NOK188.75.

- The Discount Rate for SpareBank 1 Sør-Norge remained effectively unchanged, moving only marginally from 9.94% to 10.06%.

- The Future P/E for SpareBank 1 Sør-Norge remained effectively unchanged, moving only marginally from 16.44x to 16.50x.

Key Takeaways

- Technical integration, digital investment, and geographic diversification are expected to lower costs, reduce risks, and expand both the customer base and revenue streams.

- Emphasis on sustainable finance, efficient capital deployment, and shareholder return initiatives positions the bank for long-term growth and market leadership.

- Sustained competitive, regulatory, and market pressures threaten profitability, balance sheet quality, and capital efficiency, while overexposure to real estate amplifies vulnerability to sector volatility.

Catalysts

About SpareBank 1 Sør-Norge- Provides various financial products and services for personal and corporate customers in Norway.

- The full technical integration of the merged banks will unlock NOK 300 million in annual operational synergies by 2027, driving both lower cost-to-income ratios and improved net margins, which are currently understated due to one-off merger costs.

- Accelerated investment in digital solutions and automation, combined with strong local distribution power, will enable cost-effective scaling and broaden the customer base, supporting revenue growth and ongoing improvements in efficiency.

- The bank's expansion and diversification-both geographically (now balanced between Western and Eastern Norway) and across client types (retail, SME, corporate)-significantly reduces concentration risk and underpins lending growth and fee income potential over the long term.

- The focus on sustainable finance and green lending, in line with rising ESG demand in Norway, positions the bank to capture new market segments and increase lending volumes in growth industries, supporting long-term revenue expansion.

- Anticipated ability to deploy excess liquidity and capital more efficiently, along with potential reductions in regulatory capital requirements, will allow for increased lending, higher net interest income, and enhanced shareholder returns via growing dividends and the introduction of share buybacks.

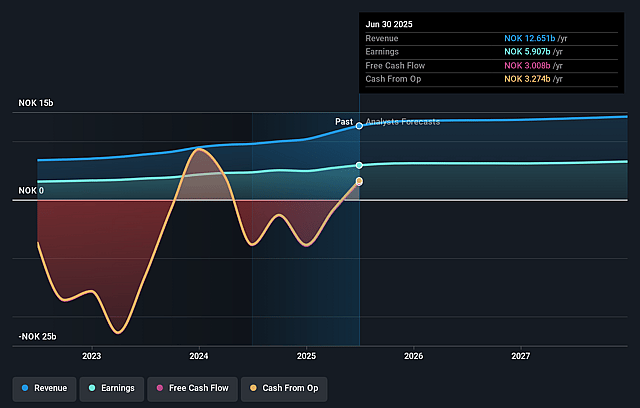

SpareBank 1 Sør-Norge Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SpareBank 1 Sør-Norge's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 46.7% today to 48.1% in 3 years time.

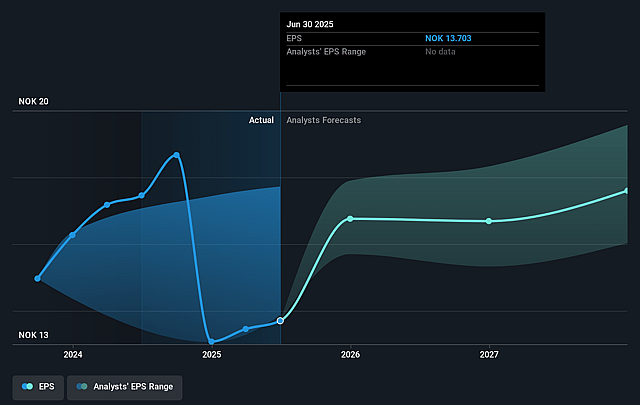

- Analysts expect earnings to reach NOK 7.0 billion (and earnings per share of NOK 17.56) by about September 2028, up from NOK 5.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as NOK6.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, up from 10.9x today. This future PE is greater than the current PE for the GB Banks industry at 10.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.94%, as per the Simply Wall St company report.

SpareBank 1 Sør-Norge Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in both retail and corporate banking, highlighted by management's repeated references to fierce competition and the need to constantly improve cost-effectiveness, is likely to create sustained margin pressure on lending and deposit products, thereby directly impacting net interest margins and long-term profitability.

- Stable or stagnating growth in the corporate loan portfolio, as acknowledged by management (the total growth of the Corporate Market...is approximately 0 this quarter and negative growth on the corporate side), suggests potential headwinds in the ability to generate new lending revenues, with a risk of this trend persisting if Norwegian economic activity slows or regional sector exposure underperforms.

- Heavy reliance on the real estate and mortgage market, as evidenced by the strong contribution of real estate brokerage and lending volumes to fee and commission income, exposes the bank to cyclical downturns or corrections in the property sector, which could result in elevated loan losses and impairments, pressuring earnings and balance sheet quality.

- Overliquidity relative to internal targets (LCR above 200% versus target of 130–150%) and the expressed current inability to fully deploy excess deposits into productive assets raise concerns about efficient capital utilization, which could temporarily diminish return on equity and dampen short-to-medium term earnings growth if not resolved.

- Ongoing regulatory changes and capital requirements (e.g., awaiting FSA approval of model changes and IRB approvals, upcoming CRR3 implementation) introduce operational uncertainty and the potential for higher compliance costs or less favorable capital treatment, which could limit the bank's capacity for dividend payouts, share buybacks, and ultimately depress shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK188.75 for SpareBank 1 Sør-Norge based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK14.5 billion, earnings will come to NOK7.0 billion, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 9.9%.

- Given the current share price of NOK172.2, the analyst price target of NOK188.75 is 8.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.