Key Takeaways

- Geopolitical tensions, cost inflation, and rising R&D expenses could pressure BESI's margins, revenue growth, and earnings stability.

- Intensifying competition and stagnant end-market demand threaten BESI's technology lead and long-term market share.

- Leadership in advanced packaging, strong partnerships, and resilient financial policy position BESI for long-term growth despite short-term market volatility.

Catalysts

About BE Semiconductor Industries- Develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries in the Netherlands, Switzerland, Austria, Singapore, Malaysia, and internationally.

- Intensifying geopolitical tensions, particularly ongoing tariff and protectionist measures between the US, China, and other global blocs, are already causing delays in customer orders and creating near-term uncertainty. Prolonged disruptions or escalation could force BE Semiconductor Industries to incur higher supply chain costs and lose access to key growth markets, resulting in structurally lower revenue growth and increased earnings volatility.

- Advanced chip packaging cost inflation, driven by stricter environmental regulations and the premium costs of hybrid bonding technology, may become unsustainable for customers. As customers in memory and mobile markets debate the cost-benefit of new processes, the risk grows that BESI will be unable to command sufficient pricing power, leading to margin compression and deteriorating profitability.

- Rapidly rising research and development expenses are touted as critical for maintaining a technology edge, yet continued delays and uncertainty around volume adoption of hybrid bonding in both memory and mobile markets indicate that the return on these investments could be poor over the medium term. This scenario risks BESI's net income being squeezed between flattening revenues and a rising cost base.

- Aggressive competition from emerging Asian capital equipment vendors-bolstered by state support and lower pricing strategies, especially within China-threatens long-term market share. BESI's lead in hybrid bonding is increasingly vulnerable, and erosion of its global share would pressure both top-line revenue and bottom-line margins.

- Structural demographic headwinds in developed markets, such as slower population growth and a plateauing demand for traditional consumer electronics, will ultimately cap the size and growth rate of the semiconductor packaging equipment market. This would limit BESI's ability to achieve the strong, sustained earnings growth implied in an overvalued scenario.

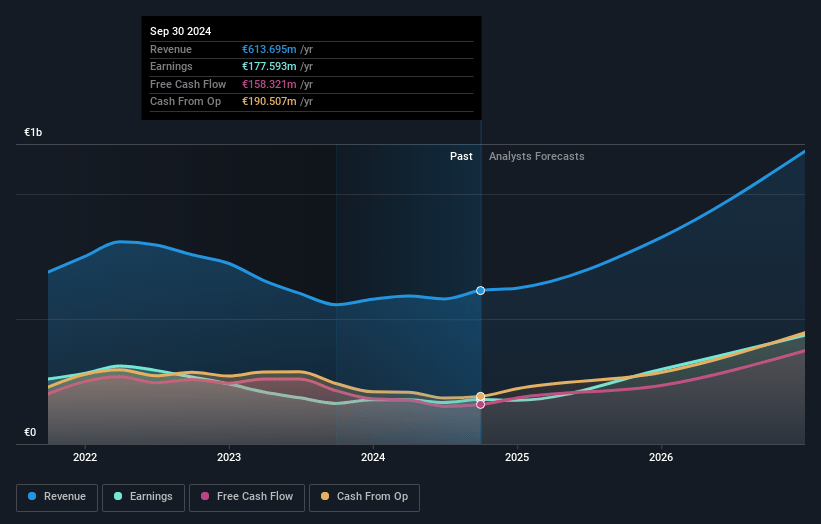

BE Semiconductor Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on BE Semiconductor Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming BE Semiconductor Industries's revenue will grow by 13.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 29.7% today to 31.8% in 3 years time.

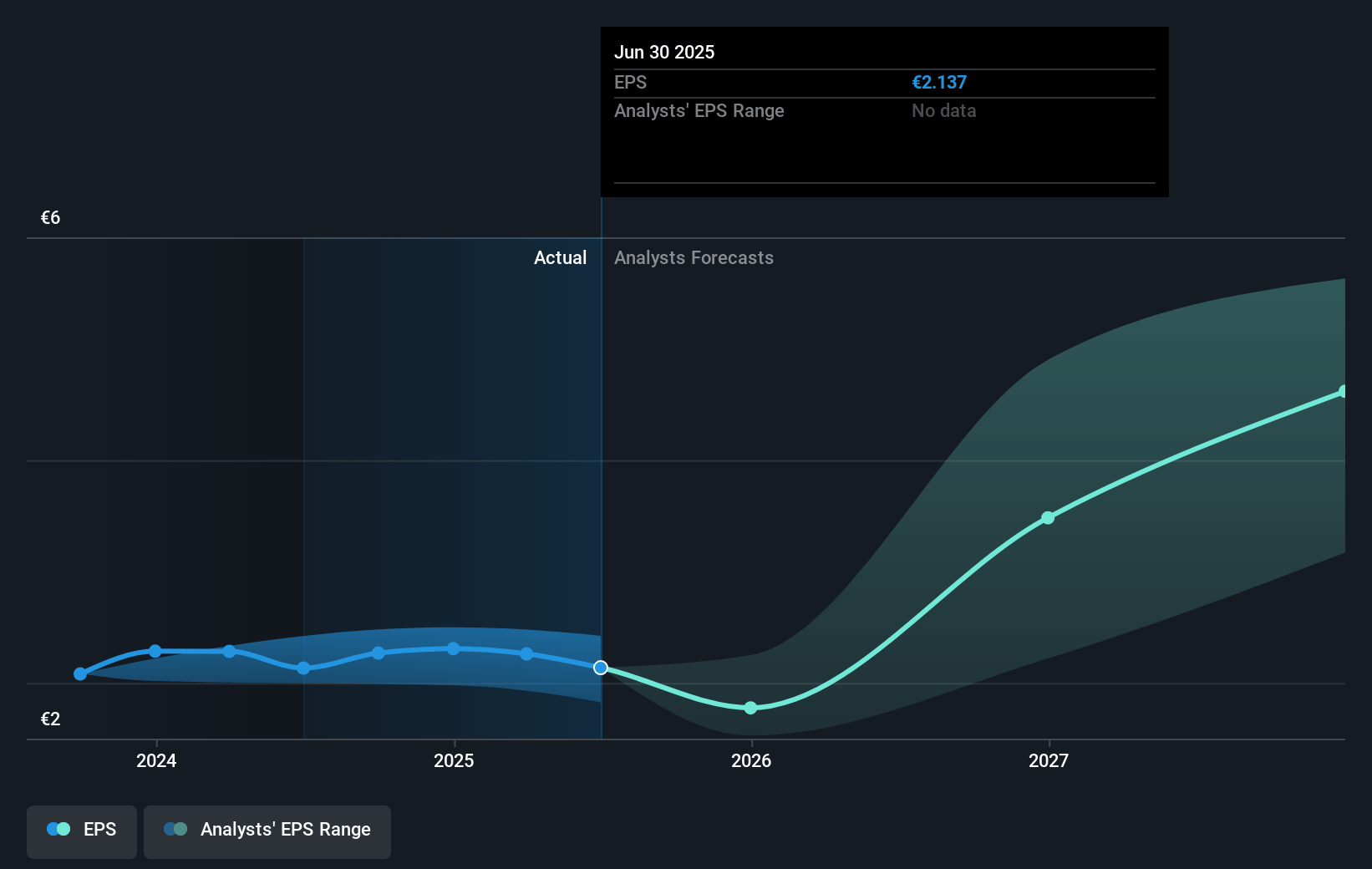

- The bearish analysts expect earnings to reach €279.6 million (and earnings per share of €3.53) by about July 2028, up from €179.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 34.9x on those 2028 earnings, down from 54.6x today. This future PE is lower than the current PE for the GB Semiconductor industry at 51.0x.

- Analysts expect the number of shares outstanding to decline by 0.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

BE Semiconductor Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite near-term weakness, long-term demand for advanced semiconductor packaging is expected to grow significantly due to trends in AI, data center infrastructure, and the electrification of mobility, which could drive order volumes, revenue, and a sustained backlog for BE Semiconductor Industries.

- BESI's demonstrated leadership in hybrid bonding technology, with successful customer trials and ongoing shipments to top-tier memory and logic manufacturers, may support future gross margin expansion and improved competitive positioning, countering downside risk.

- Strategic partnerships-including Applied Materials' 9% ownership stake and continued collaboration-could enhance BESI's innovation pipeline, technology integration, and customer access, underpinning long-term earnings stability and premium pricing.

- Industry forecasts from TechInsights project a 13% assembly market upturn in 2025 and a 26% increase in 2026, suggesting secular demand tailwinds that may result in higher revenues and profit recovery once tariff and macroeconomic uncertainty subsides.

- BESI's active investments in next-generation products, combined with a strong balance sheet, robust cash flow, and committed capital return policy, provide flexibility to sustain R&D leadership and support net margin resilience through cyclical downturns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for BE Semiconductor Industries is €100.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of BE Semiconductor Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €175.0, and the most bearish reporting a price target of just €100.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €877.9 million, earnings will come to €279.6 million, and it would be trading on a PE ratio of 34.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of €123.65, the bearish analyst price target of €100.0 is 23.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.